Vaccine Stock Options Traders Are Targeting Right Now

The vaccine sector is in the spotlight again today, with Moderna Inc (NASDAQ:MRNA) at the masthead. The stock will soon join the S&P 500 (SPX) and received price-target hikes from J.P. Morgan Securities and Goldman Sachs to $131 and $299, respectively. Separately, Takeda Pharmaceutical said it would supply an extra 50 million doses of Moderna's vaccine to Japan.

If more analysts follow suit, Moderna stock could move higher in the coming weeks. Of the 13 in coverage, eight still call it a tepid "hold." Plus, today's price-target hikes put MRNA's 12-month consensus price target at $195.93, which is a 35.2% discount to current levels.

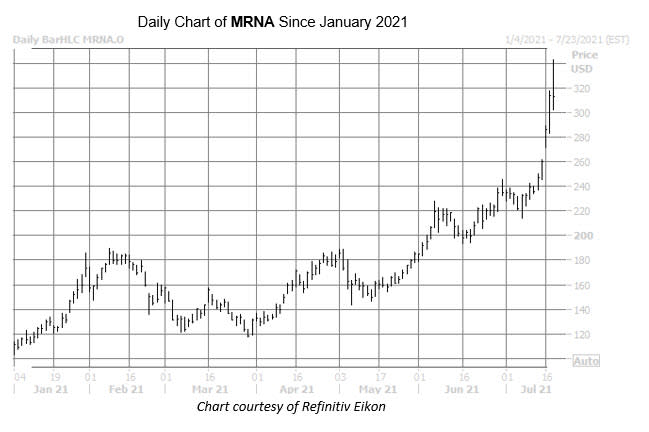

The stock was last seen down 4.4% to trade at $299.77, after earlier today it hit its fifth-straight record high of $342.51. Now, it looks like MRNA is set to snap a four-day win streak, though in the last nine months alone, the equity is up an incredible 323.5%.

Options traders have swarmed the stock, with 231,000 calls and 247,000 puts across the tape so far -- five times what is typically seen at this point. The most popular contract is the 7/23 300-strike put, followed by the 340-strike call in the same weekly series. It looks like positions are being sold to open at both.