Is Univar Solutions (NYSE:UNVR) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Univar Solutions Inc. (NYSE:UNVR) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Univar Solutions

How Much Debt Does Univar Solutions Carry?

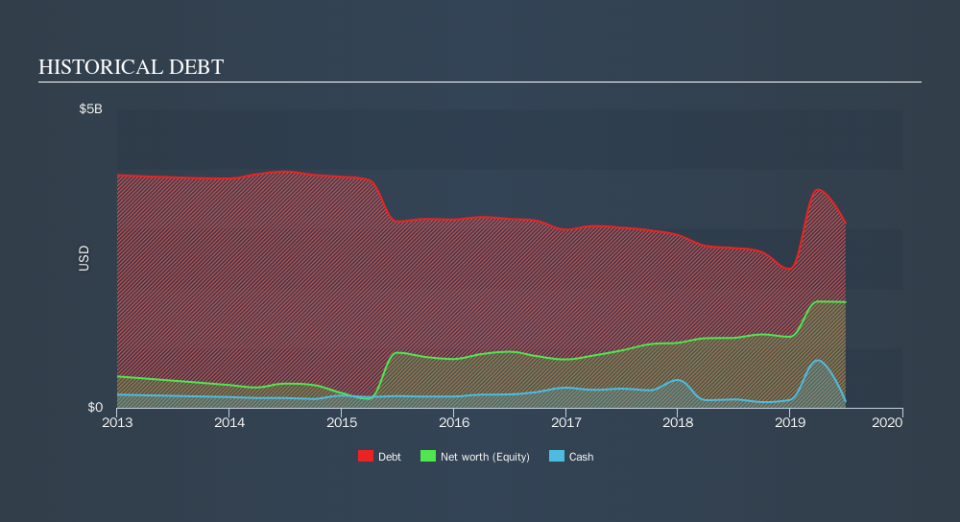

The image below, which you can click on for greater detail, shows that at June 2019 Univar Solutions had debt of US$3.09b, up from US$2.68b in one year. However, it also had US$109.5m in cash, and so its net debt is US$2.98b.

A Look At Univar Solutions's Liabilities

Zooming in on the latest balance sheet data, we can see that Univar Solutions had liabilities of US$1.60b due within 12 months and liabilities of US$3.76b due beyond that. On the other hand, it had cash of US$109.5m and US$1.54b worth of receivables due within a year. So its liabilities total US$3.70b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of US$3.78b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Univar Solutions's debt is 4.9 times its EBITDA, and its EBIT cover its interest expense 2.9 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. More concerning, Univar Solutions saw its EBIT drop by 8.0% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Univar Solutions's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Univar Solutions's free cash flow amounted to 41% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Univar Solutions's interest cover left us tentative about the stock, and its net debt to EBITDA was no more enticing than the one empty restaurant on the busiest night of the year. But at least its conversion of EBIT to free cash flow is not so bad. Overall, it seems to us that Univar Solutions's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given our hesitation about the stock, it would be good to know if Univar Solutions insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.