VMware (VMW) Q4 Earnings Beat Estimates, Revenues Rise Y/Y

VMware’s VMW fourth-quarter fiscal 2021 non-GAAP earnings of $2.21 per share beat the Zacks Consensus Estimate by 7.8% and also grew year over year by the same percentage.

Moreover, revenues of $3.29 billion surpassed the consensus mark by 1.9% and also improved 7.2% on a year-over-year basis.

Top-Line Details

Region-wise, U.S. revenues (48.9% of revenues) increased 2.6% year over year to $1.61 billion. International revenues (51.1%) grew 12% from the year-ago quarter to $1.68 billion.

Services revenues (47.8% of revenues) rose 6.1% year over year to $1.57 billion. Software Maintenance revenues (83.1% of Services revenues) climbed 5.8% to $1.31 billion. Professional Services revenues (16.9% of Services revenues) were $266 million, up 7.3% year over year.

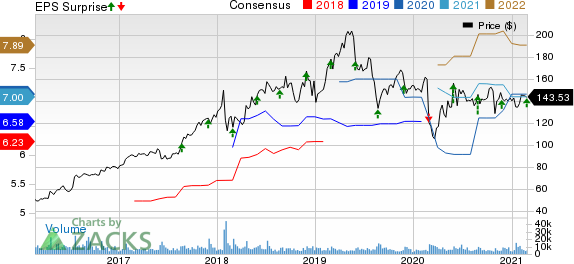

VMware, Inc. Price, Consensus and EPS Surprise

VMware, Inc. price-consensus-eps-surprise-chart | VMware, Inc. Quote

Total License and Subscription & SaaS revenues (52.2% of revenues) improved 8.2% from the year-ago quarter to $1.72 billion.

License revenues (58.9% of License and Subscription & SaaS revenues) declined 1.9% year over year to $1.01 billion.

Subscription & SaaS revenues (41.1% of segment revenues) increased 27.2% year over year to $707 million, driven by strong growth in VCPP, EUC, CarbonBlack and VMC on AWS.

At the end of the fourth quarter, ARR for Subscription & SaaS was $2.9 billion, up 27% from the year-ago quarter.

During the reported quarter, the company closed a record 35 deals, worth more than $10 million.

Operating Details

Research & development (R&D) expenses as a percentage of revenues increased 140 basis points (bps) year over year to 19.1%.

However, sales & marketing (S&M) expenses as a percentage of revenues decreased 180 bps on a year-over-year basis to 26.8%.

Moreover, general & administrative (G&A) expenses as a percentage of revenues decreased 90 bps to 5.7%.

Non-GAAP operating margin expanded 10 bps on a year-over-year basis to 34.4% in the reported quarter, driven by lower spending.

Balance Sheet & Cash Flow

As of Jan 29, 2021, cash & cash equivalents were $4.72 billion compared with $3.90 billion as of Oct 30, 2020.

Total debt as of Jan 29, 2021, unchanged sequentially.

Operating cash flow was $1.3 billion compared with $992 million reported in the previous quarter.

Free cash flow was $1.2 billion compared with $908 million reported in the previous quarter.

Revenue Performance Obligation increased 10% year over year to $11.3 billion.

Key Q4 Highlights

During the reported quarter, VMware Workspace ONE Access achieved FedRAMP Moderate Authorization.

The company also announced a partnership with Dell Technologies DELL and SK Telecom to develop a multi-access edge-computing solution that brings together private 5G and edge-computing capabilities.

Additionally, the company announced the commercial availability of VMware Blockchain, an extensible and scalable enterprise-grade platform to build business networks and deploy business-critical decentralized applications.

VMware also announced the expansion of its partnership with Accenture ACN in the reported quarter.

Guidance

For first-quarter fiscal 2022, VMware expects revenues of roughly $2.90 billion, suggesting 6% year-over-year growth. Subscription & SaaS and License revenues are expected to be $1.3 billion, indicating nearly 7% growth year over year.

Non-GAAP operating margin is anticipated to be 27.5%. Moreover, non-GAAP earnings are expected to be $1.49 per share for first quarter fiscal 2022.

For fiscal 2022, VMware expects revenues of roughly $12.70 billion, suggesting 8% year-over-year growth.

Subscription & SaaS and License revenues are expected to be $6.3 billion, indicating nearly 12% growth year over year.

Non-GAAP operating margin is anticipated to be 28%. Moreover, non-GAAP earnings are expected to be $6.68 per share for fiscal 2022.

Further, cash flow from operations, capital expenditure and free cash flow are expected to be $3.8 billion, $380 million and $3.4 billion, respectively.

A Key Pick

VMware has a Zacks Rank #4 (Sell).

Zoom Video Communications ZM with a Zacks Rank #2 (Buy) is a stock worth considering in the broader computer & technology sector. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.9% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research