Turn off the gas: is America ready to embrace electric vehicles?

- Oops!Something went wrong.Please try again later.

In Detroit, auto plants have for decades churned out trucks built with Motor City steel and fueled by gasoline. But this week’s rollout of the Ford F-150 Lightning electric truck offered a vision of the future in America’s automotive heartland: aluminum-clad pickups running off of electric powertrains with lithium batteries.

Related: Ford launching electric F-150 truck in ‘huge’ shift for low-emission vehicles

An electric model of the nation’s best-selling vehicle at an accessible $40,000 has the potential to shift the auto industry’s course, and do more to advance the transportation sector’s electrification than any recent development, analysts say.

“Offering a well-known vehicle at a competitive price could really help push the EV agenda in the US,” said Jessica Caldwell, executive director of insights at Edmunds.com.

Meanwhile, Ford characterized the Lightning’s introduction as a “watershed moment”, but it also represents a major gamble. The F-150 embodies American ruggedness, and it raises the question: is the truck market’s meat-and-potatoes base ready to embrace environmentally friendly electric vehicles (EVs)?

It’s uncharted territory, said Michelle Krebs, Autotrader executive analyst. The success of the Lightning or any EV hinges on a major infrastructure build-out that’s far from certain.

“There’s no EV pickup market at the moment, so we just don’t know how big it could be, or what consumer acceptance will be,” she said.

Truck consumers are generally unwilling to switch to cars just to go electric, Krebs said. So pitching them on the Lightning not only opens a new market for Ford, but is a critical step in the nation’s efforts to rein in greenhouse gas emissions, of which the transportation sector accounts for 29%. The EV transition is a key component of Joe Biden’s climate plan, which calls for the nation to cut emissions by 50% from 2005 levels by 2030, and net-zero emissions economy-wide by 2050.

Though EVs only make up less than 2% of new-vehicle sales in the US, there’s perhaps no better line to push the needle on those figures than the F-Series. Last year, Ford generated about $42bn in the sale of over 800,000 F-Series trucks, according to data from the company and Edmunds.com. Sales of the F-150, the line’s light-duty truck, exceeded 556,000.

The Lightning feature that seems to be catching the most attention isn’t under the hood or in the cab, but on the price tag. With EV tax incentives, the truck’s base model could cost about $32,000 – less than a $37,000 gas-powered F-150 with a crew cab. By contrast, the GMC Hummer EV and Rivian R1T, are priced at $80,000 and $70,000 though they are slightly flashier.

The Lightning also marks one of the first attempts to electrify a well-known, everyday vehicle that appeals to a mass market. Previously, EVs were mostly small, unconventionally designed cars that appealed to environmentally minded people who made a personality statement with their vehicle, Caldwell said. The “pendulum has swung” in terms of design, she added.

The Lightning’s range is also notable. One charge will take a base model Lightning 230 miles, or, for an additional $20,000, the extended range trim will travel 300 miles. It can haul up to 2,000lb of payload and tow up to 10,000lb. However, Ford doesn’t offer any data on range with a heavy payload or tow, and Car And Drive estimated it at as little as 100 miles.

That’s the type of detail that could keep consumers away from not just the Lightning, but all electric pickups. On a 150kw DC fast charger, the extended-range trim targets up to 54 miles of range in 10 minutes, or just under an hour for a full charge.

It’s not hard to imagine a scenario in which someone who may be buying a truck to tow a camper a long distance once or twice per year opting for a gas-powered F-150 instead being inconvenienced with an hour-long stop to recharge every 100 miles or so, Caldwell said.

But several once-in-a-while Lightning features are generating a buzz, like a drain hole in case the cab needs to be hosed out. Its dual battery system can power tools in the field, or a house for three days during an outage. The F-150 Hybrid was utilized as a mobile generator in the recent deadly Texas blackouts.

The Lightning’s power is another selling point – it can go 0-60mph in just over four seconds, offers 775lb-ft of torque, and the extended range model targets 563 horsepower.

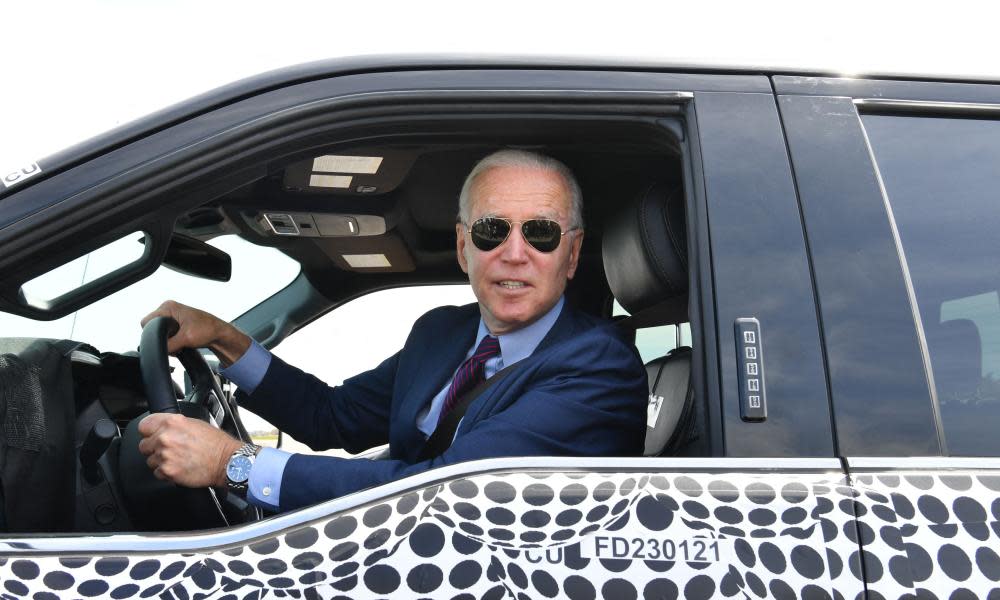

That was enough to impress the president, who test drove a Lightning during a Michigan stop last week. “This sucker’s quick,” he declared.

Among those who will need to harness the truck’s full power and hauling capacity are contractors. It’s worth consideration, said Dave Alder, an electrician in Detroit, especially if it could save on gas money. But he worried about where he would charge it, and said it’s a bit of a “If it’s not broken, don’t fix it” situation with his gas-powered Chevy Silverado.

The Lightning has the support of the United Auto Workers union, which at times has been skeptical of electrification. The truck will be built at the Rouge Electric Vehicle Center in Dearborn, which sits just outside of Detroit and next to the Dearborn Truck Plant that produces gas-powered and hybrid F-150s. Lightning production is slated to start next spring, with the trucks hitting the lot in mid-2022.

Critical to its success is an infrastructure build out, and Biden’s $2tn infrastructure plan includes $174bn to support the EV transition.

Biden has framed his pitch by repeatedly claiming the US is in an electrification race with China.

“The future of the auto industry is electric. There’s no turning back,” he said during the Lightning’s unveiling. “The question is whether we will lead or we will fall behind in the race to the future.”

Buy-in from the auto industry could help Biden push his proposal with Congress, though it’s uniformly opposed by the GOP. Republican leadership has pointed to the lack of infrastructure as a chief reason for opposing spending on the EV transition, but at the same time opposes funding an infrastructure build-out.

American consumers have said they won’t buy an EV without the infrastructure in place, Krebs said, which leaves the industry facing a “chicken and egg” situation.

“That’s key – they have got to have the charging infrastructure in place or this will all go kaput,” she said.