ViacomCBS: Can You Get Past Its Debt?

First, one was spun off from the other and they became separate companies. Then they merged. Then they separated. Then they merged again.

That's a brief history of ViacomCBS Inc. (NASDAQ:VIAC), which may or not be a merger made in heaven. In any case, Viacom and CBS reunited on Dec. 4, 2019 and, not surprisingly, there have been both advocates and critics of this most recent move.

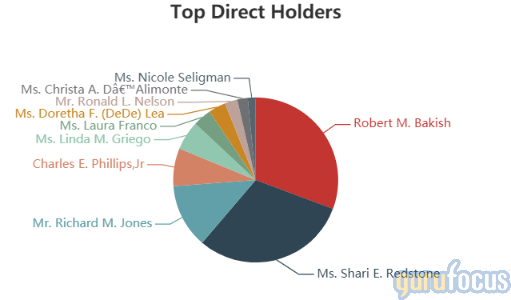

Both companies had been controlled by Shari Redstone, who now chairs the combined entity. She reportedly pushed hard for the re-merger.

A lawsuit launched by two institutional investors in Pennsylvania alleges that Redstone, members of the CBS board and Joseph Ianniello (acting CEO of CBS Corp. before the merger) acted to protect the interests of the Redstone family and their investment vehicle, National Amusements Inc., at the expense of minority CBS shareholders.

This pie chart shows the new company is controlled by three big investors: Robert Bakish, the former CEO of Viacom and the current CEO of ViacomCBS, Shari Redstone and Richard M. Jones, an executive vice president at both CBS and ViacomCBS:

The combined company owns several prominent media properties: CBS, Showtime, Nickelodeon, MTV, Comedy Central, VH1, BET, thirty television stations, publisher Simon & Schuster and the Paramount movie studio. There are reports that Simon & Schuster may be sold or spun off in order to focus on film-related content.

A value investor's perspective

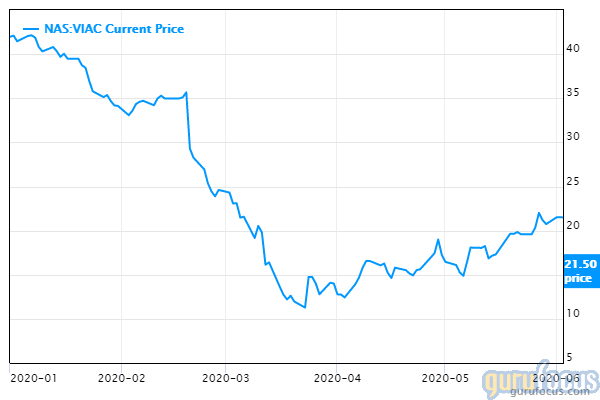

We'll look at ViacomCBS from a value investor's perspective, asking whether we should take an interest in this company that barely got started before the Covid-19 selloff began. As this year-to-date chart shows, the price is now roughly half of what it was at the beginning of the year:

Gurus

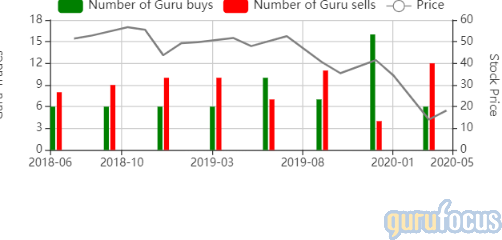

The next chart shows that some gurus were buying in or expanding their holdings earlier this year, but have since pulled back:

Among the gurus who like the new entity is Mario Gabelli (Trades, Portfolio) of the Gabelli Value 25 Fund. In March, he wrote, "The companies separated in 2005, but changes in the media landscape have put a premium on global scale. Together ViacomCBS should be able to better navigate shifts in consumer behavior and monetization while generating significant cost savings and enhancing revenue growth."

The Ariel Fund's John Rogers (Trades, Portfolio) noted on April 10, "Cancellations in sports programming, softness in ad revenues, production delays, and a disruption in the upfront process will negatively impact near-term financial results. Nonetheless, we believe premium video content is the most valuable part of the media ecosystem. Based on our sum of the parts analysis, VIAC is currently trading -75% below our estimate of private market value."

Altogether, 15 of the gurus hold positions in ViacomCBS, the largest of which is owned by Seth Klarman (Trades, Portfolio) of the Baupost Group with 22.5 million shares. Larry Robbins (Trades, Portfolio) of Glenview Capital Management holds roughly nine and a quarter-million shares, while John Rogers (Trades, Portfolio) holds 6.2 million.

Fundamentals

Starting with financial strength, we see a mediocre rating, mainly the result of the debt load carried by the company:

In making historical comparisons, presumably the GuruFocus system is using the combined predecessor companies' results.

The system reports, on the ViacomCBS long-term debt page: "ViacomCBS's annual Long-Term Debt increased from Dec. 2017 ($9,464 Mil) to Dec. 2018 ($18,100 Mil) but then declined from Dec. 2018 ($18,100 Mil) to Dec. 2019 ($18,002 Mil)."

While the debt did decline, by $300 million by the end of 2019, $18 billion is still a huge debt load. According to the 30-year financials, the company paid $1.08 billion in interest in 2019.

Still, GuruFocus contributor Ian New wrote that the load is manageable: "The debt level is high compared with its assets and equity value, but the company is profitable and relatively stable, and its 2019 operating profit was almost five times the interest payment."

As New noted, ViacomCBS is profitable; in fact, it receives a high score for profitability:

Part of that is in the relationship between its weighted average cost of capital and its return on invested capital, as shown in the financial strength table. On the profitability table, we see a strong operating margin, modest net margin and a healthy return on equity.

Because of the company's past, it's hard to read much into the history column. However, if we give our attention to the versus industry column, we see it is strong in comparison with its peers and competitors in the media-diversified space.

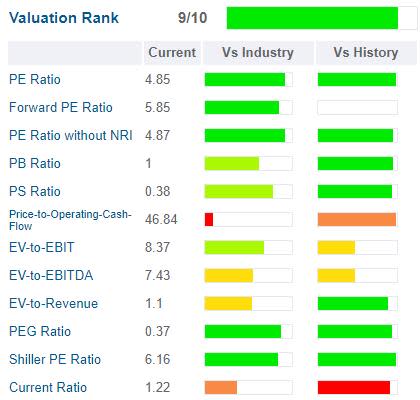

ViacomCBS also receives a strong rating for its valuation, which as we noted is down substantially from the start of the year:

The price-earnings ratio is just below 5, which is quite low, and its PEG ratio (price-earnings divided by growth) is well below 1, indicating undervaluation.

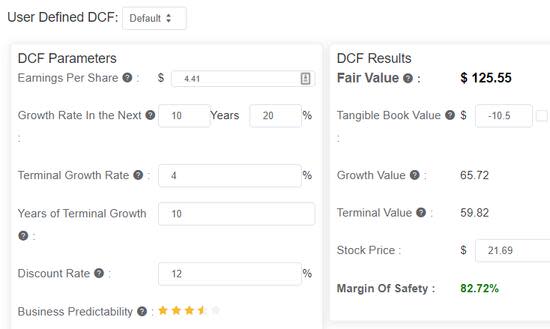

Those indicators are backed up by the discounted cash flow valuation. With the share price at $21.69, it is well below fair, or intrinsic, value of $125.55, producing a margin of safety of almost 83%:

At the current share price, the dividend yields 3.89%. And with the dividend payout ratio at 28%, there is no reason to think the dividend is not sustainable.

Conclusion

The world is awash in content, thanks to the internet. But there is a limited amount of premium content, which is why the new ViacomCBS attracts the attention of at least some value investors.

The company is well positioned to take advantage of its assets, has generally good fundamentals and right now is selling at a deeply discounted price. New made a strong case that investors willing to be aggressive and profit from the coming rebound should take a look at ViacomCBS.

For conventional value investors, though, the long-term debt will be a bridge too far.

Disclosure: I do not own shares in any companies named in this article and do not expect to buy any in the next 72 hours.

Read more here:

Booking: Is This a Value Stock?

Taro Pharmaceuticals: Strong Balance Sheet and Strong Competition

Kroger: Capital Preservation and More at a Good Price

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.