Is Torchmark Corporation (TMK) A Good Stock To Buy?

At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

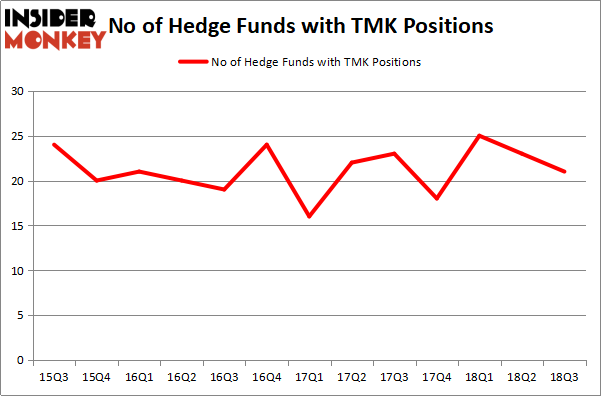

Torchmark Corporation (NYSE:TMK) investors should be aware of a decrease in hedge fund sentiment recently. TMK was in 21 hedge funds' portfolios at the end of September. There were 23 hedge funds in our database with TMK positions at the end of the previous quarter. Our calculations also showed that TMK isn't among the 30 most popular stocks among hedge funds.

In today’s marketplace there are tons of metrics investors employ to assess publicly traded companies. Two of the most useful metrics are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the best investment managers can trounce the S&P 500 by a solid amount (see the details here).

We're going to check out the new hedge fund action surrounding Torchmark Corporation (NYSE:TMK).

How are hedge funds trading Torchmark Corporation (NYSE:TMK)?

At Q3's end, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the previous quarter. By comparison, 18 hedge funds held shares or bullish call options in TMK heading into this year. With hedgies' positions undergoing their usual ebb and flow, there exists an "upper tier" of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

The largest stake in Torchmark Corporation (NYSE:TMK) was held by Berkshire Hathaway, which reported holding $550.8 million worth of stock at the end of September. It was followed by AQR Capital Management with a $59.7 million position. Other investors bullish on the company included Citadel Investment Group, Pzena Investment Management, and Prospector Partners.

Since Torchmark Corporation (NYSE:TMK) has faced a decline in interest from the entirety of the hedge funds we track, it's safe to say that there exists a select few money managers who were dropping their entire stakes by the end of the third quarter. At the top of the heap, Benjamin A. Smith's Laurion Capital Management cut the biggest investment of the 700 funds followed by Insider Monkey, worth about $5 million in stock. Paul Marshall and Ian Wace's fund, Marshall Wace LLP, also dumped its stock, about $4.5 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 2 funds by the end of the third quarter.

Let's also examine hedge fund activity in other stocks similar to Torchmark Corporation (NYSE:TMK). We will take a look at Bunge Limited (NYSE:BG), Perrigo Company plc (NYSE:PRGO), EXACT Sciences Corporation (NASDAQ:EXAS), and Steris Plc (NYSE:STE). All of these stocks' market caps resemble TMK's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position BG,39,1301171,0 PRGO,21,1045562,-4 EXAS,33,625480,2 STE,21,268624,0 Average,28.5,810209,-0.5 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $810 million. That figure was $763 million in TMK's case. Bunge Limited (NYSE:BG) is the most popular stock in this table. On the other hand Perrigo Company plc (NYSE:PRGO) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Torchmark Corporation (NYSE:TMK) is even less popular than PRGO. Considering that hedge funds aren't fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn't behind this stock. This isn't necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index