United Airlines Is a Little Bit Less Ugly

When the novel coronavirus touched down on the U.S., the broader travel industry, including top players like United Airlines (NASDAQ:UAL), Delta Air Lines (NYSE:DAL) and American Airlines (NASDAQ:AAL) suffered an almost immediate impact. Of course, this volatility is hardly surprising. Even in the best of circumstances, you can easily get sick in a densely packed flying tube with wings. Thus, UAL stock and its rivals hit every branch of the ugly tree.

Source: NextNewMedia / Shutterstock.com

However, as my high school football coach loved to say, tough times don’t last, but tough people do. For United, it appears that the societal and economic backdrop, while still terrible, are showing signs of life. First, most states have now initiated reopening measures to various degrees. Even economic strongholds like California and New York have implemented regional reopening.

Better yet and to my second point, the American public has responded eagerly. Conspicuously, we noticed huge crowds swarm beaches and other large events across the nation. In many cases, it appeared that few cared little about social distancing or mitigation procedures such as wearing masks. After being cooped up in their homes, Americans just want to have fun, to loosely paraphrase Cyndi Lauper.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

You can question the wisdom of these antics. At the same time, this is a positive development for UAL stock. If people are willing to mix it up with thousands of strangers, they’ll likely be open to do so with hundreds.

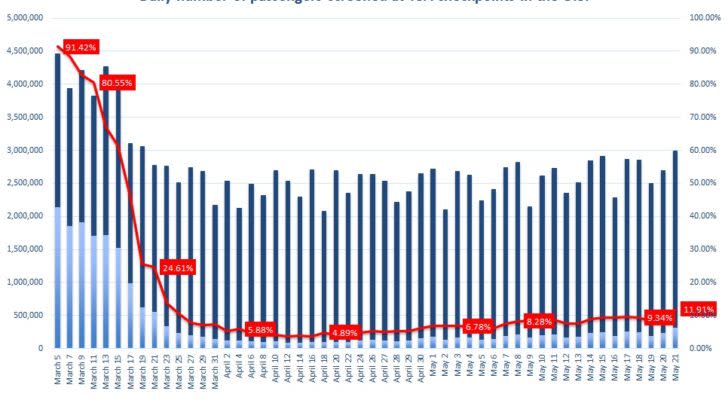

Further, travel data – if you’re looking at it from a glass-half-full perspective, is encouraging for UAL stock. For instance, the Friday before Memorial Day weekend saw a big percentage gain in air passenger volume relative to this year’s lows.

The New Normal Will Be Ugly for UAL Stock

Fortunately for speculators, airliner stocks have resonated with the improved travel sentiment. Since mid-May, UAL stock – along with other airliners – have posted double-digit performances. On the surface, it seems that the markets are slowly shifting toward a risk-on profile.

Adding to this argument is biotechnology specialist Novavax (NASDAQ:NVAX) announcing the start of early stage clinical trials for its coronavirus vaccine. Should encouraging results stem from the trials, it would potentially give concerned Americans multiple vaccination or treatment options.

And really, boosting confidence is what everybody has been trying to do, from the federal government with its emergency relief programs down to local businesses. That momentum is generating has been good enough for those wanting to bet on UAL stock.

Granted, its huge discount makes it an attractive buy on paper. However, investors should look at the entire picture before reserving a position.

On the Saturday before Memorial Day, Fox Business reported that the Transportation Security Administration screened 253,190 passengers. This was down a staggering 88% from the 2.12 million passengers that flew in the year-ago level.

Source: Data from Statista

In other words, the rebound volume is only 12% of normal capacity. What makes this allocation worse is that this depressed level hasn’t been unusual since the pandemic shuttered almost everything. Between April 2 and May 21, the average passenger volume is 6.63% that of 2019 volume during those same days.

Yes, a shift from 6.6% to 12% is a sizable improvement. However, if passenger volume continues to remain below 20% throughout this year, I highly doubt that we need so many airliners.

While United should survive a potential game of musical chairs, it’s very difficult to live off a consumer base that’s been gutted 80% or more.

International Flight Implosion Will Be a Killer

As you might imagine, the dearth in domestic air travel demand applies to the international realm as well. In fact, many popular global tourist destinations have suffered a catastrophic implosion.

Case in point is Japan. This year, the country was scheduled to host the 2020 Summer Olympics before the coronavirus changed everything. Thanks to China, that part of the world received a black eye to its image.

Indeed, the situation is so bad that the Japanese government is considering subsidizing some of the travel costs for foreign visitors. While that seems like an extreme measure, consider that only 2,900 non-Japanese tourists visited Japan in April. That’s down an unfathomable 99.9%.

I’m not sure how Japanese businesses levered to tourism are going to survive this calamity. And I ask the same question about UAL stock and similar investments. Chances are, you’re not swimming to Japan. So, this demand erosion represents a direct hit to the airliners.

Ultimately, United Airlines is still in the same position it was back when the coronavirus touched down. That the narrative got slightly less ugly doesn’t change the overall equation.

A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global 500 companies. Over the past several years, he has delivered unique, critical insights for the investment markets, as well as various other industries including legal, construction management, and healthcare. As of this writing, he did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The Huge Story for 2020 & Beyond That You Aren’t Hearing About

Revolutionary Tech Behind 5G Rollout Is Being Pioneered By This 1 Company

The post United Airlines Is a Little Bit Less Ugly appeared first on InvestorPlace.