Tuscaloosa County School System pins hopes on property tax increase

As Feb. 14 approaches, the Tuscaloosa County School System and supporters who share the system's assessment of the need for more education funding hope to feel love from county residents, in the form of a 'Yes' vote on an 8-mill increase on property taxes.

The vote falls on Valentine's Day, but this year for TCSS and the Tuscaloosa County Commission, it's also referendum time, when proponents of the special district school tax hope its shared messages are reaching their targets.

Those for have underlined the fact that the 8-mill increase — which in net will be 7.5 mill, as the state of Alabama contributes .5 mill to the county's current 9.5 mill, to raise it to 10 mill, the lowest allowable rate by law — would represent a bump of less than a dollar per day, for many property owners. A property with assessed value of $100,000 would see tax raise by roughly $75 per year, or 20 cents per day; a property assessed at $200,000 would pay an extra $150, or 40 cents a day, and so on.

More:'We're in a teacher crisis': Tuscaloosa educators discuss public school challenges

The vote is open to registered voters outside the Tuscaloosa city limits and the tax hike would only affect landowners outside of the city. In making its pitch before the Tuscaloosa County Commission and other groups over recent months, TCSS has shared that it's the ninth-largest school district in Alabama by enrollment, with about 19,000 students.

"But geographically, we're the largest," said Keri Johnson, superintendent of TCSS since July 1, 2020. Tuscaloosa County covers 1,351 square miles, she said, in a Nov. 23 presentation before the County Commission, pitching the Feb. 14 special election. "That's a lot of county. We're big, and we have a lot of needs."

Among those expressed needs:

New and updated school buildings, for a system that has 14 school buildings 50 or more years old, another four between 40 and 49 years old, seven that are 15 to 39 years old, and 10 schools 14 years old or less

Additional school security resource officers and building security improvements

Pre-K availability for all students

More electives and career tech options for high school students

Art and music education for elementary school students

Smaller class sizes

Dual enrollment scholarships

Increased mental health resources

Construction of a centrally-located performing arts venue

Proposed improvements for each of the six high school attendance zones — Brookwood, Hillcrest, Holt, Northside, Sipsey Valley and Tuscaloosa County High — are being rolled out in explanation sessions at the facilities. Holt, TCHS and Brookwood meetings were held Jan. 24, 26, and 31 respectively. The Hillcrest session will be at 6 p.m. Feb. 2. Northside will meet 6 p.m. Feb. 7.

Information on specifics can also be found on the TCSS website at www.tcss.net/Page/39648.

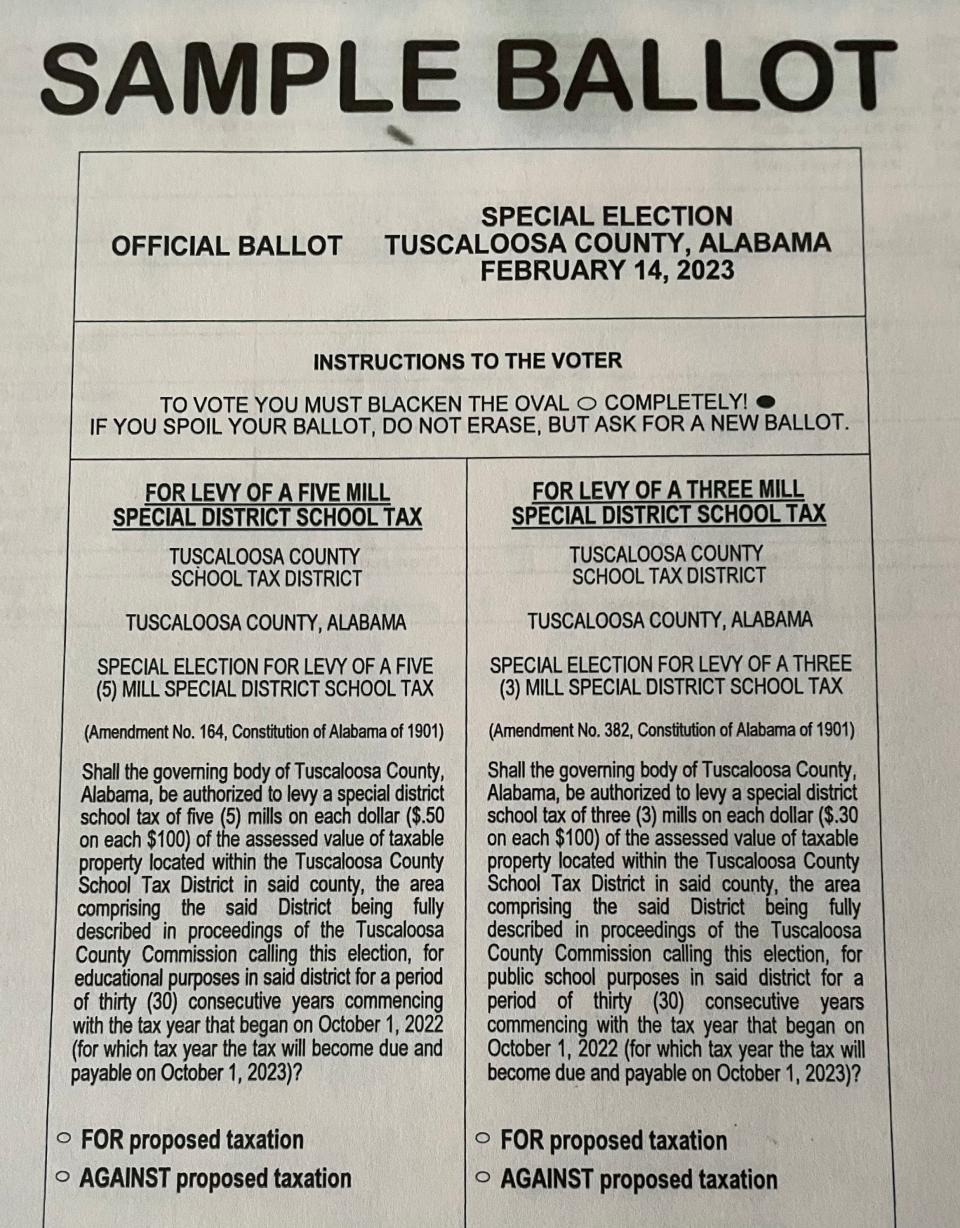

The Feb. 14 ballot will actually include two 'Yes' or 'No' votes, for 5 mill (or 50 cents on each $100) and for three mill (or 30 cents on each $100) additions. If passed, the increased funding could add about $15 million annually, Johnson said.

"One of the things that other systems are able to do that we're just not, because we don't have a lot of extra money after that 10 mills comes in, is local (teaching) units," Johnson said. In comparison, Tuscaloosa City Schools, with 20 schools and a little under 11,000 students, have 148 local units to TCSS's 38 local units. "Of those 38, the vast majority of them are reading coaches, and instructional coaches. So there are very very few in the classroom.

"We don't have art and music teachers in every single one of our elementary schools. We have electives that we're not able to offer because we have to put our teacher units in for the core courses, and special ed, and ELL (English language learners; students for whom English is not their first language)."

How Tuscaloosa County schools are funded

In meeting with teachers, administrators and other stakeholders, Johnson and Danny Higdon, the system's chief financial officer, have tried to explain more about the money sources.

"A lot of people don't really understand how we are funded," Johnson said, breaking it down as 57 percent from the state, 19 percent from federal sources, and 24 percent from local funds.

Of that, Higdon said, 68 percent of all funding is spent in the classroom, as salaries and benefits for teachers and administrators. More goes to child nutrition programs and transportation, and there isn't enough to go around, he added.

"We have a lot of unfunded mandates," he said. TCSS has about 75 percent of what it needs for transportation, Higdon said, noting that thanks to inflation, the average yearly fuel cost has risen from about $23,000 to $40,000. Another $6 million is needed for utilities, and $3 million for special education, numbers that are also on the rise. Each of the 35 county schools has a nurse, and that program is not fully funded. The information technology department costs continue to grow, because of technological demands. And there's not a lot of flexibility.

"More than 90 percent of our funds are earmarked, by state and federal law," Higdon said.

Though it's ninth-largest by enrollment, and largest physically, out of the 139 Alabama school districts, Tuscaloosa County ranks at the bottom in millage rate for local school funding. The extra .5 mill the state contributes bumped the county's current 9.5 up to 10.

Should the Feb. 14 vote go yes on both the proposed 5 mills and the proposed 3 mills, the Tuscaloosa County rate would then be 18 mills, but because of the state contribution, property owners would be affected by a net 7.5 mill — one dollar per $1,000 dollars of assessed value — hike.

Section 214 of Alabama's 1901 constitution limits the state millage rate on both real (the land, buildings, other permanent fixtures) and personal (not permanently affixed things, such as furniture, equipment and tools) property to 6.5 mills. Of that, 3 mills goes to education, 1 mill for relief and 2.5 mills for general use.

However, cities and counties may levy additional mills. According to Alabama Department of Revenue figures, the average rate statewide is 42 mills. The city of Tuscaloosa's rate is 21 mills.

And yet the state of Alabama still has the second-lowest property taxes in the United States, after Hawaii, whose average annual property tax of $606 beats out Alabama's $895. Numbers three and upward pay from $1,113 up to $5,419 yearly.

Another salient figure: Tuscaloosa County voters have not voted yes on a millage rate increase for local school funding since 1917.

Bobby Herndon says vote 'No'

Though no one seems ready to argue about the system's needs, some voices have spoken out against what's perceived as a lack of transparency and accountability. Former Northport Mayor Bobby Herndon posted an eight-and-a-half minute video on his Facebook page earlier this week, saying that he was voting no, in part because of those perceived gaps, in part because he wants Northport to establish its own school district — which is not part of the Feb. 14 vote. Others who've weighed in as 'No' voters think schools should find other means of funding, including a state lottery, which currently does not exist.

"That'll be 8 mills more the citizens of Northport have no say-so, no control, no voice, as to where the money will be spent," Herndon said in his video. He posted follow-ups reiterating his support for the school system, noting that the aging facilities had not gone unnoticed: "To see the students of Collins Riverside, Matthews, Crestmont and Flatwoods have to go into those buildings that should have been bulldozed years ago breaks my heart," he wrote.

On the need for upgraded facilities, most agree, at least in principle.

"We do a fantastic job maintaining those schools," Johnson said, "but it is a constant battle. When schools get that much age on them, they cost money to maintain, and they always need something done."

Though he's planning to vote yes on the property tax raise, Jim Colby recently questioned the TCSS push to make the case clear and accessible. The first presentation, to the County Commission in November, was difficult to parse, he said, though the messaging has improved recently. At the Jan. 26 TCHS meeting, for the Q&A, he raised the first question.

"I lead with 'Look you gave this to the commission on Nov. 23rd, and we haven't heard a single peep since,' " he said. " Y'all have wasted three months not getting your message out there.' "

But that information can be found, he stressed, though from what he's seeing on social media discourse, many voters aren't looking, having already made up their minds.

"The oversight and accountability is out there for everyone to see," said Colby, who frequently attends and shoots video of commission meetings, livestreaming and posting them on the Tuscaloosa County Citizens Alliance Facebook group. And that's including financial accountability reports, required by law, thousands of lines' worth of them, counted down to the penny.

"You just have to know to dig for it, and figure out what you're looking for, and how they titled it," he said. "When people say there's no oversight and no accountability, I can send them a link to that."

He's posted such links in numerous places, and gotten a few thank-you notes, but mostly no response.

Though retired now, and a landowner, with neither children nor grandchildren in the schools, Colby said he's never hesitated to vote for a property tax increase, knowing the state of Alabama's rates are still second-lowest nationwide.

"They're no big deal," he said. "With my 70 acres or so, plus my barn, the old house (which he hasn't lived in since it was damaged by the April 27, 2011 tornado), the tiny cabin and Airstream trailer up here ... my property taxes were only a couple of hundred dollars last year.

"These people that are screaming and hollering about the numbers, they own thousands of acres of property."

Social media posts have expressed anger at rumors that proponents of the millage raise are hoping for low voter turnout.

"That coupled with all the misleading information," Colby said, "it's just got everyone fired up."

The vote could go no, because of such heated, misinformed crosstalk, he said.

"I hope I'm wrong. This has just exploded way out of proportion."

This article originally appeared on The Tuscaloosa News: Tuscaloosa County School System pins hopes on property tax increase