Volatility 101: Should European Eltech (MCX:EELT) Shares Have Dropped 16%?

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by European Eltech Public Joint Stock Company (MCX:EELT) shareholders over the last year, as the share price declined 16%. That contrasts poorly with the market return of 0.5%. We wouldn't rush to judgement on European Eltech because we don't have a long term history to look at. There was little comfort for shareholders in the last week as the price declined a further 2.2%.

View our latest analysis for European Eltech

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the European Eltech share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

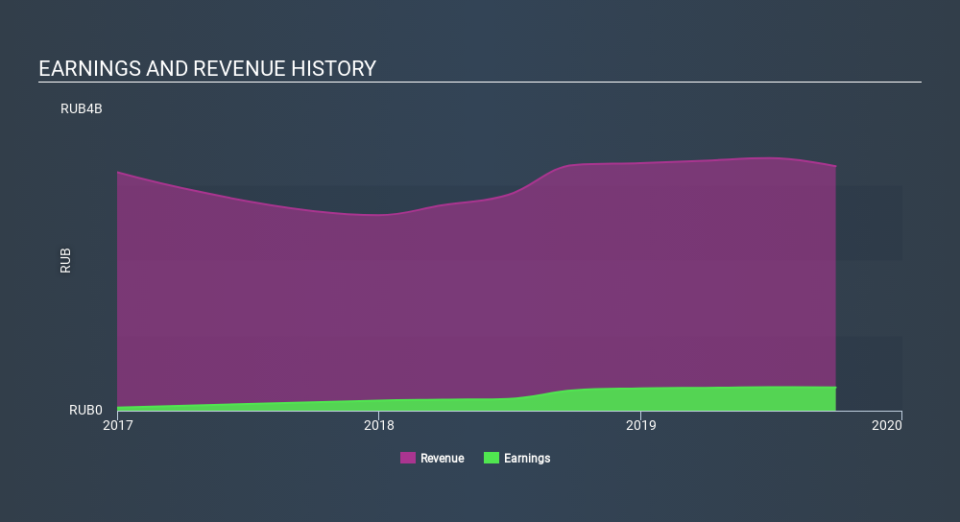

Revenue was pretty flat on last year, which isn't too bad. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While European Eltech shareholders are down 15% for the year, the market itself is up 0.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 4.6%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for European Eltech (2 are significant) that you should be aware of.

Of course European Eltech may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.