Unifi (NYSE:UFI) Takes On Some Risk With Its Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Unifi, Inc. (NYSE:UFI) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Unifi

How Much Debt Does Unifi Carry?

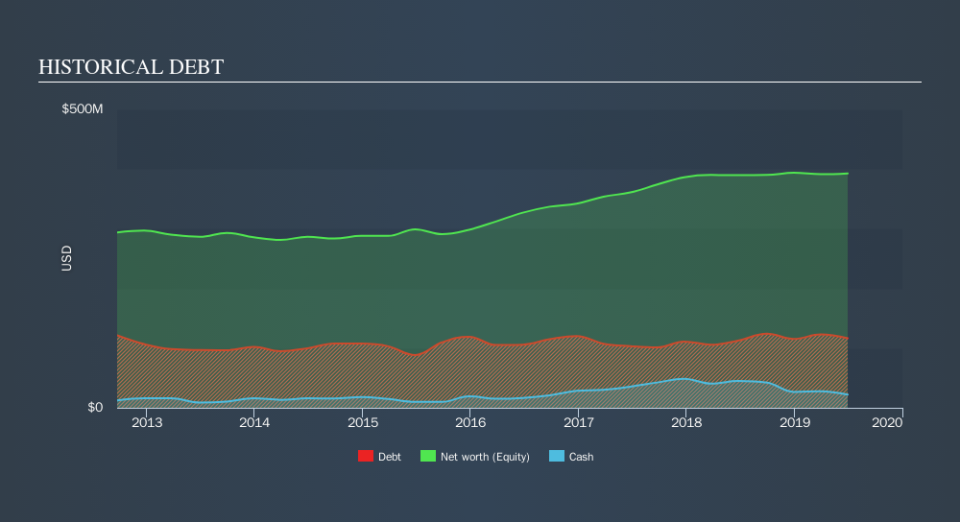

As you can see below, Unifi had US$116.6m of debt at June 2019, down from US$130.5m a year prior. On the flip side, it has US$22.2m in cash leading to net debt of about US$94.4m.

A Look At Unifi's Liabilities

The latest balance sheet data shows that Unifi had liabilities of US$74.7m due within a year, and liabilities of US$124.6m falling due after that. Offsetting this, it had US$22.2m in cash and US$103.6m in receivables that were due within 12 months. So its liabilities total US$73.5m more than the combination of its cash and short-term receivables.

Given Unifi has a market capitalization of US$424.2m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Unifi has a debt to EBITDA ratio of 2.7 and its EBIT covered its interest expense 2.6 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, Unifi's EBIT was down 59% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Unifi can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Unifi created free cash flow amounting to 8.1% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

We'd go so far as to say Unifi's EBIT growth rate was disappointing. Having said that, its ability to handle its total liabilities isn't such a worry. Looking at the bigger picture, it seems clear to us that Unifi's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. Given our hesitation about the stock, it would be good to know if Unifi insiders have sold any shares recently. You click here to find out if insiders have sold recently.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.