Trump’s farmer bailout just hit $7.7 billion – but 'it no way makes us whole'

As the Trump administration continues trade talks with China, the U.S. Department of Agriculture (USDA) has paid out a total of $7.7 billion in aid to farmers to offset the effects of tariffs.

The aid “certainly was appreciated,” Blake Hurst, a soybean farmer and president of the Missouri Farm Bureau, told Yahoo Finance’s On The Move. He noted that the money particularly helped at a time when farmers are renegotiating their loans and talking to lenders.

However, Hurst added, “it’s not enough in the sense that it no way makes us whole for what we suffered from these trade disputes.”

‘A lot of things can happen’

When the trade war went into full effect in 2018, the Trump administration pledged two installments of a farmer bailout program through the USDA. The first round of payments, which came to about $4.7 billion, was paid in September, while the second round commenced in December. Although part of the bailout program hit a snag during the government shutdown, aid resumed without issue after Congress and the White House reached a deal.

Two days into trade talks, China bought two million tons of U.S. soybeans in a sign of good faith. And on Friday, U.S. Agricultural Secretary Sonny Perdue tweeted that “the Chinese committed to buy an additional 10 million metric tons of U.S. soybeans. ... Strategy is working. Show of good faith by the Chinese. Also indications of more good news to come.”

The U.S. stated that the deadline of a deal would be March 1, though that might not happen. Trump recently says that he could extend the deadline while keeping current tariffs in place, adding that March 1 “is not a magical date. A lot of things can happen.” If no deal is reached, then U.S. tariffs on Chinese imports are scheduled to go from 10% to 25% on $200 billion worth of Chinese imports.

‘A tremendous backlog and surplus of soybeans’

China has reportedly offered to buy an additional $30 billion a year of U.S. agricultural products, according to Bloomberg. Hurst stressed that this likely would not be exclusive to soybean farmers.

“I would assume that the $30 billion would include other products besides soybeans, although we have a tremendous backlog and surplus of soybeans on hand,” Hurst said. “I’m sure that they’re talking about perhaps ethanol, perhaps beef, perhaps wheat, cotton as well, so there’s lots of agricultural products that could be included in that $30 billion, were it to happen.”

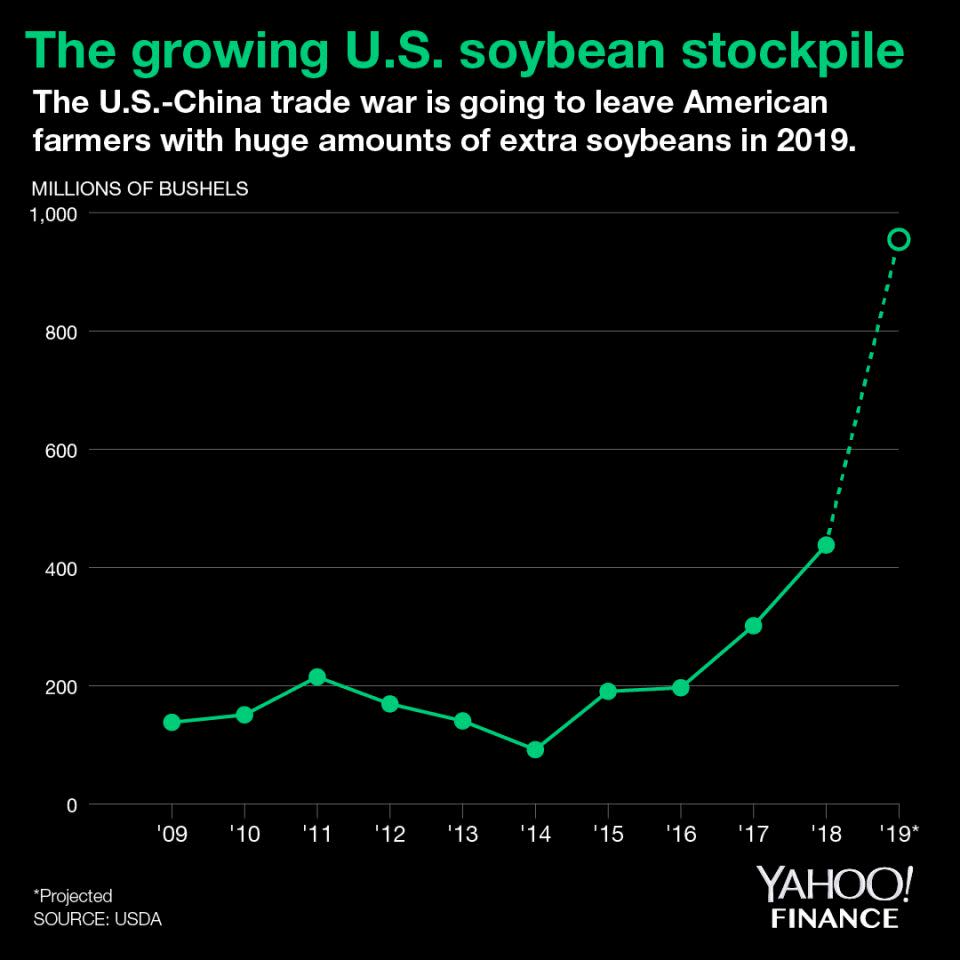

The backlog that Hurst is referring to is the U.S. soybean inventory, which is projected to reach an estimated 955 million bushels in 2019, almost double the amount of the year prior.

Hurst said that the current carryover is in storage and can last for a long time.

But, “hopefully, it won’t have to and we’ll have a chance to get them moved into the market,” he said, noting that the carryover varies from year to year. “Part of that huge carryover is because of trade disputes and part of it is because we’ve had about five years of really excellent production here in the U.S. It hangs over the market, it depresses prices, but it will not be wasted.”

In the meantime, though, Hurst said he won’t be making any changes in his operations “until we see some actual purchases from the Chinese.”

‘We will see what 2019 brings’

Before the U.S. and China started their talks in December 2018, the percentage of U.S. soybean exports to China fell 98% that year. This gave other countries, like Brazil and Russia, the chance to swoop in and take over the competition.

“It used to be very difficult to sell soy here,” Russian farm manager, Viktor Silokhin, told the Wall Street Journal. “Now I get calls from China every day.”

This has made financial situations even worse for American farmers, who are seeing a rise in bankruptcies. Soybean and pork prices both dropped following retaliatory tariffs on U.S. steel and aluminum.

The billions in aid “was very much help, particularly for soybeans,” Gary Schnitkey, Professor in Farm Management at the University of Illinois, told Yahoo Finance. He added that payments from the Market Facilitation Program (MFP) — the official name of the trade dispute mitigation program administration by the USDA Farm Service Agency— had added about $1.65 to the price of each bushel of soybeans in Illinois.

"That added to a fall cash price of around $8.50 [per bushel] in Illinois took the effective price up to $10.15 [per bushel]. Cash prices in the previous two years were in the high $9 range. So the MFP payment got prices up to levels of previous years."

The price of soybean per bushel in the U.S. as of February 19, 2019, is $9.0075.

Treal concern now is 2019,” Schnitkey added. “We currently have much lower soybean prices [and] rising costs. MFP payments aided in 2018 incomes. We will see what 2019 brings.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

A U.S.-China trade deal by March 1 deadline is 'really far-fetched': Strategist

The growing U.S. soybean stockpile could come back to haunt Trump

U.S. soybean farmer: 'We obviously are struggling' amid U.S.-China trade war

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.