Tri-Cities nuclear contractor accused in $1.4M COVID loan fraud to pay his credit cards

A Hanford site subcontractor is accused of stealing $1.4 million in COVID-19 relief money from taxpayers.

Wilson Pershing Stevenson III, 44, the owner of BNL Technical Services, faces a maximum prison sentence in federal court of 30 years if found guilty on all counts, according to the Eastern Washington U.S. Attorney’s Office.

Stevenson received $1.4 million in federal loans during the pandemic, almost all of which was later forgiven.

Much of the money was intended to cover the wages of workers it employed before and during the COVID pandemic, but Stevenson used the money for his personal benefit, according to court documents.

But there was no need for a loan to pay BNL workers at Hanford, as they continued to be paid with money provided by the Department of Energy.

Stevenson used most of the COVID small business relief money he received to pay off loans, according to prosecutors. It included giving money to his father and a family trust, plus paying off many credit cards, including his wife’s.

“COVID-19 relief programs quickly ran out of money due to the number of people and businesses that request funding, which meant that some deserving small businesses were not able to obtain funding to keep their businesses in operation during the COVID-19 pandemic,” said U.S. Attorney Vanessa Waldref.

Stevenson and BNL are named in a federal court indictment released Thursday with five counts of wire fraud, three counts of bank fraud and three counts of false, fictitious or fraudulent claims related to loans from the Coronavirus Aid, Relief and Economic Security (CARES) Act and a second COVID loan program.

BNL, which has an office in Richland, hires staff and deploys them to Hanford nuclear reservation and other federal contractors, a service called staff augmentation.

Staff for which it received federal loans to pay wages were assigned to work for Hanford contractors Washington River Protection Solutions, Mission Support Alliance and CH2M Hill Plateau Remediation Co., according to court documents.

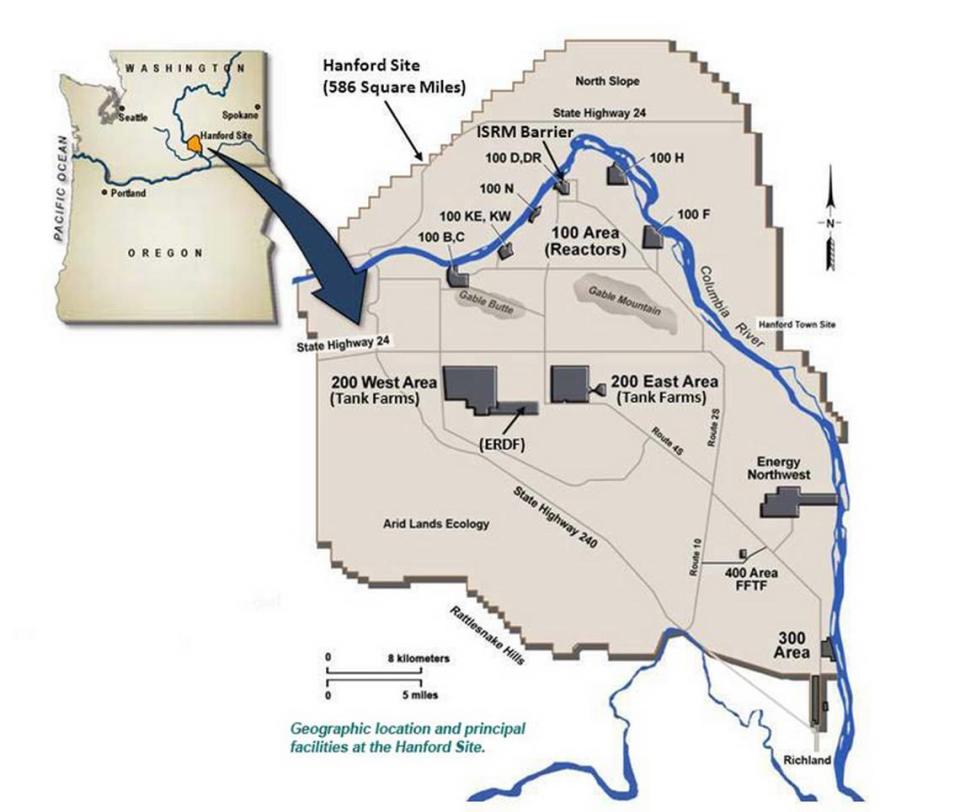

The Hanford nuclear reservation in Eastern Washington adjacent to Richland was used to produce almost two-thirds of the plutonium for the nation’s nuclear weapons program, leaving massive environmental contamination on the 580-square-mile site.

During the early part of the pandemic the number of workers reporting for environmental cleanup at the site was limited, with most workers telecommuting or paid with DOE money to wait for more work to resume.

How loan allegedly used

Stevenson received nearly $494,000 in CARES Act money in April 2020 that he applied for to retain workers and maintain payroll, although DOE already was paying for that, according to the indictment.

Within 48 hours of getting the money he had spent at least $453,000 to pay off personal and family debts, according to the indictment.

That included $100,000 transferred to his father and $48,600 to a family trust, according to the indictment.

Much of the rest of the money was used to pay off credit card debt, including $24,500 on his Bank of America card, $14,500 on his wife’s Bank of America card, $15,500 on an Alaska Airlines card, $54,000 on Citi cards and $47,000 on a Citibank Costco card, according to the indictment.

The next month Stevenson applied for another type of COVID loan, an Economic Injury Disaster Loan. The low interest loan could be used to maintain operations during the pandemic and payments on it could be delayed during the pandemic.

He received $150,000 in payments in May and July.

Stevenson also applied for a second CARES Act payroll loan, receiving about $820,000 in January 2021 that he said would be used for payroll costs, utilities and telecommuting software.

Less than a week after he had received the money, he spent at least $767,000 on personal debts and on business debts that were not eligible to be paid with CARES Act money, according to the indictment.

It included paying off the $150,000 COVID loan, which was not eligible to be forgiven, according to the indictment.

Both of the CARES Act loans totaling about $1.3 million were forgiven by the federal government.

Earlier Hanford loan fraud case

This is the second report to be made public of alleged COVID loan fraud at Hanford.

HPM Corp., based in Kennewick, and its owners during the pandemic received a CARES loan of $1.3 million, which they did not have to pay back.

Hollie Mooers, the founder of HPMC, and her husband transferred the money to their personal account and the money was later given to charities, according to accusations in federal court documents.

HPMC and the Mooers paid nearly $3 million to the federal government in a settlement agreement and then sold the company, which had been barred under the Mooers from doing business with the federal government.

The alleged BNL fraud was uncovered by the COVID-19 Fraud Strike Force, an initiative of the U.S. Attorney’s Office and federal law enforcement agencies.

In addition to the strike force, BNL was investigated by DOE; the Office of Inspector General, including its Richland Field Office; the Small Business Administration and the Office of Inspector General. Assistant U.S. attorneys Tyler Tornabene and Dan Fruchter are prosecuting the case.