Is Universe Printshop Holdings (HKG:8448) In A Good Position To Invest In Growth?

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Universe Printshop Holdings (HKG:8448) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Universe Printshop Holdings

When Might Universe Printshop Holdings Run Out Of Money?

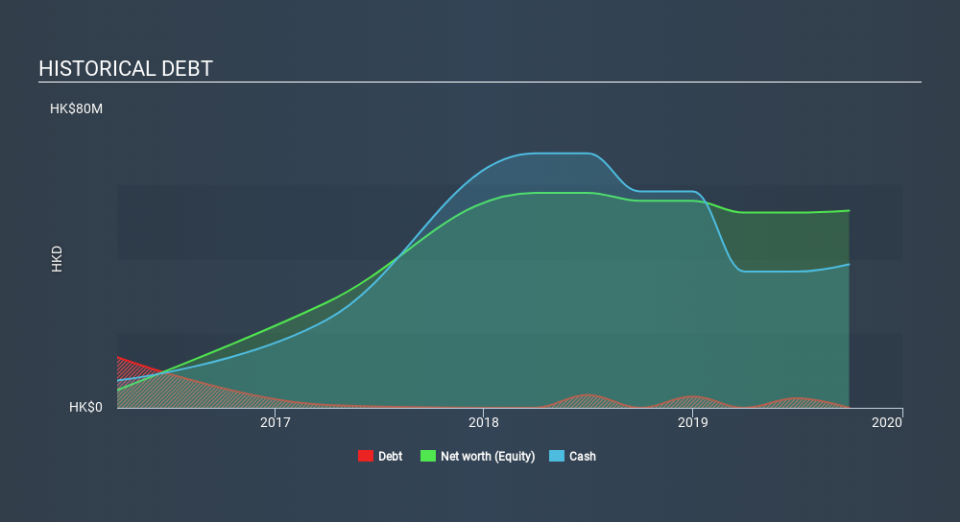

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In September 2019, Universe Printshop Holdings had HK$38m in cash, and was debt-free. Importantly, its cash burn was HK$15m over the trailing twelve months. So it had a cash runway of about 2.5 years from September 2019. Arguably, that's a prudent and sensible length of runway to have. However, if we extrapolate the company's recent cash burn trend, then it would have a longer cash run way. You can see how its cash balance has changed over time in the image below.

How Well Is Universe Printshop Holdings Growing?

Universe Printshop Holdings boosted investment sharply in the last year, with cash burn ramping by 92%. On top of that, the fact that operating revenue was basically flat over the same period compounds the concern. Considering both these metrics, we're a little concerned about how the company is developing. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Universe Printshop Holdings is building its business over time.

How Easily Can Universe Printshop Holdings Raise Cash?

Even though it seems like Universe Printshop Holdings is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash to fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of HK$62m, Universe Printshop Holdings's HK$15m in cash burn equates to about 24% of its market value. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

Is Universe Printshop Holdings's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Universe Printshop Holdings's cash runway was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. For us, it's always important to consider risks around cash burn rates. But investors should look at a whole range of factors when researching a new stock. For example, it could be interesting to see how much the Universe Printshop Holdings CEO receives in total remuneration.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.