Triangle office market outlook turns bleak as sublease vacancy rate hits new high

IQVIA’s logo may still hang atop one the Triangle’s most prominent office towers overlooking Interstate 40 in Durham, but no one is actually working there.

Most employees emptied out of the tower’s top four floors after the company put its 260,000-square-foot space up for sublease last October, shifting headquarters to downsize.

In fact, the entire building is empty. The rest of its space — 106,286 square feet — has been up for sublease since late 2021, as the rise of hybrid work, surging interest rates and tech layoffs push sublease vacancy rates to record highs.

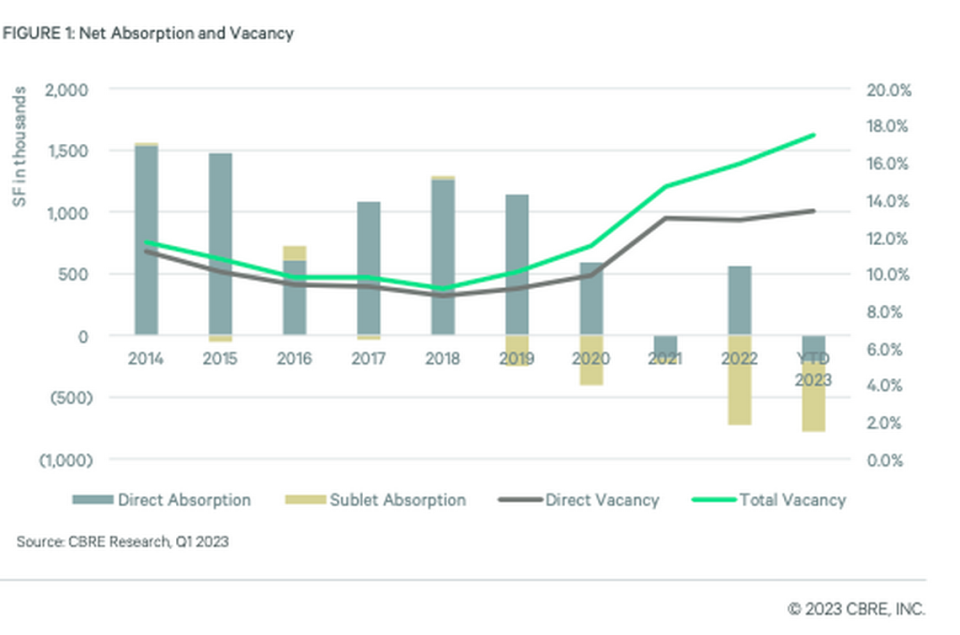

Roughly 4.4 million square feet of office space is vacant across the Triangle, according to CBRE Raleigh Research’s first-quarter market report.

That’s roughly 8.3% of overall market inventory and a new record high, surpassing the previous high-water mark of 5.3% witnessed in the aftermath of the dot-com bust and the 9/11 terrorist attacks. In a balanced market, sublease availability is typically closer to 2% of inventory, the report said.

Overall, office vacancy rose to 13.4%, up 50 basis points quarter over quarter.

It’s a trend hitting metro areas nationwide. And while some analysts are calling it the beginning of the “office apocalypse,” Elizabeth Gates, a CBRE Raleigh senior analyst, wouldn’t go so far. However, the sheer volume of space on the market in the Triangle is reason for “significant concern,” she said.

Among the largest new offerings: UNC Health, which placed 324,874 square feet of administrative space on the market at 1025 Think Place and 5221 Paramount Parkway in the RTP/I-40 corridor earlier this year. In downtown Raleigh, Citrix placed its 153,000-square-foot headquarters building on the market for sublease.

A correction is likely, but the severity will vary greatly by location, Gates said. “Even within our market, there will be areas that perform well and others that will face more challenges. The reality is, it’s going to take some time to work through the current glut of space.”

Gary Woodhill, a senior leasing agent with Avison Young and landlord of the newly developed South Green Shopping Center in Chapel Hill, agreed. He said the region isn’t at a crisis point — yet. “But are we in a good spot? No. Until some sublease space gets taken off the market, things won’t start to recover. It’s not going to be a quick fix.”

Some bright spots

It’s not all bad news, however.

Tenants are also continuing their “flight to quality,” where newer properties, particularly those in walkable, amenity-rich settings, have attracted the lion’s share of interest. That demand remains strong.

For example, GFL Environmental leased 92,300 square feet and Summit Design and Engineering Services leased 30,171 square feet at 1000 Social in Midtown Raleigh. Currently under construction, the building is now 50% leased.

And just this past week, engineering firm WithersRavenel and co-working space Cary Founded confirmed they’ll be the future anchor office tenants of the 50,000-square-foot Rogers buildings coming to downtown Cary this fall. That building is now 100% leased, according to its developers, Northwood Associates and Chatham Street Commercial.

To compete, building owners are stepping up efforts to attract tenants, offering broker incentives and concessions. While “trophy buildings” remain the exception, rent growth is beginning to slow, the report said.

The hardest hit

Meanwhile, older suburban properties, particularly buildings built between 1980 and 2009 and lacking amenities, are getting the hardest hit.

In some instances, opportunities could emerge to redevelop under-performing properties, a separate CBRE study found, such as allowing for more mixed-use development in traditionally office-centric locations. But analysts also warn of inaction, with languishing properties increasing the chances of falling property values.

“If we witness a widespread reduction in property values, the resulting impact on local tax revenues could become a challenge,” Gates said.

In the meantime, more than 2.2 million square feet of office space is under construction across the Triangle. That’s down roughly 44% from two years ago.

The pipeline includes Bandwidth’s new 533,889-square-foot headquarters in West Raleigh, which will occupy the entire building. The rest of the space under construction across the market — 1.7 million square feet — is being built on a speculative basis. To date, developers have secured tenants for 13% of the speculative space under construction. The rest is still available.

“The positive is that we’re in a high-growth market. We’re far better positioned than many areas, but there will be some pain to work through to get there,” said CBRE Raleigh executive vice president Brad Corsmeier.