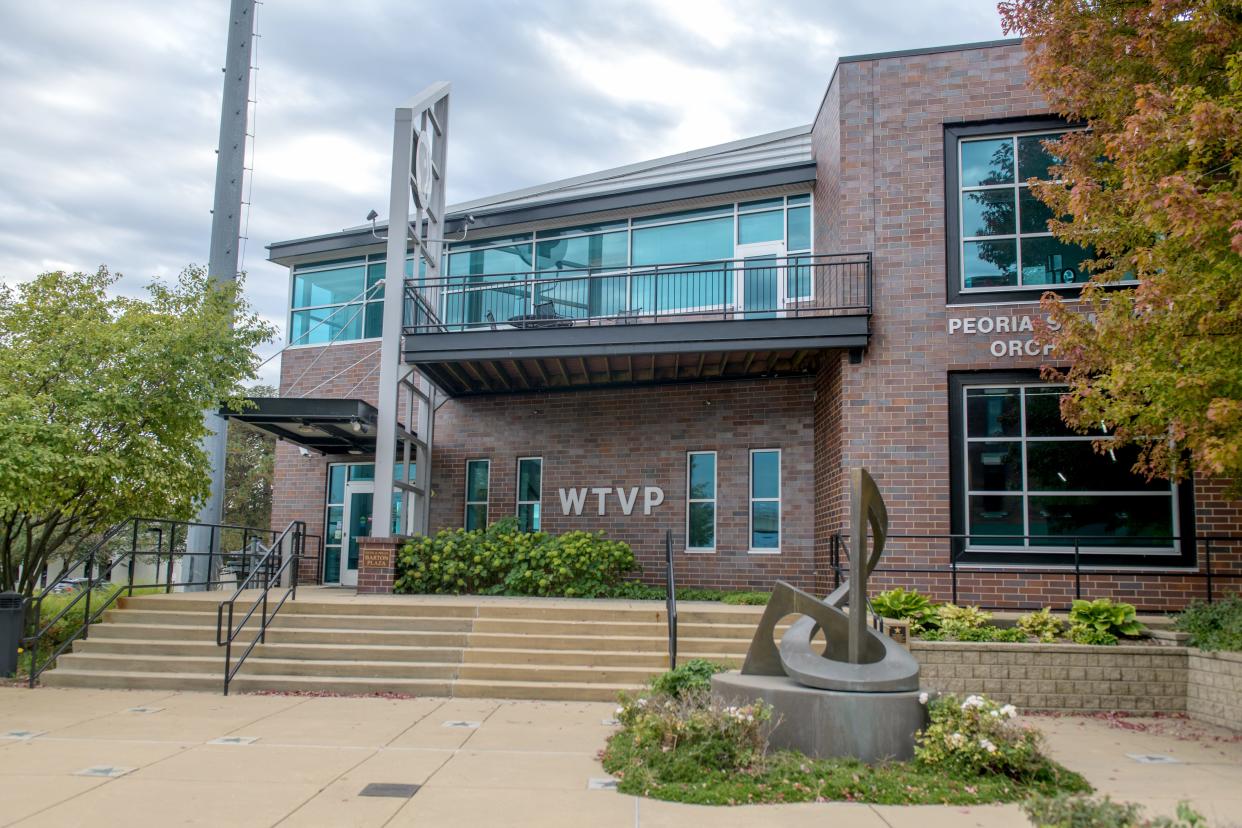

Released WTVP board minutes show station borrowed money, liquidated assets to stay afloat

Newly released board minutes from WTVP-PBS show the station was at risk of running out of money this summer before someone working there took out a line of credit and liquidated assets without approval or knowledge of the board of directors.

Minutes from WTVP's Sept. 6 and Oct. 2 board meetings had been closed to the public until Tuesday when the board of directors approved the minutes and they were posted on its website Wednesday.

Those previously unreleased minutes came from back-to-back closed meetings held by the board's executive committee, paint a picture of a TV station that was hemorrhaging money and attempted to save itself by taking financial actions without the board's knowledge.

More: 'Questionable, unauthorized or improper' spending found at WTVP amid financial losses

Board treasurer Helen Barrick informed the WTVP board of directors on Sept. 6 that the station would have had a negative cash balance of $45,000 at the end of July had someone not taken out a $100,000 line of credit from PNC and liquidated $320,000 in investment assets without board knowledge to keep the station afloat.

WTVP CEO Julie Sanders deferred media inquiries to board chairman Andrew Rand. Rand did not return a call from the Journal Star on Wednesday.

The board minutes never specify who approved the liquidation of assets or the new line of credit.

However, at the Sept. 6 board meeting, board Vice Chairman Sid Ruckriegel was assigned to be the "supervising representative" from the board to then-CEO Lesley Matuszak in what was called a "leadership-advisory relationship" in an effort to "continue working to better understand what actions need to be taken to reverse the negative cash flow," according to the board minutes.

Matuszak resigned from WTVP on Sept. 27 and was found dead in her home on Sept. 28.

On Tuesday, the WTVP board slashed the station's budget by $1.5 million and cited "questionable, unauthorized or improper" spending as part of the reason.

The Sept. 6 board minutes also paint a picture of TV station that didn't seem to have a solid idea where it sat financially, other than knowing things were not good.

An outside auditing firm, CLA, had been brought in by the WTVP board to review the station's 2023 financials, and during that audit they seemed to uncover irregularities in the budget.

More: Lesley Matuszak left an indelible mark on the Peoria community

Early financial statements projected WTVP to have a $650,000 loss in 2023. Work by the auditors projected that loss to be $820,000.

The board minutes then say that Barrick worked with the auditors to reconcile the differences between the two figures, and they eventually settled on $641,000 as the expected losses for WTVP in 2023.

In 2022, the station saw $560,000 in losses.

Matuszak told the board in April that the station would be sitting on $460,000 in cash by the end of the fiscal year on June 30. The station ended up with only $160,000 cash, falling well short of Matuszak's stated figure.

Matuszak also told the board that Peoria Magazine, which WTVP owns, had "made" $750,000. Barrick corrected that statement, saying the magazine "grossed" $750,000, which is the figure tallied before expenses are taken into account.

At the Sept. 6 board meeting, Rand suggested the board "focus on the magazine’s actual performance to determine precisely how it is doing."

Also at the meeting, the board approved further oversight by the executive committee on the day-to-day operations at WTVP. That new oversight included the following actions:

Review and approve executive’s workplan every 30-60 days

Determine and implement budget modifications to meet board expectations,

Cease or scale back operations that negatively impact cash flow,

Improve reliability and timeliness of financial information,

Review and approve/deny all expenditures prior to implementation,

Pre-approve all fund disbursements prior to check generation or payments of any kind,

Review all internal financial statements, including accounts receivable, deposits,financial transfers, or Quick Books records,

Provide full access to information for the Treasurer and the executive committee,

Borrow from WTVP’s existing credit line and/or liquidate assets in our investmentaccount (not to exceed $750,000 unless board approved) until we can stabilize the cash burn.

This article originally appeared on Journal Star: WTVP borrowed money, liquidated assets without board knowledge