With Ukraine’s Aid in Doubt, Companies Say They’re the Plan B

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- From its base in the city of Dnipro in central Ukraine, Biosphere Corp. supplied countries across the former Soviet Union with household and cleaning products. Demand was buoyant. Orders were good.

Most Read from Bloomberg

Hyperloop One to Shut Down After Failing to Reinvent Transit

Tencent Leads $80 Billion Rout as China Rekindles Crackdown Fear

Harvard Financial Pain Grows as Blavatnik Joins Donor Revolt

Giuliani Files for Bankruptcy After $148 Million Defamation Loss

Then, like for the rest of the country, life turned upside down in February last year when Russia invaded. Sales collapsed 30%. Biosphere needed to fill the void as Ukrainians went to war. The result: a wet wipe in a khaki-green envelope that’s suitable for soldiers in the trenches.

The product is just one of the many innovations for the war effort that have demonstrated Ukraine’s resilience over the past 22 months. Yet Biosphere is also now an example of how companies have adapted to a reality that politicians have been more reluctant to accept: the conflict isn’t going to end any time soon, and Ukraine needs a Plan B.

The country faces dwindling resources after a counteroffensive that failed to make any significant gains. Fresh assistance from the US and European Union, meanwhile, is mired in their internal politics. President Volodymyr Zelenskiy was in Washington last week to try to corral support, though was told to wait. The EU then failed to agree on a new €50 billion ($54 billion) aid package.

What is moving is the economy. Companies have pivoted to new markets and products — many in the defense industry — and consumers are spending money while they have it.

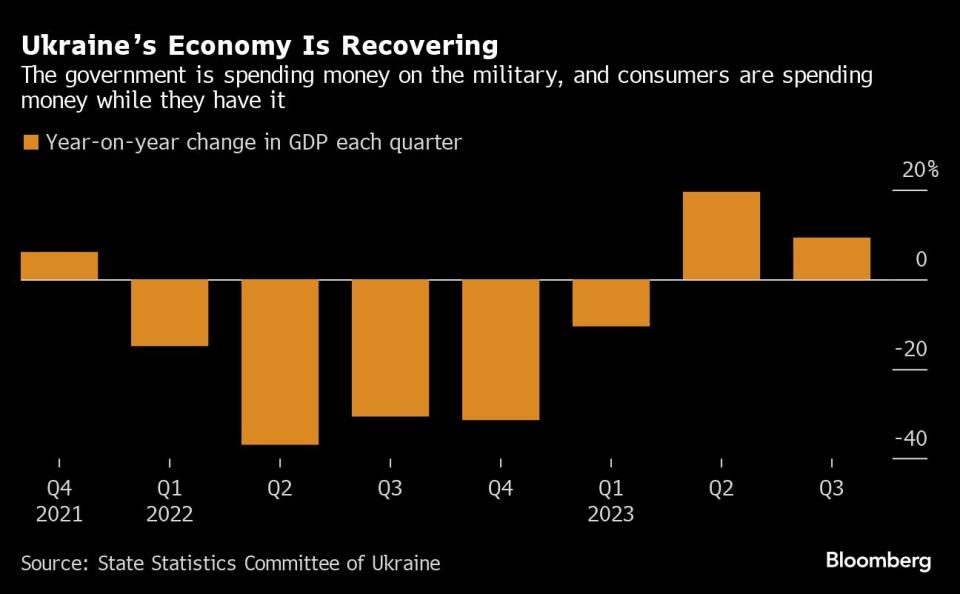

Gross domestic product jumped 9% in the third quarter from a year earlier after almost 20% growth in the second, defying all expectations. GDP might even reach its prewar level of $200 billion next year, investment bank Dragon Capital said on Dec. 4. That’s despite a currency devaluation in July 2022 and an exodus of people.

“The war is long and the state and quality of the economy will determine its outcome,” said Andriy Zdesenko, Biosphere’s chief executive officer. “Debate in the US and Europe over future aid should make the president and the government look inward — at Ukrainian business. We understand the responsibility we carry.”

Companies making products ranging from food to trash bags to security alarm technology — many of which have lost factories, trading partners and staff — are ensuring their survival while contributing to the war effort.

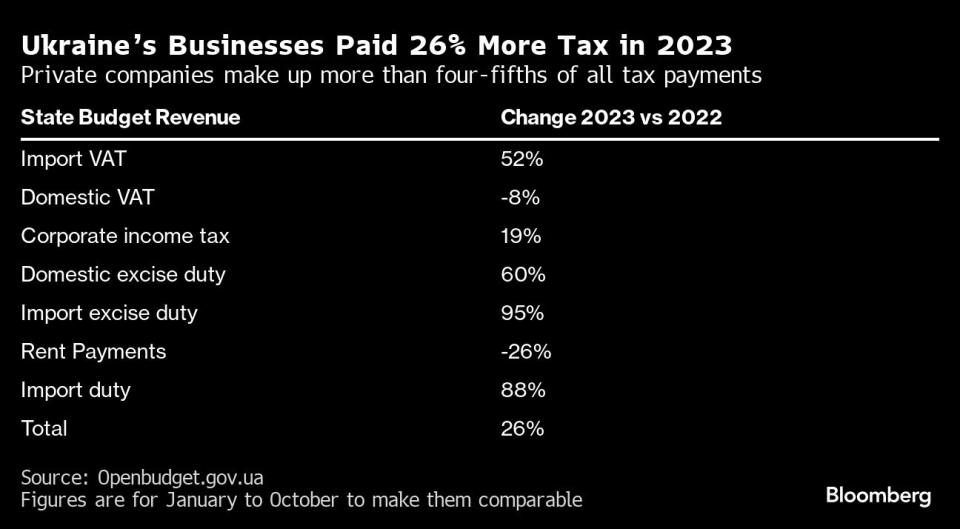

Currently, budget revenue is equal to about 60% of total government spending, with foreign money helping fund public sector salaries and healthcare. With aid in doubt, executives say they are building a source of sustainable income in a country with a history of corruption and tax evasion.

The Finance Ministry said on Dec. 13 that military spending next year will be largely covered by tax paid by companies and individuals. The money coming in will total 1.58 trillion hryvnia ($42.7 billion), equivalent to 93% of planned defense spending.

For Aleksandr Konotopskyi, founder and chairman of security alarms company Ajax Systems, it’s a case of getting on with it. The mantra is either the firm stops working or adjusts to the new circumstances, he told a business event held in the Ukrainian capital in October.

In the month after Russia’s invasion, the company used 160 trucks to relocate its plant from Kyiv to the region bordering with Hungary and Slovakia. It resumed production the following month and by the summer opened a new plant in Turkey. It also started a new app alerting Ukrainians to air raids and has about 24 million installs so far.

“My current strategy is that the war will never end,” said Konotopskyi, who was ranked among the 20 richest Ukrainians in 2022 by Forbes Ukraine. “We should build upon what we have here and now.”Read More: What If Putin Wins? US Allies Fear Defeat as Ukraine Aid Stalls Kyiv Seeks Better Air Defense to Boost Exports Via the Black Sea Ukraine’s Struggle for Arms and Attention Gives Putin an Opening Kyiv’s Harsh Winter Deepens Gloom Over Battlefield Failures

In Dnipro, about 400 kilometers (250 miles) southeast of Kyiv, Biosphere halted all sales to Russia and Belarus the day Vladimir Putin’s troops invaded on Feb. 24, 2022. Since then, about 6 million people — mostly women and children — are estimated to have left Ukraine, meaning there’s less of a market for things like nappies and cleaning products.

But the company kept its four sites open, moved some production west and has an additional warehouse in case its main one in Dnipro comes under bombardment. It also set to work on altering its product mix. Its new wet wipes, for example, are designed not to rustle and alert the enemy. The disposable cloth is able to clean the whole body.

Next up is tea, a market previously controlled by Russian companies. Biosphere has bought Italian equipment to start production by the end of the year. CEO Zdesenko just hopes the impasse over foreign aid won’t hit the currency.

“A weakening caused by these deliberations would be very negative for my business because I import things like machinery,” Zdesenko said. He’s also concerned Zelenskiy and his officials are too preoccupied with securing aid. “The government doesn’t fully understand the need for self-reliance,” he said.

McKinsey & Co. found that a fifth of Ukrainian companies lost 50% of their revenue or more since the war began. The biggest threats continue to be attacks on facilities, disruption to supply chains or energy, and low employee morale.

But companies have become more nimble and resilient while rallying workers behind the cause, said Olga Gordusenko, partner at the consultancy firm. That was reinforced by the American Chamber of Commerce, one of the biggest business lobbies in Ukraine. It said on Dec. 14 that 74% of companies had managed to achieve their predicted financial results in 2023.

Take the Milk Alliance, which processes a tenth of Ukraine’s milk. Immediately after the war started, occupied regions lost 90% of their cows as farmers slaughtered livestock and fled while other animals were killed in the fighting.

Danone SA temporarily halted production in the first month, meaning people switched to Milk Alliance for products like baby food. But then demand collapsed when women and children left the country.

Milk Alliance’s problem now is how to meet orders, rather than cancel them, particularly in export markets, said Sergiy Vovchenko, the head of its supervisory board. Milk Alliance has four processing sites, but struggles with transportation to places like Kazakhstan to deliver cheese with the animal fat replaced with plant-based fat.

There also aren’t enough drivers and men that can do heavy lifting, said Vovchenko. “The main thing is victory,” he said, adding that the war derailed his plan to retire. “So people come back so we have workers and also consumers.”

Indeed, consumers appear to be rescuing the economy in a way few people expected. Online retailer Rozetka was on the brink of bankruptcy in March 2022 yet managed to survive and expand. Uncertainty about the future boosts shopping, according to its co-owner, Vladyslav Chechotkin.

“Such a stressful situation as the war releases people’s ‘brakes’ in terms of consumption,” he said. “A person thinks like this: ‘why should I abstain from buying something, if I might simply not exist tomorrow?’”

It was an existential choice that Ukrainian entrepreneur Oleksii Komlichenko faced last year. His headhunting business was in its 14th year when he joined a territorial defense unit. After serving for several months as a policeman, he needed to figure out what to do next. Komlichenko said he had always expected the war to be a long one from the day Russia invaded.

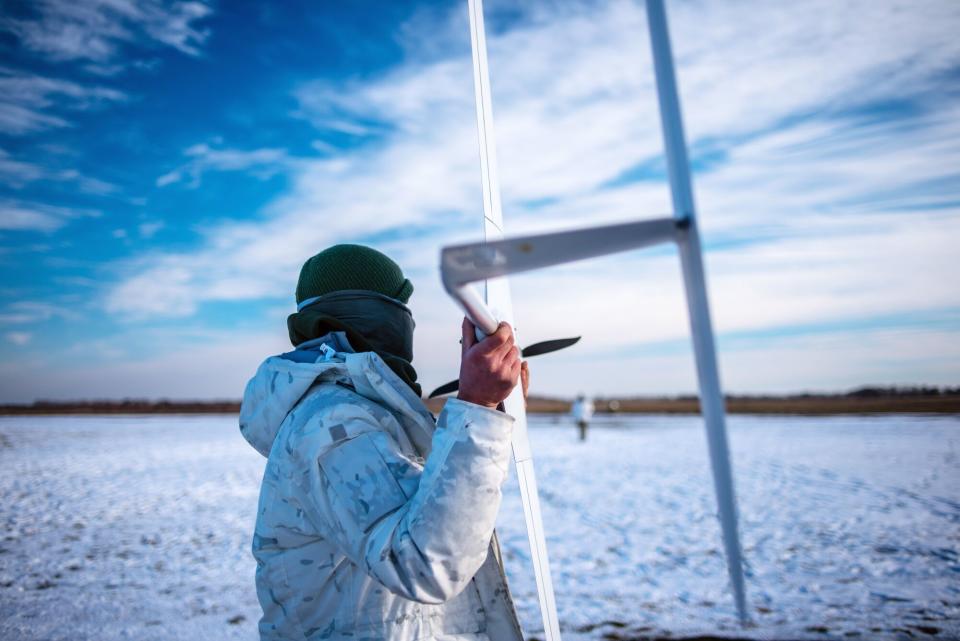

So, he created a fund with his friend, a former banker, to invest in military tech companies including those producing software and unmanned military vehicles. The fund, called Resist UA, bought a minority stake in a drone maker based in Ukrainian western region of Lviv.

“Mainstream businesses included renewables or something related to ecology recently, but now this is defense, defense, defense,” Komlichenko said over breakfast in a Kyiv café this month. “It was a clear understanding that there is a need to adjust.”

--With assistance from Daryna Krasnolutska.

Most Read from Bloomberg Businessweek

One Man’s Longevity Obsession Now Includes Fountain-of-Youth Injections

What Dermatologists Really Think About Those Anti-Aging Products

What the Oldest Lab Rodents Are Teaching Humans About Staying Young

Michael J. Fox and Sergey Brin Take Their Push for a Parkinson’s Cure to the Next Level

©2023 Bloomberg L.P.