Total Gabon (EPA:EC) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Total Gabon (EPA:EC) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Total Gabon

What Is Total Gabon's Net Debt?

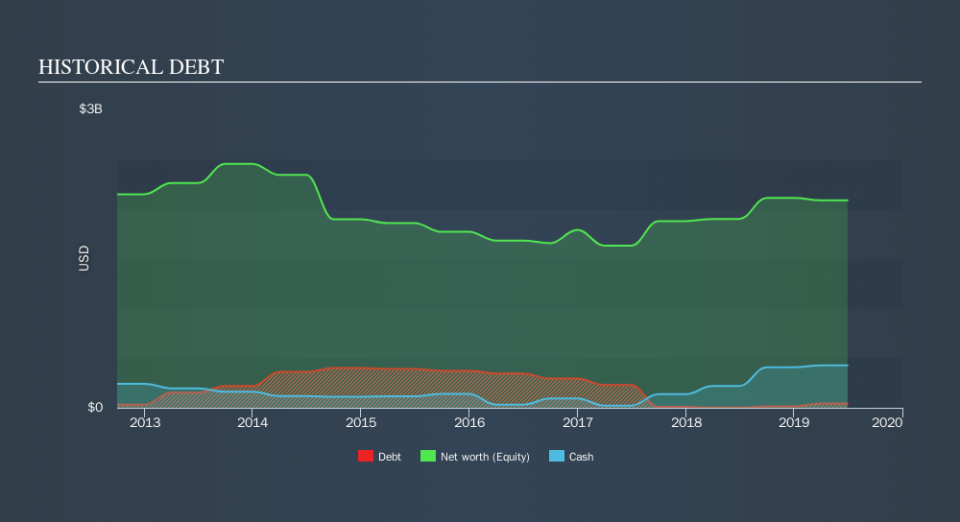

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Total Gabon had US$43.3m of debt, an increase on US$2.16m, over one year. But on the other hand it also has US$426.2m in cash, leading to a US$382.9m net cash position.

A Look At Total Gabon's Liabilities

The latest balance sheet data shows that Total Gabon had liabilities of US$225.3m due within a year, and liabilities of US$1.95b falling due after that. On the other hand, it had cash of US$426.2m and US$426.6m worth of receivables due within a year. So its liabilities total US$1.32b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$701.2m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, Total Gabon would likely require a major re-capitalisation if it had to pay its creditors today. Given that Total Gabon has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

The good news is that Total Gabon has increased its EBIT by 7.8% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Total Gabon will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Total Gabon may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Total Gabon actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

Although Total Gabon's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$382.9m. And it impressed us with free cash flow of US$206m, being 146% of its EBIT. So we are not troubled with Total Gabon's debt use. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Total Gabon's dividend history, without delay!

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.