America is creating more jobs than it needs: Morning Brief

Thursday, October 3, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Wouldn’t about 100,000 jobs per month be okay?

The U.S. economy has sent investors some concerning news this week.

Manufacturing data released on Tuesday showed activity in the sector at its lowest level since the crisis. Service-sector readings on Thursday indicated that the economy's growth-driver — services accounts for about 85% of GDP — is expanding at the slowest pace in three years. Meanwhile, markets endured their roughest start to the fourth quarter since the financial crisis.

All of this puts added pressure on Friday's September jobs report. And potentially sets investors up for a big disappointment.

Wall Street economists are currently forecasting job gains of 145,000 last month, according to data from Bloomberg. This would be an acceleration from last month's disappointing job gains of 130,000, but still points to a slowing in the pace of hiring across the economy.

“In this environment, companies are taking an increasingly cost-conscious approach to payrolls, with September consequently seeing surveyed firms report a net drop in headcounts for the first time since 2010," IHS Markit's chief business economist Chris Williamson said on Thursday. "This translates into non-farm payroll growth trending below 100,000."

But ahead of this morning's jobs data, it is worth keeping in mind what economists have said for years about the torrid pace of hiring we saw from 2013-2018: the economy probably only needs to create 100,000 jobs per month to sustain trend economic growth.

On Wednesday, MUFG economist Chris Rupkey reminded viewers during his appearance on The Final Round that Yellen had, some years ago, outlined the need for about 100,000 job gains per month to sustain the expansion. But Rupkey notes that in this current environment, the market might not take kindly to a report that is "at trend," given the fragile state of recession-fearing investors.

"Didn't Janet Yellen say jobs could be 110,000 per month forever and it would still be okay?" Rupkey said. "But I think if we get 110,000 [jobs created in September] on Friday, people are not gonna like that. They'll think the next step is down."

In Congressional testimony in December 2015, then-Federal Reserve chair Janet Yellen told lawmakers that, "To simply provide jobs for those who are newly entering the labor force probably requires under 100,000 jobs per month."

At that point in the expansion, the Fed had not raised rates at all since the crisis and the unemployment rate stood at 5%. Since Yellen's comments, the Fed has raised rates nine times and cut rates twice. The economy has added more than 8 million jobs, or an average of around 190,000 per month. And the unemployment rate has declined to 3.7%, just above the 50-year low of 3.6% reached in April and May of this year.

In 2016, researchers at the San Francisco Fed estimated that trend job growth to sustain the expansion was between 50,000-110,000 per month. And while this research showed job growth often deviates widely from trend growth during cycles — it usually exceeds estimated trend growth during expansions and falls below this level during recessions — a slowdown in the pace of hiring from already-high levels is not sufficient as a warning sign that recession is around the corner.

And when it comes to those recession fears, Rupkey notes that while the bond market has been sending concerning signals for months — the 3-month/10-year spread inverted for the first time back in March — the labor market offers a few likely signposts for recession that we have not yet seen, including consecutive months of job losses and a spike in initial jobless claims.

So, while August's jobs report may have been weaker than expected, adding 130,000 is a far cry from seeing companies shed workers.

"The labor markets seem fine," Rupkey said.

We'll see if investors agree later today.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him @MylesUdland

What to watch today

Economy

8:30 a.m. ET: U.S. Department of Labor release September jobs report. Change in non-farm payrolls, September (145,000 expected, 130,000 prior); Unemployment rate, September (3.7% expected, 3.7% prior); Average hourly earnings MoM, September (0.2% expected, 0.4% prior); Average hourly earnings YoY, September (3.2% expected, 3.2% prior)

8:30 a.m. ET: Trade balance, August (-$54.5 billion expected, $54.0 billion prior)

2 p.m. ET: Federal Reserve Chair Jerome Powell delivers opening remarks at a “Fed Listens: Perspectives on Maximum Employment and Price Stability” event in Washington, D.C.

From Yahoo Finance

Tune into The First Trade 30 minutes early at 8:30 a.m. ET for full coverage of the September jobs report. And continue watching all of our live shows through the closing bell for in-depth analysis of the results.

In honor of the 50th anniversary of Sesame Street, The Final Round co-anchor Jen Rogers talks to the one-and-only ELMO about money for this week’s My Three Cents.

Top News

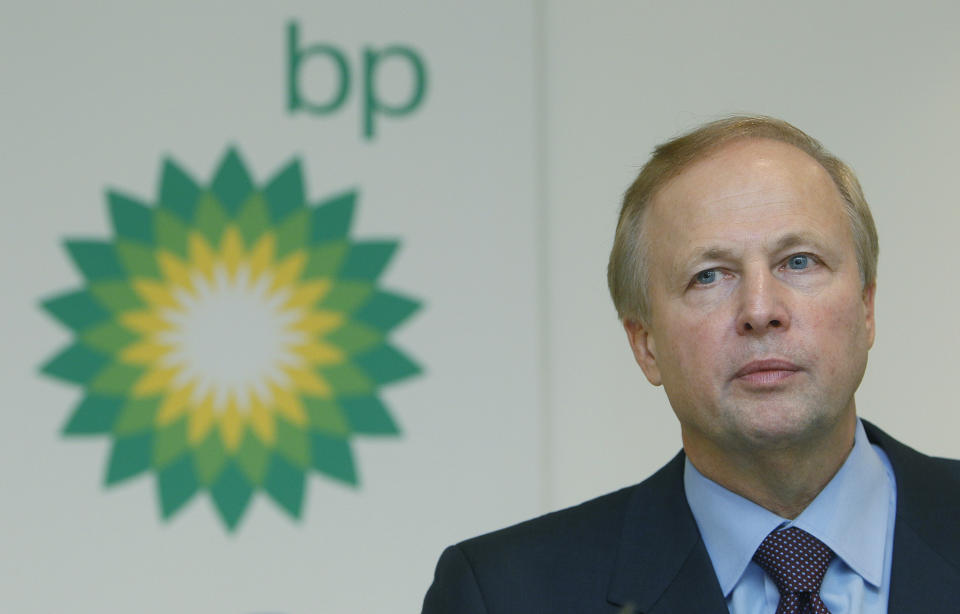

BP lifer Bernard Looney named new CEO as Bob Dudley retires [Yahoo Finance UK]

Apple reportedly raises iPhone 11 production by about 10% [Reuters]

Samsung ends smartphone phone production in China [Associated Press]

WeWork bosses tell employees job cuts are coming this month [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Trump's Nickelback tweet is a reminder that copyright trumps all

Ray Dalio: 'I'm going to go quiet in about a year'

Will Smith explains what it takes to get people off their couches and into the movie theater

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.