Volatility 101: Should Exel Industries Société Anonyme (EPA:EXE) Shares Have Dropped 41%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Exel Industries Société Anonyme (EPA:EXE) share price slid 41% over twelve months. That's disappointing when you consider the market returned 5.9%. To make matters worse, the returns over three years have also been really disappointing (the share price is 32% lower than three years ago). Furthermore, it's down 19% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Exel Industries Société Anonyme

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

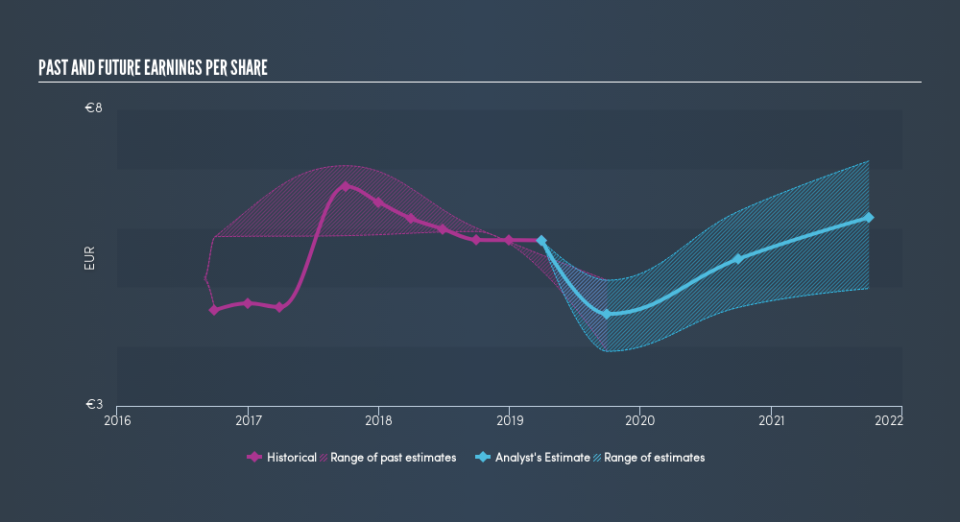

Unhappily, Exel Industries Société Anonyme had to report a 6.0% decline in EPS over the last year. This reduction in EPS is not as bad as the 41% share price fall. This suggests the EPS fall has made some shareholders are more nervous about the business. The less favorable sentiment is reflected in its current P/E ratio of 9.36.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Exel Industries Société Anonyme's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Exel Industries Société Anonyme shareholders, and that cash payout explains why its total shareholder loss of 40%, over the last year, isn't as bad as the share price return.

A Different Perspective

Exel Industries Société Anonyme shareholders are down 40% for the year (even including dividends), but the market itself is up 5.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 0.2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how Exel Industries Société Anonyme scores on these 3 valuation metrics.

Of course Exel Industries Société Anonyme may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.