UFP Industries (UFPI) Banks on Acquisitions & Product Innovation

Shares of UFP Industries, Inc. UFPI outperformed the Zacks Building Products - Wood industry in the year-to-date period. The trend is likely to continue as it has benefited from exploring new markets and enhancing its existing product portfolio via acquisitions and product innovation. The solid U.S. residential market, strong demand for repair and remodeling activities and a stable balance sheet bode well.

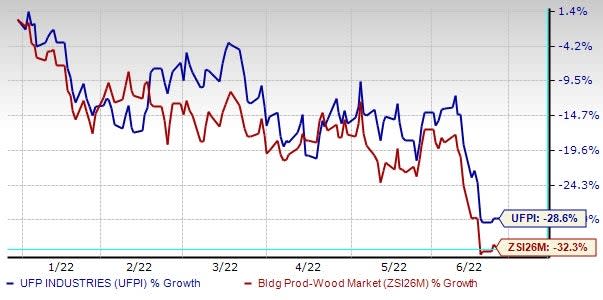

In the year-to-date period, its shares have plunged 28.6% compared with the industry’s 32.3% decline. The entire industry is grappling with exaggerated prices of material, labor and transportation and supply chain disorder. UFPI also faced these headwinds in the past several quarters.

Nonetheless, its cost-containment efforts and managing liquidity to offset cost woes is commendable. Let’s check the factors substantiating its Zacks #1 Rank (Strong Buy).

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Potential

In the last reported quarter, UFPI performed pretty well. Both earnings and net sales beat the Zacks Consensus Estimate and improved impressively on a year-over-year basis. In fact, its earnings and sales surpassed the consensus mark in all the trailing five quarters. The uptrend was mainly driven by the diversity of markets and an improved pricing model.

Earnings estimates for 2022 have moved up to $9.60 per share compared with $8.76 in the past 60 days. This indicates an 11.8% year-over-year growth. The trend signifies bullish analyst sentiments, indicating robust fundamentals and the expectation of further outperformance in the near term.

The company currently has a VGM Score of B, supported by Value Score of A. Our VGM Score of A or B along with Zacks Rank #1 or 2 (Buy) indicates the highest probability of success in the future.

Acquisitions Driving Revenue

UFP Industries has been following a systematic inorganic strategy to expand market reach, boost profitability and strengthen its product portfolio. Recently, it acquired Cedar Poly LLC via its subsidiary Deckorators, Inc for the purchase price of $17 million and comprises incentive payments. Cedar Poly will operate in UFP’s Deckorators business unit. (Read more: UFP Industries Buys Polyethylene Recycler Cedar Poly)

In first-quarter 2022, UFPI recorded a 7% increase in unit sales from acquisitions. Acquisitions also contributed $12 million to quarterly adjusted EBITDA and $10 million to earnings. UFPI acquired nine companies in 2021 and five in 2020. Acquisitions contributed 24% to unit sales growth in 2021.

Product Innovation

UFP Industries’ continuous efforts to introduce new products will also likely boost its performance. In 2021, new product sales rose 56% from the year-ago period’s levels. New product sales of $151 million increased 58% during first-quarter 2022. The company aims to achieve new product sales of $525 million in 2022.

Solid Demand Trends

The company is poised to benefit from rising demand for housing, repair and remodeling activities in the quarters ahead. It has been benefiting from a solid U.S. residential market. Moreover, the company's industrial and construction segments are experiencing favorable growth trends and profitability, given normalized retail demand.

Impressive Liquidity Position

UFP Industries maintained a strong liquidity position to navigate through the current environment. The company ended first-quarter 2022 with $445 million in liquidity. For the quarter, net cash used in operating activities was $248.3 million compared with $196.7 million in the corresponding year-ago period. The current liquidity level is sufficient to meet the short-term obligation of $104.6 million. The company plans to reduce net working capital investment in the future.

UFP Industries follows a consistent policy of returning its shareholders’ funds handsomely. On Apr 20, 2022, the board approved an increase in its quarterly dividend payment to 25 cents per share, reflecting an increase of 25% over the dividend paid on Mar 15, 2022, and 67% higher than the dividend paid on Jun 15, 2021.

Other Key Picks

Louisiana-Pacific Corporation LPX: Headquartered in Nashville, TN, this company manufactures building products primarily for use in new home construction, R&R as well as outdoor structure markets. Strong Siding Solutions (formerly known as SmartSide) revenues and an increase in OSB pricing will boost Louisiana-Pacific’s bottom line despite the ongoing headwinds from raw material prices and availability. Operational efficiency and cost-containment efforts are also encouraging.

Louisiana-Pacific currently carries a Zacks Rank #2. The consensus estimate for 2022 earnings has witnessed an upward revision of 14.2% in the past 60 days.

Rayonier Inc. RYN: Jacksonville, FL-based Rayonier is a leading pure-play timberland REIT. With a solid portfolio of timberlands in some of the most productive timber-growing regions of the Southern United States, Pacific Northwest and New Zealand, this company is well-positioned to capitalize on higher demand trends. This will help RYN improve export market conditions and lead to a favorable pricing environment. It also remains focused on adding high-quality timberlands to its portfolio through acquisitions.

The consensus estimate for Zacks #2 Ranked Rayonier’s 2022 earnings has witnessed an upward revision of 4.8% in the past 30 days.

Boise Cascade Company BCC: Based in Boise, ID, this Zacks Rank #2 company makes wood products and distributes building materials in the United States and Canada. Boise Cascade’s Building Materials Distribution and Wood Products segments are gaining strength from strong end-product demand (particularly for EWP) as well as higher commodity product prices. It has also been increasing commodity offerings that will instill growth in the existing markets, underserved markets and across its entire national footprint.

Importantly, Boise Cascade has seen a 22.3% upward estimate revision for 2022 earnings over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research