V-Mart Retail (NSE:VMART) Shareholders Have Enjoyed A Whopping 642% Share Price Gain

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It hasn't been the best quarter for V-Mart Retail Limited (NSE:VMART) shareholders, since the share price has fallen 20% in that time. But that doesn't change the fact that the returns over the last half decade have been spectacular. In that time, the share price has soared some 642% higher! Arguably, the recent fall is to be expected after such a strong rise. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

It really delights us to see such great share price performance for investors.

View our latest analysis for V-Mart Retail

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

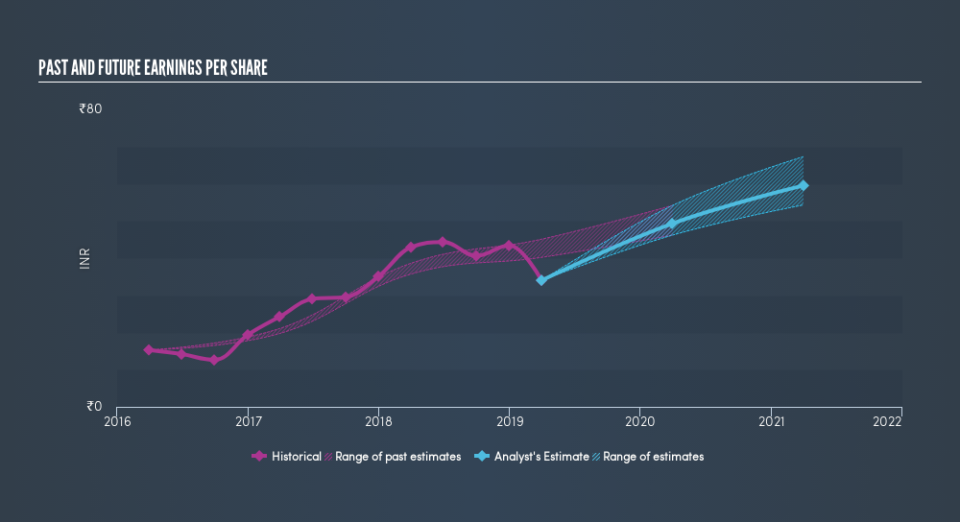

Over half a decade, V-Mart Retail managed to grow its earnings per share at 19% a year. This EPS growth is lower than the 49% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 65.86.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that V-Mart Retail has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on V-Mart Retail's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for V-Mart Retail the TSR over the last 5 years was 649%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

V-Mart Retail shareholders are down 6.3% for the year (even including dividends), but the market itself is up 0.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 50% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course V-Mart Retail may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.