A trust fund for all babies born in Mass.? Lawmakers ponder 'baby bonds'

- Oops!Something went wrong.Please try again later.

Every child born in Massachusetts could become a “trust fund baby” if legislation addressing the state’s wealth gap is enacted in the Statehouse during the current legislative session.

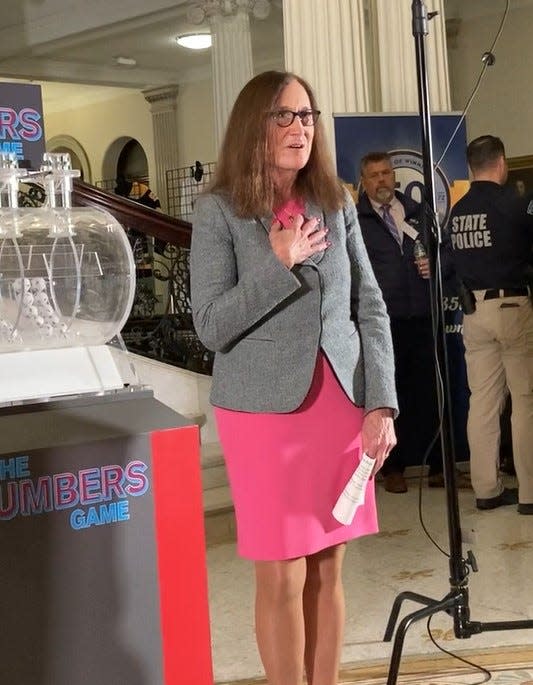

The proposal, backed by Sen. Paul Feeney, D-Foxborough, Rep. Andrés Vargas, D-Haverhill, and state Treasurer Deb Goldberg, would create a trust fund for each Massachusetts-born child. The initial investment would be substantial enough to promise anywhere from a $10,000 to $20,000 return by the time a youngster reaches age 18.

Under the proposal, the funds would be earmarked exclusively for financing education, purchasing housing or opening a business. The investment could even be left fallow and allowed to grow as a retirement fund.

Change meant to address generational poverty

The legislation, proponents said, would change the state’s approach to economic issues, extending beyond the safety net of emergency assistance and one-time payments. The program, according to the legislators, is designed to increase overall family wealth and lift those who have been marginalized out of poverty.

“A child born today, by the time they turn 18, could have enough money to begin college, launch a career, start a business,” Feeney said.

He described the program as beyond the state’s current emergency “triage approach, and day-to-day" safety net. "This would be taking steps to build people up."

Safety nets are important, said New School professor David Radcliffe, who attended a virtual presentation Monday morning about the program hosted by Goldberg.

“But they don’t create the base to build up wealth,” said Radcliffe, who was involved in legislation that created a baby bonds program in Connecticut.

With his experience there, Radcliffe identified three areas that need attention if the state opts to enact the program:

Legislators have to commit to a long-term investment that will not show benefits for 18 years. The state must sustain the public will over the long term.

The state must find a dedicated and durable funding stream that outlasts changes in legislators and administrations.

The state must ensure automatic enrollment and engage families in financial education programs immediately upon the birth of a child.

“This is a policy solution. It changes how wealth is created,” he said.

Fellow New School economics and urban studies professor Darrick Hamilton said income and education alone cannot solve the wealth gap.

Life is not Monopoly

“Wealth generates wealth,” Hamilton said. Life, he noted, is not like the game of Monopoly, where all start with the same amount of money and without owning any property. Some economically advantaged people can launch youngsters into the world without incurring staggering educational debt and have enough resources to help children purchase property.

“If you look at history, look at Black and Indigenous people, they have no access to capital,” Hamilton said. “Massachusetts should lead on this issue.”

A task force studied the proposal, its costs and ramifications, Feeney said.

Still to be decided is the initial deposit: A lower amount of $4,250 could grow to $10,228 by the time a child reaches adulthood. Higher initial deposits could see growth to $20,000 or even $36,000. The projected cost depends on the size of the deposits and ranges from $4.2 million a year to $8.5 million.

“A large initial deposit that grows can make a difference for an 18-year-old,” Feeney said. “We want the money to make a difference in their lives.”

Vargas sees range of economic disparities in district

Vargas, who represents a district that includes golf courses and gang violence, quoted one 2015 study by the Boston Federal Reserve Bank that found Black families had a median financial worth of roughly $8, while white families had a median financial worth of $247,500.

The study also found that Dominican families' median net worth was $0.

“In my district the median household income ranges from $25,000 to $175,000,” Vargas said.

“We can address those gaps through this legislation,” Vargas said. “We can ensure all children in Massachusetts are not limited by the ZIP code they were born into or their parents’ household wealth.”

The baby bonds funds would “divorce” children from the financial inequities experienced by their families, Vargas said.

A similar plan was proposed on the federal level by Sen. Cory Booker, D-New Jersey, and U.S. Rep. Ayanna Pressley, D-Massachusetts. Their proposal would have had the federal government deposit $1,000 into a trust fund for every child born in the United States with additional investments throughout their lives. These deposits, they proposed, could remain higher for children in lower-income households, while they would diminish and gradually end for children born to parents in higher-income brackets.

Federal program lagging: Legislators urge Mass. to step up

While the federal proposal has far to go, some states have picked up the torch. Connecticut passed legislation creating a trust fund for children born into income-eligible households. California did as well and included children in long-term foster care.

Massachusetts, Nevada and New York are in the midst of reviewing proposals.

The nuts and bolts of the proposed program still need to be figured out including the amount of the initial investment, the number of future deposits into funds and how exactly the money could be used.

The proposed trust fund would complement the state’s BabySteps program.

Every child born in Massachusetts is eligible to receive $50 into a U.Fund 529 account — a tax-advantaged college savings plan — up to a year after their birth or adoption.

“These two programs could work nicely together,” said Feeney.

This article originally appeared on Telegram & Gazette: Money for being born in Massachusetts proposed by state legislators