Volatility 101: Should Wells Fargo (NYSE:WFC) Shares Have Dropped 14%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the Wells Fargo & Company (NYSE:WFC) share price is down 14% in the last year. That contrasts poorly with the market return of 7.1%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 0.7% in three years.

Check out our latest analysis for Wells Fargo

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Wells Fargo share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

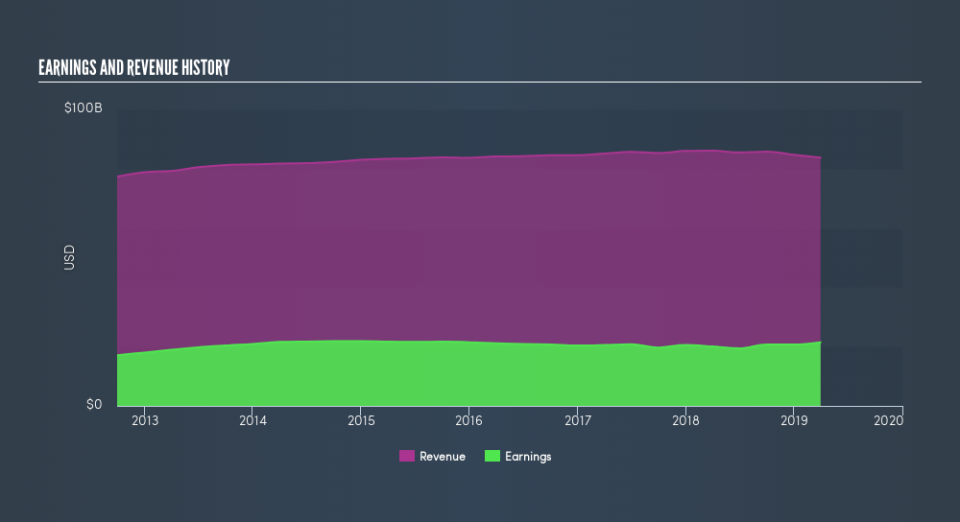

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Wells Fargo is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Wells Fargo stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Wells Fargo the TSR over the last year was -11%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Wells Fargo had a tough year, with a total loss of 11% (including dividends), against a market gain of about 7.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 1.4%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you would like to research Wells Fargo in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Wells Fargo may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.