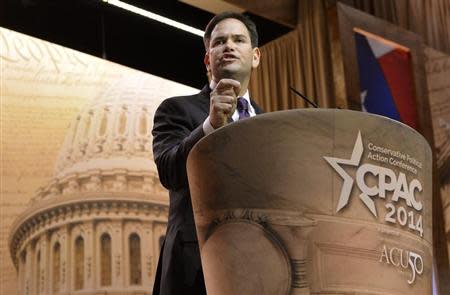

Republican Rubio offers bill on new education financing vehicles

By Caren Bohan and Julia Edwards WASHINGTON (Reuters) - U.S. Republican Senator Marco Rubio, a possible 2016 White House contender, unveiled legislation on Wednesday to broaden the use of financial vehicles known as "income share agreements" that students can use to fund their higher education costs. Under the agreements, which are marketed as an alternative to traditional student loans, private investors or organizations provide students with financing for their education costs in exchange for a percentage of their future earnings. "The same way that private investors invest in a business idea, they could invest in a person who basically says: ‘This is who I am. This is what my career goals are. This is what I've done so far. This is what I intend to major and graduate in. And in return, when I graduate, I will pay a percentage of my salary over a defined period of time in return for that investment,'" Rubio told Reuters in an interview on Tuesday. Some companies, including Upstart, developed by former Google employees, and Pave, already offer the financial instruments. The legislation Rubio is proposing is aimed at making the vehicles more widely available by providing a legal framework for them. "Many players have resisted getting into the marketplace because they're not sure of the legal certainty behind it. The fact that it's now a recognized investment vehicle would allow more players to get into the space and could encourage more to come forward," Rubio said. The Florida senator added that the legislation would also establish new legal protections for both investors and students. But some critics of the "income share agreements" see risks for students in them. David Bergeron, an expert on education at the Center for American Progress, a liberal think tank, said he welcomed Rubio's effort to bring new ideas to the table on higher education financing but said he was concerned investors would "rig the game" in way that would be unfair to students. Because students pay a portion of income for a defined period of time, they could end up paying the investors "substantially more" than the original amount of financing they received, Bergeron said. Bergeron said the federal student loan program offered greater built-in protections for students. Republican Representative Tom Petri, who has proposed a companion bill on income share agreements in the House, said the financial instruments would not replace traditional student loans in many cases but supplement them. The amount of outstanding student loan debt has eclipsed that of auto loans and credit cards in the United States, according to the Federal Reserve Bank of New York. "It's a huge problem and a growing problem," said Petri, a Wisconsin congressman who sits on the House Education and Workforce Committee. "College costs have been growing for years faster than even healthcare. It is reaching crisis proportions." Rubio has often talked in speeches about how he graduated from law school with close to $150,000 in debt. He paid off the debt with the proceeds of his 2012 autobiography, "An American Son." Rubio told CNBC television on Wednesday that income share agreements were not for everyone and might in some cases be a better fit for people pursuing advanced degrees. "My guess is that you will likely see this more often than not in a graduate level, people going into the STEM fields or medicine or some other profession where there is certainty for the investor that, that person is going to find a job and make sufficient money to make their payments," Rubio said. (Reporting by Caren Bohan and Julia Edwards; Editing by Peter Cooney and Jonathan Oatis)