Our View On Five Point Holdings' (NYSE:FPH) CEO Pay

This article will reflect on the compensation paid to Emile Haddad who has served as CEO of Five Point Holdings, LLC (NYSE:FPH) since 2016. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Five Point Holdings

Comparing Five Point Holdings, LLC's CEO Compensation With the industry

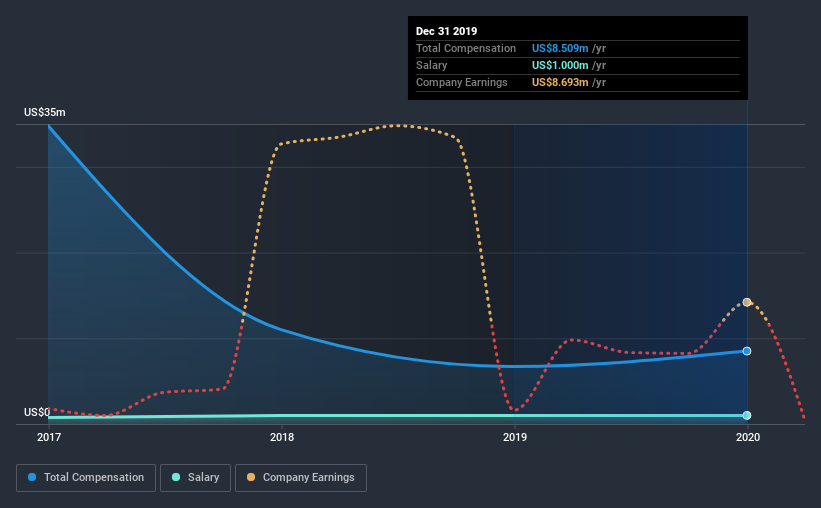

According to our data, Five Point Holdings, LLC has a market capitalization of US$712m, and paid its CEO total annual compensation worth US$8.5m over the year to December 2019. Notably, that's an increase of 27% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.0m.

For comparison, other companies in the same industry with market capitalizations ranging between US$400m and US$1.6b had a median total CEO compensation of US$4.1m. Hence, we can conclude that Emile Haddad is remunerated higher than the industry median. Furthermore, Emile Haddad directly owns US$6.3m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2019 | 2018 | Proportion (2019) |

Salary | US$1.0m | US$1.0m | 12% |

Other | US$7.5m | US$5.7m | 88% |

Total Compensation | US$8.5m | US$6.7m | 100% |

Speaking on an industry level, nearly 32% of total compensation represents salary, while the remainder of 68% is other remuneration. In Five Point Holdings' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Five Point Holdings, LLC's Growth Numbers

Over the last three years, Five Point Holdings, LLC has shrunk its earnings per share by 4.3% per year. It achieved revenue growth of 283% over the last year.

The reduction in earnings, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Five Point Holdings, LLC Been A Good Investment?

Given the total shareholder loss of 67% over three years, many shareholders in Five Point Holdings, LLC are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we touched on above, Five Point Holdings, LLC is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. At the same time, looking at EPS and total shareholder returns, it's tough to say Five Point Holdings is in a sound position, considering both metrics are down. On a more positive note, the company has produced a more positive revenue growth more recently. Most would consider it prudent for the company to hold off any CEO pay rise until performance improves.

Shareholders may want to check for free if Five Point Holdings insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.