The Tuesday Morning (NASDAQ:TUES) Share Price Is Down 93% So Some Shareholders Are Rather Upset

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held Tuesday Morning Corporation (NASDAQ:TUES) for five whole years - as the share price tanked 93%. And some of the more recent buyers are probably worried, too, with the stock falling 58% in the last year. The falls have accelerated recently, with the share price down 17% in the last three months.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Tuesday Morning

Given that Tuesday Morning didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Tuesday Morning saw its revenue increase by 3.1% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 41% per year is completely deserved, but the market is doubtless disappointed. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

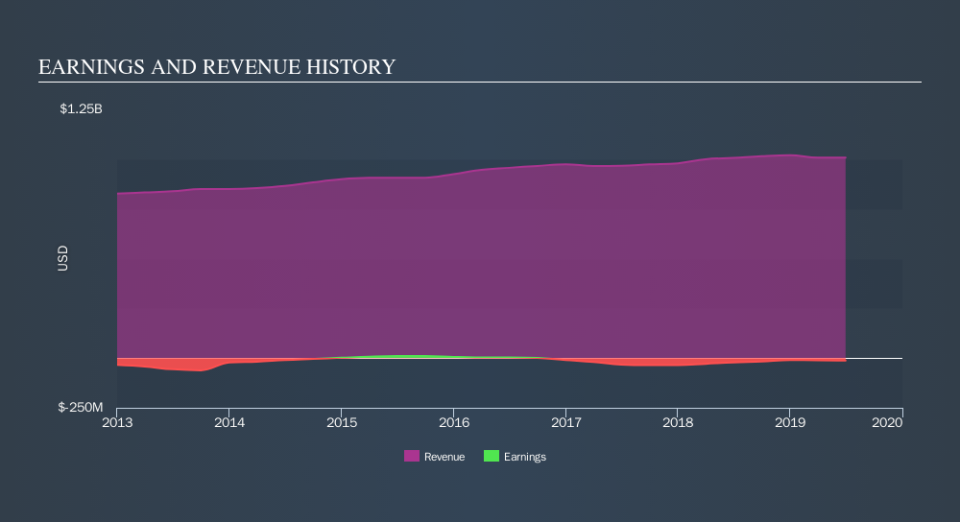

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Tuesday Morning stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in Tuesday Morning had a tough year, with a total loss of 58%, against a market gain of about 9.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 41% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Tuesday Morning is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.