Is VBI Vaccines, Inc. (VBIV) A Good Stock To Buy?

The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 821 13F filings submitted by hedge funds and prominent investors. These filings show these funds' portfolio positions as of March 31st, 2020. What do these smart investors think about VBI Vaccines, Inc. (NASDAQ:VBIV)?

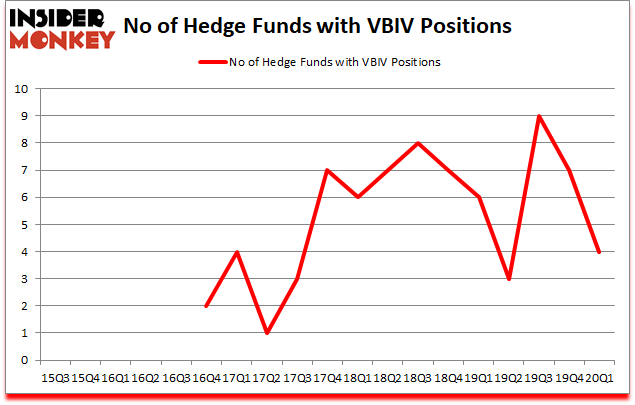

Is VBI Vaccines, Inc. (NASDAQ:VBIV) a bargain? The smart money is in a pessimistic mood. The number of bullish hedge fund positions were trimmed by 3 in recent months. Our calculations also showed that VBIV isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's monthly stock picks returned 87% since March 2017 and outperformed the S&P 500 ETFs by more than 51 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

[caption id="attachment_189632" align="aligncenter" width="400"]

David Harding of Winton Capital Management[/caption]

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020's unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we're going to review the new hedge fund action regarding VBI Vaccines, Inc. (NASDAQ:VBIV).

How have hedgies been trading VBI Vaccines, Inc. (NASDAQ:VBIV)?

At Q1's end, a total of 4 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -43% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VBIV over the last 18 quarters. With the smart money's capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Perceptive Advisors, managed by Joseph Edelman, holds the most valuable position in VBI Vaccines, Inc. (NASDAQ:VBIV). Perceptive Advisors has a $43.7 million position in the stock, comprising 1.1% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, which holds a $0.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers with similar optimism comprise Ken Griffin's Citadel Investment Group, Campbell Wilson's Old Well Partners and Ken Griffin's Citadel Investment Group. In terms of the portfolio weights assigned to each position Perceptive Advisors allocated the biggest weight to VBI Vaccines, Inc. (NASDAQ:VBIV), around 1.14% of its 13F portfolio. Old Well Partners is also relatively very bullish on the stock, dishing out 0.08 percent of its 13F equity portfolio to VBIV.

Due to the fact that VBI Vaccines, Inc. (NASDAQ:VBIV) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there were a few hedge funds that elected to cut their entire stakes heading into Q4. It's worth mentioning that David Harding's Winton Capital Management cut the largest position of the "upper crust" of funds followed by Insider Monkey, worth an estimated $0.3 million in stock. Parvinder Thiara's fund, Athanor Capital, also dumped its stock, about $0.2 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 3 funds heading into Q4.

Let's also examine hedge fund activity in other stocks similar to VBI Vaccines, Inc. (NASDAQ:VBIV). These stocks are Cortland Bancorp (NASDAQ:CLDB), MSB Financial Corp. (NASDAQ:MSBF), China Jo Jo Drugstores Inc (NASDAQ:CJJD), and Identive Group, Inc. (NASDAQ:INVE). This group of stocks' market values are similar to VBIV's market value.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CLDB,3,5586,0 MSBF,6,13953,-1 CJJD,3,10594,-2 INVE,2,4026,-1 Average,3.5,8540,-1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.5 hedge funds with bullish positions and the average amount invested in these stocks was $9 million. That figure was $44 million in VBIV's case. MSB Financial Corp. (NASDAQ:MSBF) is the most popular stock in this table. On the other hand Identive Group, Inc. (NASDAQ:INVE) is the least popular one with only 2 bullish hedge fund positions. VBI Vaccines, Inc. (NASDAQ:VBIV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on VBIV as the stock returned 129.5% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

[company-follow-email id=764195][/company-follow-email]

Disclosure: None. This article was originally published at Insider Monkey.

Related Content