Uber Seals a Deal to Gobble Up Postmates

On Monday morning, Uber Technologies Inc. (NYSE:UBER) announced that its board of directors has agreed to buy one of its rivals in the meal delivery space, Postmates, in an all-stock transaction valued at approximately $2.65 billion (according to current market values). Uber estimates that it will need to issue about 84 million shares for the acquisition, which will have comparatively little effect on its existing 1.734 billion shares.

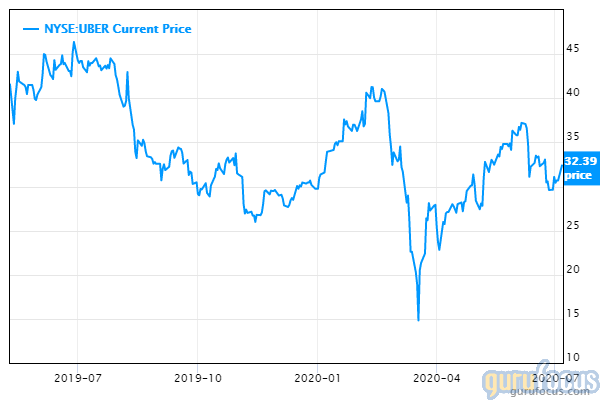

Shares of Uber were up approximately 4.89% to $32.39 in midday trading following the announcement.

According to the announcement, the transaction brings together the companies' complementary market shares and combines Uber's platform and new focus on groceries and essentials with Postmates' local restaurant connections and "delivery-as-a-service" model. Uber plans to keep the Postmates app up and running separately post-merger in order to avoid driving away customers due to loss of familiarity, but both the Postmates and Uber Eats services will have a combined merchant and delivery network.

Ube's CEO Dara Khosrowshahi had the following to say:

"Uber and Postmates have long shared a belief that platforms like ours can power much more than just food delivery--they can be a hugely important part of local commerce and communities, all the more important during crises like COVID-19. As more people and more restaurants have come to use our services, Q2 bookings on Uber Eats are up more than 100 percent year on year. We're thrilled to welcome Postmates to the Uber family as we innovate together to deliver better experiences for consumers, delivery people, and merchants across the country."

Valuing a deal

The announcement comes shortly after Uber's negotiations with Grubhub (NYSE:GRUB) fell through, with Grubhub entering an agreement to be acquired by Europe's Just Eat Takeaway (XAMS:TKWY). Compared to a deal with Grubhub, Uber will likely face less regulatory scrutiny as the companies' combined U.S. delivery services will still be behind privately-owned DoorDash.

Previously, Postmates had been considering its options in light of the favorable market environment, including going public on its own or being acquired by a special purpose acquisition company (a type of blank-shell company created to acquire existing businesses).

With higher demand for meal delivery services in light of the Covid-19 pandemic, quite a few companies in this space have been looking to either find an attractive acquisition target to improve their market share or capitalize on high market valuations to sell. In its previous round of fundraising in September of 2019, Postmates was valued at $2.4 billion, so Uber's deal represents a 10% increase compared to 10 months ago.

Financials

Uber in particular may need to rely heavily on this source of increased demand, as the company's already barely profitable ridesharing segment has taken an 80% hit to gross booking revenue. With gross booking revenue for Uber Eats increasing by 50% in the first quarter of 2020 and 100% in the second quarter, consolidating a higher position in meal delivery could serve as the breath of fresh air that the company needs to support its balance sheet.

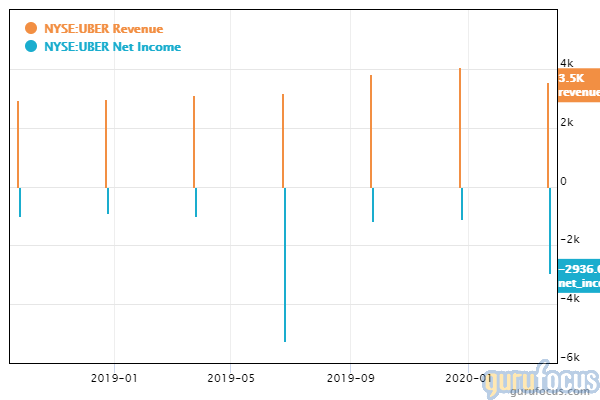

Though it is more widely known for its ridesharing and food delivery services, Uber is a technology company, which makes it more than a little difficult to value. It is still very much in the "unprofitable" category as it has yet to turn a quarterly net profit after going public in 2019.

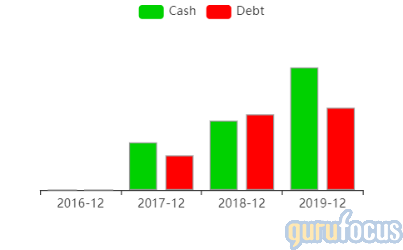

GuruFocus gives Uber a profitability rating of 1 out of 10 and a financial strength rating of 4 out of 10. Though the three-year revenue growth rate is impressive at 65.1%, it comes at the cost of an operating margin of -60.48% and a three-year Ebitda growth rate of -52.8%. The current ratio of 1.68 and cash-debt ratio of 1.06 indicate that the company can pay its short-term debts, but the Altman Z-Score of 0.42 warns the company could be in danger of going bankrupt within the next two years if it cannot raise additional funds.

Thus, the all-stock deal with Postmates is ideal, since it does not immediately put Uber further in the red from a balance sheet standpoint.

Conclusion

It seems that Uber is finally set to succeed in its mission to take advantage of the increased demand for meal delivery services and increase its market share in this space. In order to become profitable, the company has been aiming to become the dominant player first, even if that means burning cash in the short term.

The deal with Postmates seems to be a step in the right direction. Investors with a high risk tolerance might still find the stock attractive given its future prospects and the wide range of industries it is involved in, but those who are wary of cash-burning or further share dilution might want to steer clear.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.