Do United Airlines Holdings's (NASDAQ:UAL) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like United Airlines Holdings (NASDAQ:UAL), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for United Airlines Holdings

How Quickly Is United Airlines Holdings Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. United Airlines Holdings managed to grow EPS by 11% per year, over three years. That's a pretty good rate, if the company can sustain it.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that United Airlines Holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note United Airlines Holdings's EBIT margins were flat over the last year, revenue grew by a solid 6.5% to US$43b. That's a real positive.

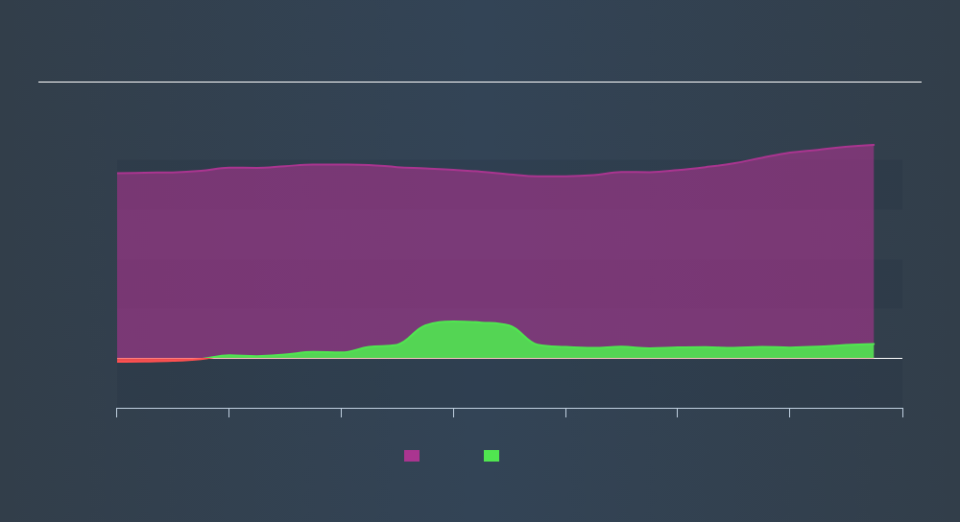

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of United Airlines Holdings's forecast profits?

Are United Airlines Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping US$4.9m that the , Edward Shapiro spent acquiring shares. We should note the average purchase price was around US$89.42. Big purchases like that are well worth noting, especially for those who like to follow the insider money.

On top of the insider buying, it's good to see that United Airlines Holdings insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$93m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does United Airlines Holdings Deserve A Spot On Your Watchlist?

One positive for United Airlines Holdings is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of United Airlines Holdings. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of United Airlines Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.