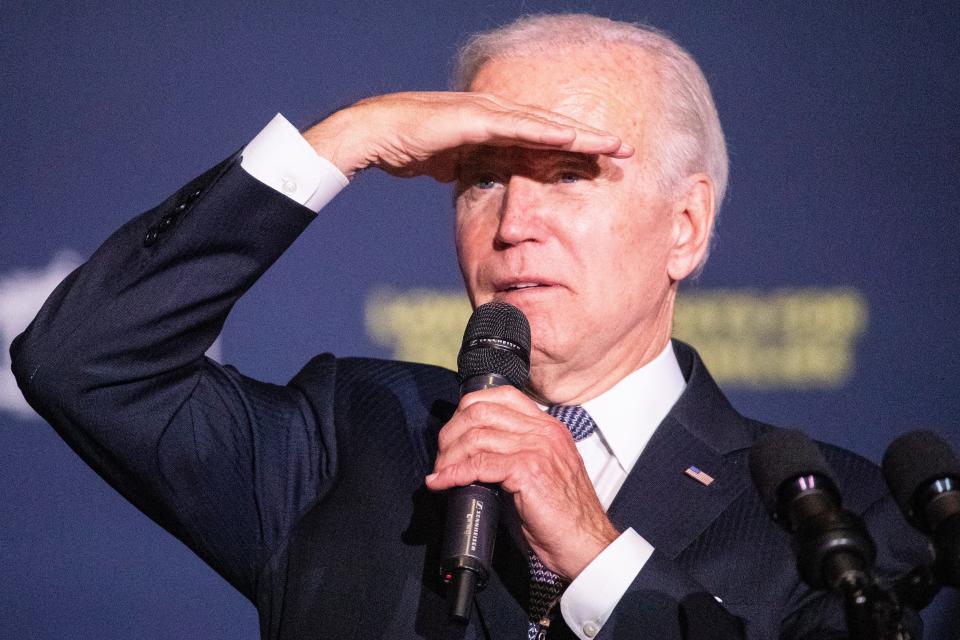

University of Delaware professor talks student debt forgiveness at the White House

- Oops!Something went wrong.Please try again later.

The Biden administration's "SAVE" plan has been making headlines since its summer 2023 launch and following relief rollouts.

The president has been looking to forgive targeted groups’ loans in a piecemeal fashion, in an alternative strategy to cancel student debt after the Supreme Court struck down his first attempt. SAVE itself, an income-driven plan, was created to replace other plans offered by the government, making more borrowers eligible for relief, certain protections and reduced monthly payments. Anyone can apply now.

Wednesday, one University of Delaware associate professor was invited to the White House to help celebrate just that.

Dominique Baker served on a panel at the White House last Wednesday, adding to the kickoff event for the "SAVE Day of Action Plan." Working in both the College of Education and Human Development and the Joseph R. Biden, Jr. School of Public Policy and Administration, Baker's research focuses on how education policy affects access and success of minoritized students in higher education, according to UD. She brought that focus to brief comments in the nation's capital.

Focusing on income, she noted, means protecting more of that money coming into the home.

"Unfortunately, due to interlocking systems of oppression in our country, the people who are more likely to have smaller incomes are also people of color, which means that they will disproportionately benefit," Baker said to the panel and audience assembled at the White House. "Which is a good thing, because we want them to be able to eat and do things like be able to travel to their job."

Baker highlighted SAVE's automatic renewals, as well as its impact on "ballooning balances," or interest fueling debt to outweigh what a borrower took out in the start. Basically, if a SAVE-plan borrower's monthly payment doesn't cover the interest, the government will cover it.

"This matters a ton for racial equity," Baker explained.

"Just to give you an example, in the most recent nationally representative data, looking at students who earned a bachelor's degree in 2015-2016, we see that for the typical student — Black students, Native American and Alaskan Native students, and Native Hawaiian and other Pacific Islander students — they actually owe more than they originally borrowed, four years after earning a bachelor's degree. That matters."

The UD expert is looking ahead to SAVE's total implementation by this summer, when more impact will be felt.

Student debt canceled: Biden's student loan forgiveness for SAVE borrowers is win but not home run for advocates

So how do I apply for this student debt assistance?

Applying to the SAVE plan is the same as other such federal programs.

You log into StudentAid.gov account with your username and password, FSA ID, and complete the IDR application. That application will ask for employment, proof of income or confirmation of any unemployment benefits, as well as family size and marital status.

"Once you complete the application, you’ll be able to review the repayment plans you qualify for and select the best plan for you," according to the Federal Student Aid website.

Student loan debt relief: Biden announced $1.2 billion in new student debt forgiveness. How much did Delaware get?

Has there even been any student loan forgiveness?

Yes, there has.

Biden announced $1.2 billion in student loan forgiveness for certain borrowers enrolled in the SAVE plan, in late February, wherein Delaware saw $5.3 million in relief. These former students borrowed $12,000 or less, have been paying their student loans for at least 10 years.

By Thursday, March 21, the administration added another round of student loan cancelation, to the tune of $5.8 billion for 78,000 public service workers, through Public Service Loan Forgiveness. Both join some $144 billion in debt relief for nearly four million people, according to administration figures, through different, tweaks, actions and programs.

Several conservative commentators and politicians have "balked" at the news of canceling student debt, USA TODAY previously reported, citing unfairness to those who have had to work to pay back loans. Others say there hasn't been enough.

Under SAVE, if someone borrowed $12,000 or less, they'd have received loan forgiveness after making the equivalent of 10 years of payments. For every $1,000 borrowed above $12,000, according to the Federal Student Aid website, a borrower can receive forgiveness after an additional year of payments. All borrowers on SAVE receive forgiveness after 20 or 25 years, depending on whether they have loans for graduate school.

And July should see another update.

Payments for borrowers with only undergraduate student loans will be cut in half in July, according to the Federal Student Aid website. Currently, such monthly payment amounts are about 10% of a borrower's discretionary income. That number would dip to 5%.

The U.S. Department of Education cautions borrowers should do their research to determine which payment plan best fits their needs. Relatedly, the department set an April 30 deadline for borrowers to consolidate federal student loans and get a one-time payment adjustment this summer, as reported by USA TODAY last week.

Hurry borrowers: Only five weeks left to consolidate student loan debt for a shot at forgiveness

Got a story? Contact Kelly Powers at kepowers@gannett.com or follow her on X @kpowers01.

This article originally appeared on Delaware News Journal: UD professor talks student debt forgiveness at the White House