What Type Of Returns Would LAIX's(NYSE:LAIX) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that LAIX Inc. (NYSE:LAIX) stock has had a really bad year. The share price has slid 54% in that time. LAIX hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 22% in about a quarter. That's not much fun for holders.

View our latest analysis for LAIX

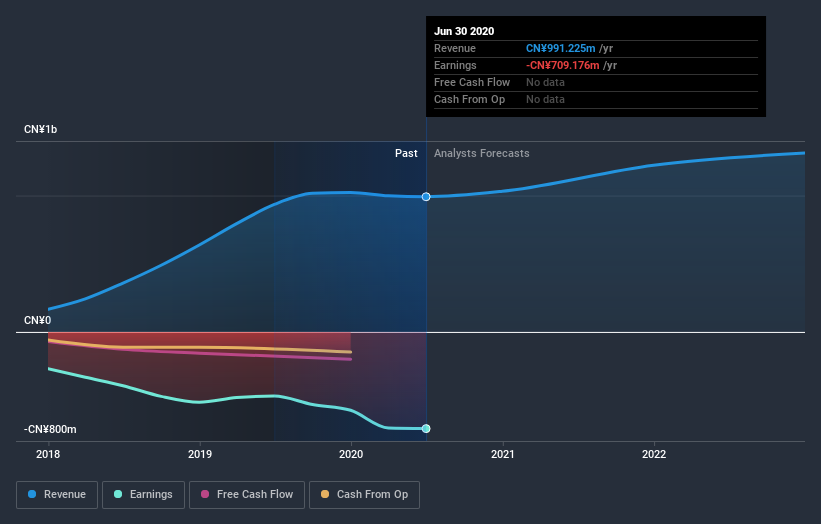

Given that LAIX didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

LAIX grew its revenue by 6.0% over the last year. That's not a very high growth rate considering it doesn't make profits. Without profits, and with revenue growth sluggish, you get a 54% loss for shareholders, over the year. Like many holders, we really want to see better revenue growth in companies that lose money. Of course, the market can be too impatient at times. Why not take a closer look at this one so you're ready to pounce if growth does accelerate.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling LAIX stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 18% in the last year, LAIX shareholders might be miffed that they lost 54%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 22% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - LAIX has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

But note: LAIX may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.