'My top stock turned a £10m stake into £130m'

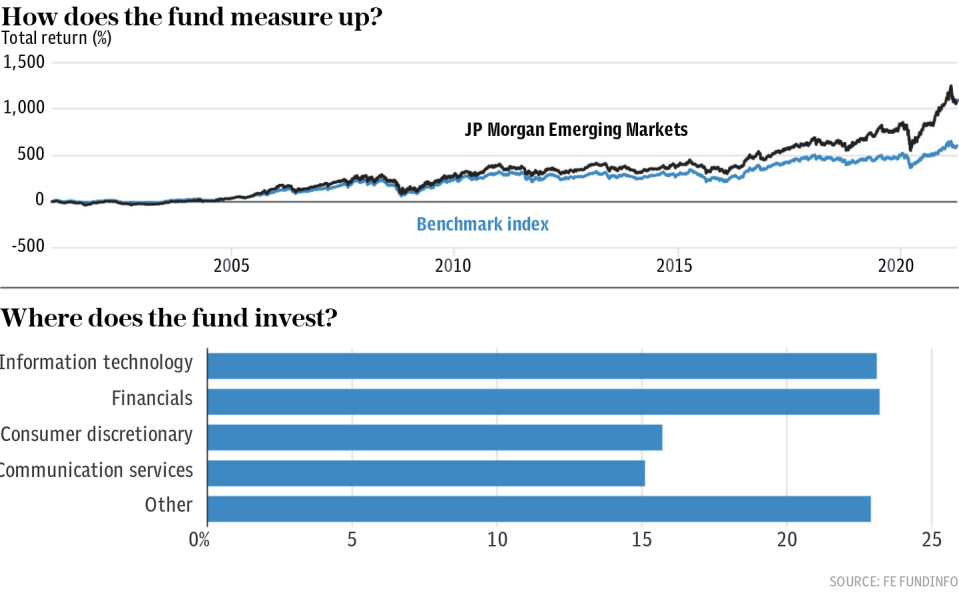

Emerging markets have often endured times on the sidelines but investors who have backed developing economies over the long term have been rewarded with strong returns.

Few know this better than Austin Forey, who has managed the JP Morgan Emerging Markets investment trust for nearly 30 years.

The trust was a new entrant to the Telegraph 25 when the list of our favourite funds was updated last month and also features as one of our Growth 10 picks.

Mr Forey talks to Telegraph Money about the rise of software companies in Asia, why Latin America has fallen down the emerging markets ladder and how his long-term strategy helps to iron out “wrinkles”.

Who is the fund for?

Anyone who wants exposure to the wealth creation that’s taking place in the developing world.

How do you pick stocks?

The first thing to say is we’re focused on the long term. We’re trying to find businesses that can grow their intrinsic value and hold them for as long as possible to keep them compounding.

We work with a big research team, which discovers a lot of companies for us. We have 40 analysts dedicated to emerging market investment on the ground all over the world.

What’s been your best investment?

The business that has made the largest profit for the trust is Taiwan Semiconductor, a computer chip maker we’ve owned for well over 20 years continuously.

The trust’s initial stake was about £10m and the investment is currently worth around £130m.

How will the global chip shortage affect the stock?

When you work on our kind of timeline those things are a bit like a wrinkle. It’s like the ship stuck in the Suez Canal – it gets in the news for a week and then it’s gone.

Our average holding period is 10 to 12 years. We keep stocks for a matter of years and decades rather than weeks and months. That’s deliberate and relatively unusual. Holding periods in stock markets seem to get shorter and shorter and we’re moving in the other direction.

What’s been your worst investment?

We invested in a catering services company in China called Fu Ji Food & Catering, which went bust. We lost most of the money we invested in it. That was a poor investment, but not the only one.

Which companies or sectors do you avoid?

We hold virtually nothing in commodities companies such as energy stocks and miners and haven’t for a long time.

We tend to be very sceptical of state-owned companies, which are more widespread in emerging markets than in the developed world. They are usually working for their government rather than shareholders so their objectives are not necessarily always the same as ours.

The majority of the fund is in Asia. Why is that?

It hasn’t always been the case. When I started, Latin America was the dominant emerging market region. But over the past 25 years or so we’ve seen stock markets much more accurately reflect underlying economies. This means that places such as China and India are very important to us.

Do you still avoid Venezuela?

That hasn’t changed. Venezuela is an example of a country where the politics and economics had gone haywire. The issue in Venezuela particularly was repatriation of capital.

If you had an investment and sold it, the money was stuck in the country for years. When a country gets to that point, it’s better not to invest in the first place. We don’t tend to rule out countries unless they are in that kind of extreme situation.

How are you paid and do you invest your own money in the trust?

I get a base salary and additional compensation that depends on performance. A significant portion of that money is used to buy shares in the investment trust.

How have things changed since you started running the trust?

At that stage a lot of markets in Asia were only just opening to foreign capital or had restrictions on foreign ownership. A huge change has been the rise of new business models built around the internet. You see that in China but by no means only there.