Volatility 101: Should Rimini Street (NASDAQ:RMNI) Shares Have Dropped 29%?

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Investors in Rimini Street, Inc. (NASDAQ:RMNI) have tasted that bitter downside in the last year, as the share price dropped 29%. That's disappointing when you consider the market returned 3.4%. We wouldn't rush to judgement on Rimini Street because we don't have a long term history to look at. Unhappily, the share price slid 3.2% in the last week.

View our latest analysis for Rimini Street

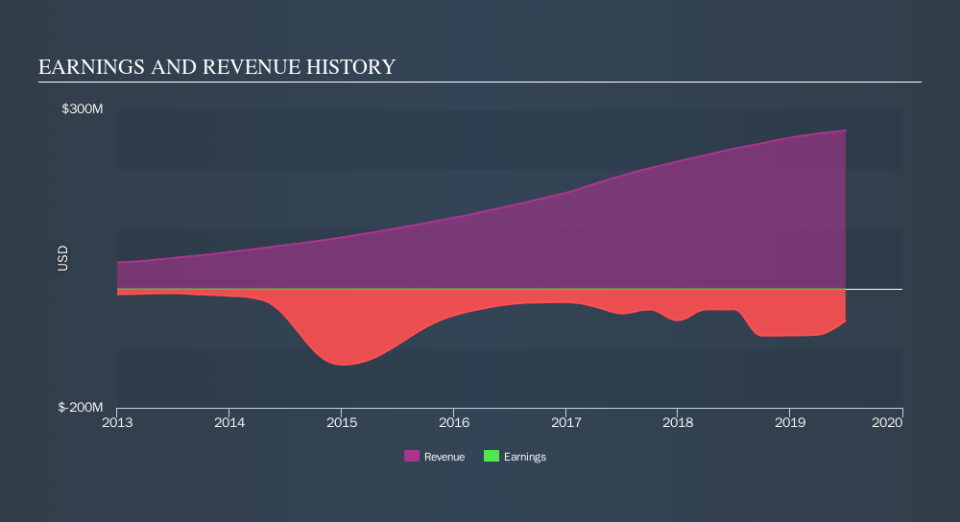

Given that Rimini Street didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Rimini Street grew its revenue by 13% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 29% in a year. It's important not to lose sight of the fact that profitless companies must grow. So remember, if you buy a profitless company then you risk being a profitless investor.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Rimini Street stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While Rimini Street shareholders are down 29% for the year, the market itself is up 3.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 7.8%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.