Value Investing Live Recap: Chip Rewey

- By Graham Griffin

GuruFocus had the pleasure of hosting a presentation with Chip Rewey, chief investment officer of Rewey Asset Management.

Rewey has over 30 years of value investing experience with leading buy-side financial institutions, including Third Avenue Management (Trades, Portfolio), Cramer Rosenthal McGlynn and Sloate Weisman Murray and Co. He has worked alongside value gurus Marty Whitman, Jerry Cramer and Laura Sloate.

At Third Avenue, Rewey led the Value Equity strategies as the lead portfolio manager of Third Avenue's flagship Value Fund, lead portfolio manager of the company's Small-Cap Fund and lead portfolio manager of the 15 to 20 name concentrated Best Ideas Strategy.

Prior to joining Third Avenue, Rewey was a senior vice president and senior portfolio manager at Cramer Rosenthal McGlynn, overseeing the SMid, Mid, Large and All-Cap Value Investment Strategies, as well as the concentrated 10 to 20 position strategies.

Prior to CRM, Rewey was a senior portfolio manager at Sloate Weissman Murray & Co., where he worked directly with the founder, Laura Sloate, on research and portfolio construction. He began his career as an associate at Smith Barney Shearson.

Watch the full presentation here:

Key takeaways

Rewey takes a fundamental-driven research approach that focuses on long-term capital appreciation and downside protection. The team focuses on small to mid-cap stocks that provide them with ample investment opportunities that might be overlooked by investors focused on larger companies.

He explained there are three key pillars that hold up his investment philosophy. The first pillar is downside protection, which Rewey believes is essential for a stock to outperform within his portfolio. Companies with downside protection will have low levels of debt that are easily serviced by operating cash flow.

The second pillar is that a company must have the ability to grow. These types of companies will show a record of compounding revenue and earnings and their return on invested capital will be significantly above the cost of capital for a three- to five-year period.

The final pillar is that there should be a compelling valuation when looking at a company. Companies that fit the bill will have at least a 30% discount to Rewey's estimate of fair value and he refuses to commit capital just to establish market exposure. His team takes several different approaches to valuation, including looking at free and discounted cash flow.

Once a company satisfies those three pillars, Rewey puts it through a rigorous investment process that is ongoing. During the process, he assesses financial strength and creates a financial model for the company. Once these are built, he is able to formulate an investment case which determines how to proceed with a company.

Stocks

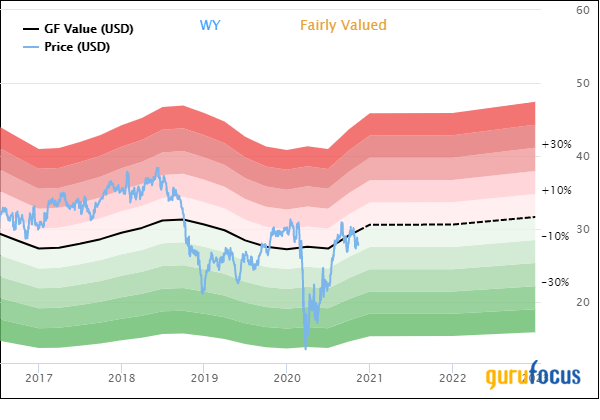

The first of two stocks Rewey decided to look at was Weyerhaeuser Co. (NYSE:WY). He explained that the stock fits throughout the majority of his criteria and has significant growth potential looking into the future. In addition, diving into the balance sheet an investor would see that the company has been working hard to pay down its debt while maintaining dividend payouts. For Rewey, there is a strong upside on the holding without the fear of things turning negative in the future.

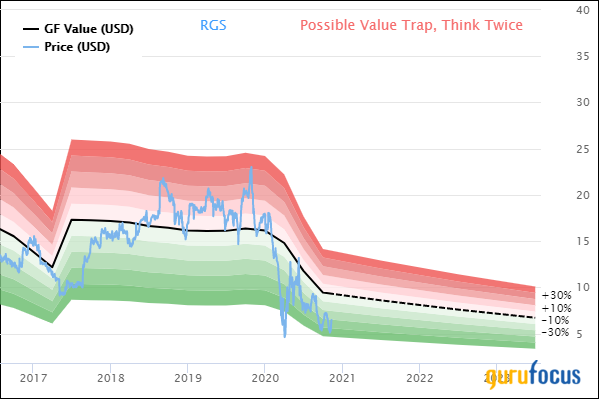

The second company he looked at was Regis Corp. (NYSE:RGS), which he explained offered a good investment despite the warning signs on its stock page. In Rewey's opinion, recent management changes alongside the pandemic induced lack of demand, have placed the company in an ideal position moving into the future. He has watched the company become increasingly capital light as locations are franchised and believes that the debt shown on the balance sheet is largely misrepresented.

Questions

One of the interesting questions that Rewey answered at the end of the presentation was about margin of safety. While he considers both upside and downside when looking at a company, he likes to keep things between 10% to 15% when looking at the downside of a company.

He continued to explain that the downside here offers the opportunity to double down on the investment. Rather than look at the downside as the time to cut losses, Rewey likes to look for ways to increase his investments and find big future gains. He explained that buying when he was down has led to some of his most successful investments of all time.

Another audience member posed a question to Rewey about how he determines if a company is a value trap or if there was something that he uses to determine if a company is truly a value trap.

He explained that a value trap is a company that cannot grow. The enemy when trying to find cheap or "cigar butt" investments is time. This type of investing requires that you find the balance between the money made by the assets at hand and the decline in value.

Rewey went deeper to explain that he looks at whether or not the assets of a company are producing positive returns over time or exceeding the cost of capital. If they are not, then this is a point of worry for him. In many cases, assets might be misrepresented on the balance sheet of a company and are not going to create value over time. Rewey believes these are the situations that should be avoided at all costs.

Disclosure: Author owns no stocks mentioned.

Read more here:

Hillman Capital Management's Biggest Portfolio Changes for the 3rd Quarter

Kahn Brothers' Biggest 3rd-Quarter Sells

Donald Smith & Co. Slashes Gold and Top Holdings

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.