Turtle Beach Shorts Anxious as Stock Breaks Out

The shares of Turtle Beach Corp (NASDAQ:HEAR) are trading up 8% at $10.64, pacing for a third straight win. Options traders are reacting to this sharp move higher, with nearly 2,500 contracts traded so far -- four times what's typically seen at this point. The bulk of the action has occurred on the call side, with speculators potentially positioning for more HEAR stock upside.

Specifically, the October 12.50 call is most active today, and traders may be buying to open new positions here. If this is the case, the call buyers expect Turtle Beach shares to break out above $12.50 by expiration at the close on Friday, Oct. 18. The last time HEAR shares close north of this strike was in early April.

Considering these calls are out of the money, it's also possible that short sellers are initiating a protective call to guard against a bigger breakout. The 4.93 million HEAR shares sold short account for almost 38% of the stock's available float, or 8.3 times the average daily pace of trading.

Whatever the reason, short-term options are cheap for those looking to buy premium on HEAR options. The stock's Schaeffer's Volatility Index (SVI) of 71% registers in the 10th annual percentile, meaning short-term Turtle Beach options have priced in lower implied volatility expectations just 10% of the time over the past year.

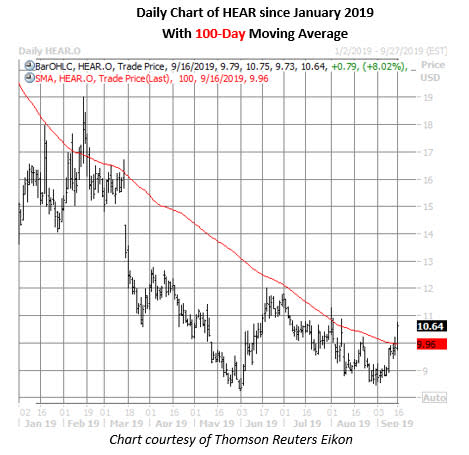

Looking closer at the charts, Turtle Beach stock is headed for its first close in double-digit territory since Aug. 8, and its first close above its 100-day moving average since Feb. 15. Longer term, though, the shares remain down 25.4% year-to-date.