Tsaker Chemical Group (HKG:1986) Seems To Use Debt Quite Sensibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Tsaker Chemical Group Limited (HKG:1986) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Tsaker Chemical Group

What Is Tsaker Chemical Group's Debt?

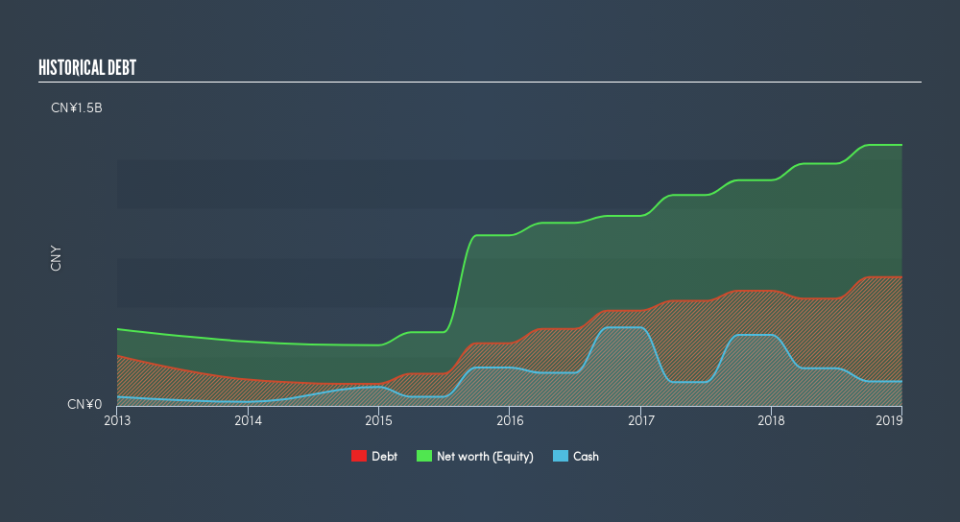

As you can see below, at the end of December 2018, Tsaker Chemical Group had CN¥651.2m of debt, up from CN¥582.0m a year ago. Click the image for more detail. On the flip side, it has CN¥124.3m in cash leading to net debt of about CN¥526.9m.

How Strong Is Tsaker Chemical Group's Balance Sheet?

We can see from the most recent balance sheet that Tsaker Chemical Group had liabilities of CN¥871.5m falling due within a year, and liabilities of CN¥317.8m due beyond that. Offsetting this, it had CN¥124.3m in cash and CN¥305.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥760.0m.

Tsaker Chemical Group has a market capitalization of CN¥3.00b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Tsaker Chemical Group's net debt is only 1.3 times its EBITDA. And its EBIT easily covers its interest expense, being 27.7 times the size. So we're pretty relaxed about its super-conservative use of debt. On top of that, Tsaker Chemical Group grew its EBIT by 73% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Tsaker Chemical Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Tsaker Chemical Group burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Tsaker Chemical Group is not finding it easy conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its interest cover. When we consider all the elements mentioned above, it seems to us that Tsaker Chemical Group is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. We'd be motivated to research the stock further if we found out that Tsaker Chemical Group insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.