Trial Zeroes In on How Trump Org Dodged Taxes

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Several Trump Organization executives were collectively paid more than a million dollars on the side as “independent contractors” in 2015 in a way that helped them avoid taxes, Manhattan prosecutors revealed at the company’s criminal trial on Thursday.

Although that particular detail didn’t become a formal criminal charge against the company, it was among many dirty deeds at the former president’s namesake firm that was placed under a microscope this week by the Manhattan District Attorney’s Office.

The Trump Organization is on trial over the way it allegedly dodged taxes by showering its then-chief financial officer with off-the-books corporate benefits, like a ritzy New York City apartment, luxury cars, and paid tuition at an expensive private school for his grandkids.

That disgraced former executive, Allen Weisselberg, pleaded guilty earlier this year and agreed to testify against the company at trial.

On Thursday, prosecutors revealed that a second executive who was never criminally charged in this case—chief operating officer Matthew Calamari Sr.—got a similar deal. Emails showed how he landed a corporate flat at the pricey Trump Park Avenue building in Midtown Manhattan in 2012 and arranged to have the company simply “reduce” his salary by $6,000 a month. That arrangement cut down Calamari’s salary on paper and treated his rent like an untaxed benefit, the way some companies treat health care costs.

Trump Organization Criminal Trial Kicks Off With a Tall Task

In a curious example of how this kind of funny business is viewed at the Trump Organization, an accountant at the company who testified on Thursday said “there was no rent.” It simply didn’t exist—even though it very much did.

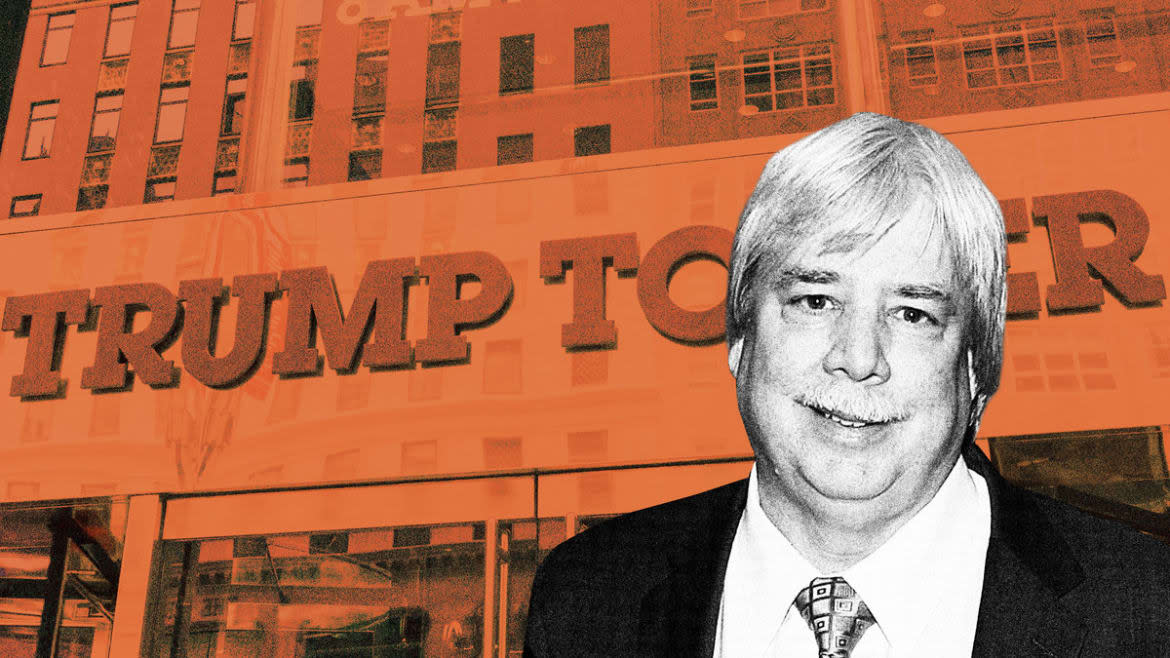

That witness, Jeffrey S. McConney, is a senior vice president at the company and has been its controller for decades. Weisselberg brought him on in 1987 and he remained the CFO’s go-to accountant ever since. On Thursday, he provided muted explanations and again proved to be a frustrating witness for the DA’s office, continuing the headache that they got when they tried to squeeze information out of him in front of a grand jury in the run-up to this trial.

According to sources and court documents, McConney became something of a fall guy by absorbing all the blame for accounting irregularities and apologizing for what he called “mistakes”—refusing to be a useful witness against Trump himself.

On Thursday, McConney reluctantly explained the company’s financial accounting—and his side job as the personal accountant to some of the company’s executives.

Assistant district attorney Joshua Steinglass asked him about the ludicrous way the company paid so many executives a portion of their salaries as “independent contractors.” Weisselberg, for example, made an extra $300,000, including $75,000 for work related to the company’s operation of the Wollman ice rink in Central Park, as well as $50,000 for work at Trump’s oceanside Florida mansion, Mar-a-Lago.

Trump’s Money Man Allen Weisselberg Pleads Guilty

Steinglass commented that the extra payments made no sense. McConney suggested that his boss probably got paid this way—at Mar-a-Lago for instance—because he did some insurance-related work there.

Steinglass asked: Isn’t that part of his regular job? After much prodding, McConney finally relented.

“Yes, it would be his normal job description,” he grumbled.

Prosecutors then established how this was obviously nefarious, getting McConney to recount the way that one of those executives—then Trump Organization lawyer, Jason Greenblatt—no longer wanted to get paid as an independent contractor because this game would kill his law license. (Greenblatt later became the Trump presidential administration’s special envoy to the Middle East.)

Prosecutors also used McConney to examine Calamari’s salary deal, which reduced his reported salary by $72,000 in 2012 alone—which amounts to an average New York professional simply not paying any taxes for a year.

“Was this reported to the tax authorities?” Steinglass asked him.

“No, sir,” he responded.

The revelation is sure to spark questions about why prosecutors did not bring a case against Calamari, a former Trump bodyguard who maintained close relationships with the New York Police Department in his decades as the go-to contact for emergencies at Trump buildings.

Steinglass ended his examination by focusing on McConney’s role as a personal accountant to these executives.

“Mr. McConney, did you intentionally help people try to evade their income taxes?”

“I tried to help them in any way I could,” he began, smirking under his white mustache. “With some suggestions.”

Trump Org’s Former Money Man Nears Plea Deal in Tax Fraud Case: Report

The Trump Organization’s outside defense lawyer, Susan R. Necheles, spent the afternoon presenting emails that minimized McConney’s role at the company. She repeatedly pointed out how McConney couldn’t approve even small checks without his boss’ approval, clearly setting up the defense that this case against the company begins and ends with a single executive who already pleaded guilty: Weisselberg.

The criminal trial, which is estimated to take six weeks, continues on Monday. It was on pause for much of the last two weeks after McConney became ill with COVID-19. He coughed relentlessly on the stand last week and eventually got the judge on the case sick as well. Justice Juan Merchan, who did not wear a mask at the start of trial, wore a blue face covering on Thursday.

Get the Daily Beast's biggest scoops and scandals delivered right to your inbox. Sign up now.

Stay informed and gain unlimited access to the Daily Beast's unmatched reporting. Subscribe now.