Is Veoneer's (NYSE:VNE) 116% Share Price Increase Well Justified?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Veoneer, Inc. (NYSE:VNE) share price has soared 116% return in just a single year. Also pleasing for shareholders was the 34% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. We'll need to follow Veoneer for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Veoneer

Given that Veoneer didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Veoneer actually shrunk its revenue over the last year, with a reduction of 28%. We're a little surprised to see the share price pop 116% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

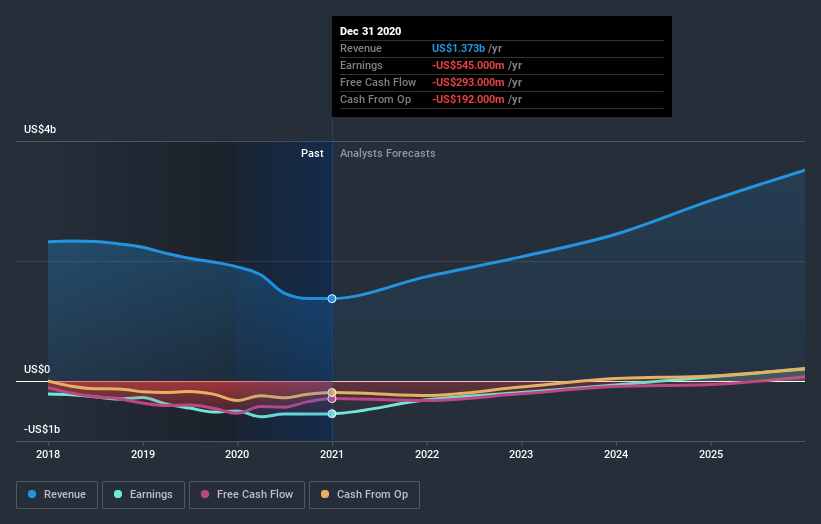

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Veoneer is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Veoneer in this interactive graph of future profit estimates.

A Different Perspective

Veoneer shareholders should be happy with the total gain of 116% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 34% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Veoneer better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Veoneer you should know about.

Of course Veoneer may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.