Volatility 101: Should Affluent Foundation Holdings (HKG:1757) Shares Have Dropped 17%?

Affluent Foundation Holdings Limited (HKG:1757) shareholders should be happy to see the share price up 25% in the last quarter. In contrast, the stock is down for the year. But on the bright side, its return of 17%, is better than the market, which is down 0.171534.

Check out our latest analysis for Affluent Foundation Holdings

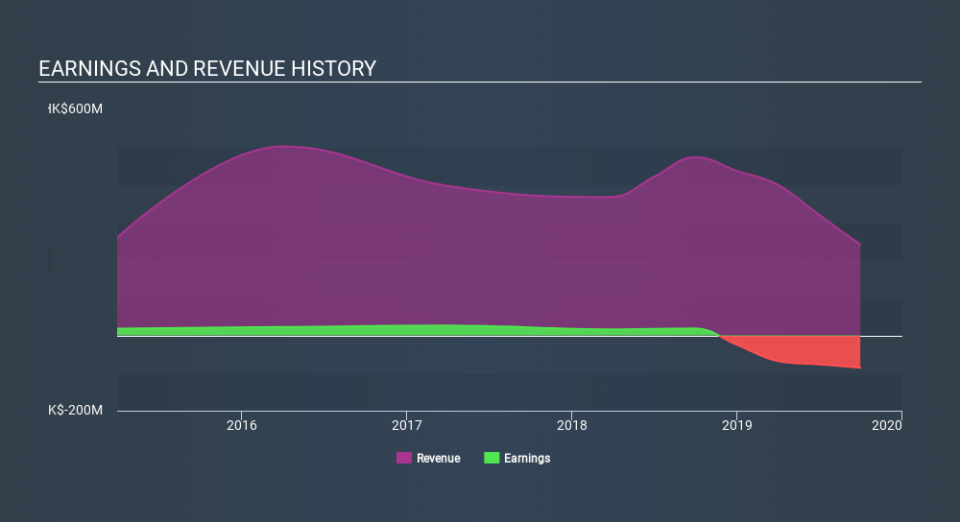

Given that Affluent Foundation Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year Affluent Foundation Holdings saw its revenue fall by 49%. That's not what investors generally want to see. The stock price only fell 17% in that period, not a bad result. So it's fair to say the weak revenue was no surprise to shareholders. It seems some people think the business stock will become profitable - the question is when

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Affluent Foundation Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Having lost 17% over the year, Affluent Foundation Holdings has generated a return within the same ballpark as the broader market. However, shareholders can take a little comfort that the share price is up 25% over the last three months. With any luck the business can produce the financial results required to maintain the positive share price momentum. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Affluent Foundation Holdings is showing 5 warning signs in our investment analysis , and 2 of those are concerning...

But note: Affluent Foundation Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.