Victory Securities (Holdings) Company Limited (HKG:8540) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Victory Securities (Holdings) Company Limited (HKG:8540) is about to go ex-dividend in just 4 days. Ex-dividend means that investors that purchase the stock on or after the 1st of June will not receive this dividend, which will be paid on the 24th of June.

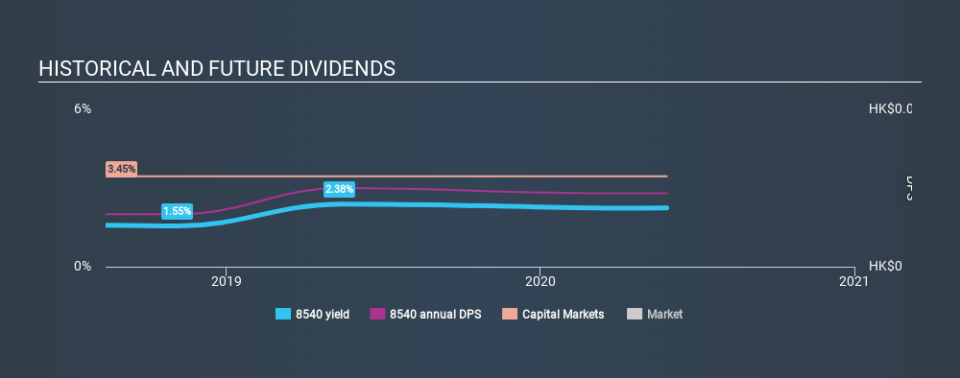

Victory Securities (Holdings)'s next dividend payment will be HK$0.016 per share. Last year, in total, the company distributed HK$0.028 to shareholders. Calculating the last year's worth of payments shows that Victory Securities (Holdings) has a trailing yield of 2.2% on the current share price of HK$1.25. If you buy this business for its dividend, you should have an idea of whether Victory Securities (Holdings)'s dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Victory Securities (Holdings)

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Victory Securities (Holdings) paid out more than half (73%) of its earnings last year, which is a regular payout ratio for most companies.

Companies that pay out less in dividends than they earn in profits generally have more sustainable dividends. The lower the payout ratio, the more wiggle room the business has before it could be forced to cut the dividend.

Click here to see how much of its profit Victory Securities (Holdings) paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. Fortunately for readers, Victory Securities (Holdings)'s earnings per share have been growing at 16% a year for the past five years.

We'd also point out that Victory Securities (Holdings) issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Victory Securities (Holdings) has delivered an average of 18% per year annual increase in its dividend, based on the past two years of dividend payments. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

Final Takeaway

Is Victory Securities (Holdings) worth buying for its dividend? Earnings per share are growing at an attractive rate, and Victory Securities (Holdings) is paying out a bit over half its profits. Victory Securities (Holdings) ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

In light of that, while Victory Securities (Holdings) has an appealing dividend, it's worth knowing the risks involved with this stock. Our analysis shows 2 warning signs for Victory Securities (Holdings) that we strongly recommend you have a look at before investing in the company.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.