A Trio of Stocks Trading Below the Peter Lynch Fair Value

- By

Investors looking for opportunities among growing companies may want to consider the following three stocks, as their share prices are trading lower than their Peter Lynch Fair Values.

The Peter Lynch Fair Value, which is based on the idea that the fair price-earnings ratio for a growing company is on par with its growth rate, derives from the combination of the following three components:

The stock's PEG ratio.

The stock's five-year Ebitda growth rate.

The stock's earnings per share (EPS) without non-recurring items (NRI) for the trailing twelve months (TTM) through the most recent quarter.

Voya Financial Inc

The first stock that matches the criteria is Voya Financial Inc (NYSE:VOYA), a New York-based financial services operator focusing on retirement, investment and employee benefits in the United States.

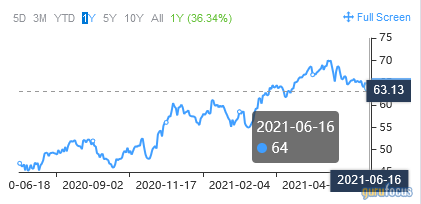

On Wednesday, Voya Financial Inc's share price closed at $64, far below its Peter Lynch Fair Value per share of $202.73, for a price-to-Peter-Lynch-Fair-Value ratio of about 0.32. This ranks higher than 72% of the 18 companies that operate in the diversified financial services industry.

The stock has a market capitalization of $7.77 billion following a 36.34% increase that occurred over the past year. The 52-week range is $44.81 to $70.68.

The stock has a GuruFocus financial strength rating of 4 out of 10 and a profitability rating of 4 out of 10.

As of June, the stock has a median recommendation rating of overweight on Wall Street. The average target price is $74.42 per share.

BrightSphere Investment Group Inc

The second stock that meets the criteria is BrightSphere Investment Group Inc (NYSE:BSIG), a Boston, Massachusetts-based asset management company serving its clients through separate specifically dedicated portfolios or equity mutual funds.

On Wednesday, BrightSphere Investment Group Inc's share price closed at $23.18, which is well below the Peter Lynch Fair Value per share of $84.25, yielding a price-to-Peter-Lynch-Fair-Value ratio of approximately 0.28. This ranks higher than 84% of the 238 companies that operate in the asset management industry.

The stock has a market capitalization of $1.81 billion following a 123.10% increase that took place over the past year. The 52-week range is $9.60 to $24.01.

The stock has a GuruFocus financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10.

As of June, the stock has a median recommendation rating of overweight on Wall Street and an average target price of $27 per share.

Hess Midstream LP

The third stock is Hess Midstream LP (NYSE:HESM), a Houston, Texas-based crude oil and natural gas midstream operator with 1,350 miles long gathering pipeline, plus processing and fractionation plants, terminals, rail cars and header systems located in Texas, North Dakota and Minnesota.

On Wednesday, Hess Midstream LP's share price closed at $27.39, below its Peter Lynch Fair Value per share of $34.87, for a price-to-Peter-Lynch-Fair-Value ratio of about 0.79. This ranks higher than 62% of the 124 companies that operate in the oil and gas industry.

The stock has a market capitalization of $683.80 million following a 39.53% jump that occurred over the past year. The 52-week range is $14.56 to $27.59.

The stock has a GuruFocus financial strength rating of 3 out of 10 and a profitability rating of 7 out of 10.

As of June, the stock has a median recommendation rating of buy with an average target price of $26.38 per share on Wall Street.

Disclosure: I have no position in any security mentioned.

This article first appeared on GuruFocus.