A Trio of Stock Picks for the 'Buy and Hold' Approach

- By Alberto Abaterusso

The easier a business can be predicted, the higher the likelihood a buy and hold investment strategy will be fruitful. Such businesses are usually characterized by a steady record of revenue per share and Ebitda per share, which is often associated with a strong long-term performance based on a 10-year study that GuruFocus conducted for the period from 1998 to 2008.

In light of the above, value investors may want to consider the following three stocks, as they represent U.S. listed equities in companies that GuruFocus has given a high rating for business predictability.

Amazon.com Inc

The first company that makes the cut is Amazon.com Inc (NASDAQ:AMZN), a Seattle, Washington-based online retail giant.

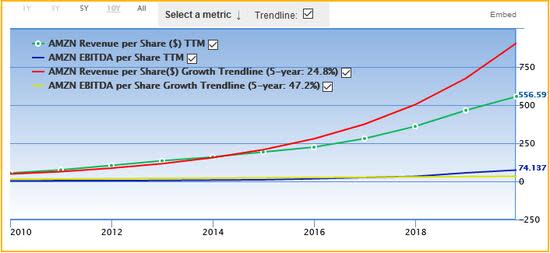

Amazon.com Inc's business has a high business predictability rating of 4.5 out of 5 stars. The company saw the revenue per share increase by nearly 25% and the Ebitda per share increase by 47.2% on average every year over the past 10 years.

The share price ($3,311.37 at close on Friday) has grown dramatically over the past 10 years as the current share price level is about 20 times more than in November of 2010. The market capitalization is trading at around $1.66 trillion.

GuruFocus assigned a financial strength rating of 7 out of 10 and a profitability rating of 8 out of 10 to the company.

The price-earnings ratio is 96.97 compared to the industry median of 22.21, the price-book ratio is 20.08 compared to the industry median of 1.49 and the price-sales ratio is 4.84 versus the industry median of 0.67.

Wall Street recommends a buy rating with an average target price of $3,830.49 per share for the stock.

Berkshire Hathaway Inc

The second company that meets the criteria is Berkshire Hathaway Inc (NYSE:BRK.A) (NYSE:BRK.B), an Omaha, Nebraska-based international conglomerate holding company.

Berkshire Hathaway Inc has a high business predictability rating of 3 out of 5 stars. The company saw the revenue per share grow by 8.6% and the Ebitda per share grow by 7.2% on average every year over the past 10 years.

The share price ($313,885 for common stock class A and $208.85 for common stock class B) has grown about 156% over the past 10 years for a market capitalization of $499.18 billion.

GuruFocus assigned a financial strength rating of 5 out of 10 and a profitability rating of 6 out of 10 to the company.

The price-earnings ratio is 22.97 versus the industry median of 12.03, the price-book ratio is 1.28 compared to the industry median of 1.01 and the price-sales ratio is 1.96 versus the industry median of 0.95.

Wall Street recommends an overweight rating with an average target price of $355,000 per share of common stock class A and of $226.50 per share of common stock class B.

The Walt Disney Co

The third company that qualifies is The Walt Disney Co (NYSE:DIS), a Burbank, Los Angeles-based global entertainment giant.

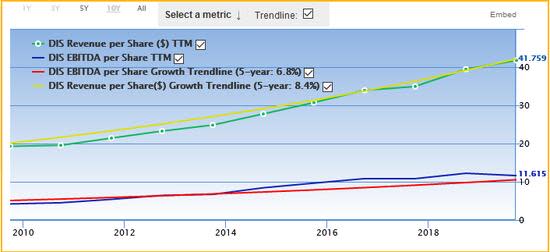

The Walt Disney Co's business has an extremely high predictability rank of 4.5 out of 5 stars. The company saw the revenue per share grow by 8.4% and the Ebitda per share grow by 6.8% on average every year over the past 10 years.

The share price ($127.46 as of Friday) has grown 245% over the past 10 years for a market capitalization of $230.33 billion.

GuruFocus assigned a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10 to the company.

The price-book ratio is 2.64 compared to the industry median of 1.44 and the price-sales ratio is 3.32 versus the industry median of 1.21.

Wall Street recommends an overweight rating with an average target price of $138 per share for the stock.

Disclosure: I have no position in any security mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.