United Natural (UNFI) to Report Q2 Earnings: Factors to Watch

United Natural Foods, Inc. UNFI is likely to witness growth in the top and bottom lines when it reports second-quarter fiscal 2021 numbers on Mar 10. While the Zacks Consensus Estimate for earnings has declined 3.2% over the past 30 days to 92 cents per share, it indicates a significant increase from earnings of 32 cents reported in the prior-year period. This distributor of natural organic, specialty, produce and conventional grocery and non-food products has a trailing four-quarter earnings surprise of 9.2%, on average.

The Zacks Consensus Estimate for revenues is pegged at $6,910 million, suggesting a rise of 12.6% from the prior-year quarter’s reported figure.

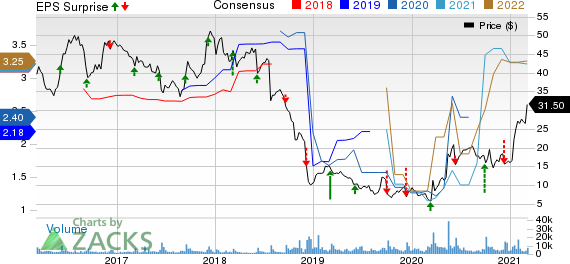

United Natural Foods, Inc. Price, Consensus and EPS Surprise

United Natural Foods, Inc. price-consensus-eps-surprise-chart | United Natural Foods, Inc. Quote

Key Factors to Note

United Natural has been gaining from strength in the e-commerce business. To this end, the company has been partnering with e-commerce operators and accelerating growth via its owned e-commerce businesses under the UNFI Easy Options and On a Screen platforms. In the last reported quarter, the company’s sales growth was backed by robust customer demand from existing as well as new retailers, including continued gains of cross-selling. Notably, the increase in retail sales reflected significant benefits from higher e-commerce sales at Cub Foods. Management in its first-quarter earnings call highlighted that the e-commerce business is the company’s fastest-growing part. In fact, e-commerce sales soared 93% in the quarter. Management expects continued benefits from such trends.

We note that United Natural is committed to certain strategic targets that include plans such as building and optimizing the distribution channel network, expanding brand portfolio and augment the e-commerce business, among others. In this regard, the company is on track with consolidating its distribution centers and making investments in automation to enhance operational savings. Also, United Natural is focused on growing higher-margin private brands, e-commerce and the Retail Solutions business. That being said, higher operating costs related to the pandemic, among other factors, pose concerns.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for United Natural this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

United Natural currently has a Zacks Rank #3 and an Earnings ESP of -11.77%.

Stocks With Favorable Combinations

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season.

Ollie’s Bargain Outlet OLLI has an Earnings ESP of +3.73% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kellogg K has an Earnings ESP of +0.64% and a Zacks Rank #3.

The Kraft Heinz Company KHC has an Earnings ESP of +2.71% and a Zacks Rank #3.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kellogg Company (K) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Ollies Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research