Volusia County property taxes are due in March. Where are tax rates highest?

People have a couple of months left to pay their 2023 Volusia County property taxes, and there's still some time to get a discount for paying early.

The tax year is from Jan. 1 to Dec. 31 each year. Tax bills get sent out around Nov. 1, and taxes for that year are due before April 1.

People in Oak Hill and Pierson pay the top tax rates in Volusia County, but that doesn't necessarily mean they pay the largest amount in property taxes.

Here's a look at taxes around Volusia County and a few things to know about paying your bill.

You can save money on taxes in Volusia County by paying early

People who haven't paid their taxes get a "3% minimum mandatory charge" added to the gross bill on April 1, according to the tax collector's office. But people can avoid that and get a discount on their tax bill by paying early.

People get a 4% discount for paying in November, a 3% discount in December, a 2% discount in January and a 1% discount in February. There is no discount for paying in March, according to the Volusia County tax collector's office.

The tax collector also offers an installment plan, but partial payments don't get a discount. Applications for an installment plan are due before May 1 for the 2024 tax year.

"I know we have a lot of fixed-income residents and that is definitely an option," Volusia County Tax Collector Will Roberts said.

Who pays the highest property tax rates in Volusia County?

Here are the 10 areas in Volusia County with the highest total millage rates, which are property tax rates, for the 2023 tax year outlined by the Volusia County property appraiser's office.

The total millage rates are a combination of millage rates from the various entities that levy taxes in those areas.

Oak Hill 21.8746 mills.

Pierson 21.3536 mills.

South Daytona 20.073 mills.

Deltona 19.6185 mills.

Orange City 19.3894 mills.

Downtown Daytona Beach 18.9279 mills. (The part of Daytona Beach that pays additional tax for the Downtown Development Authority)

Edgewater 18.8506 mills.

Lake Helen 18.7685 mills.

DeLand 18.7526 mills.

Ponce Inlet 18.6009 mills.

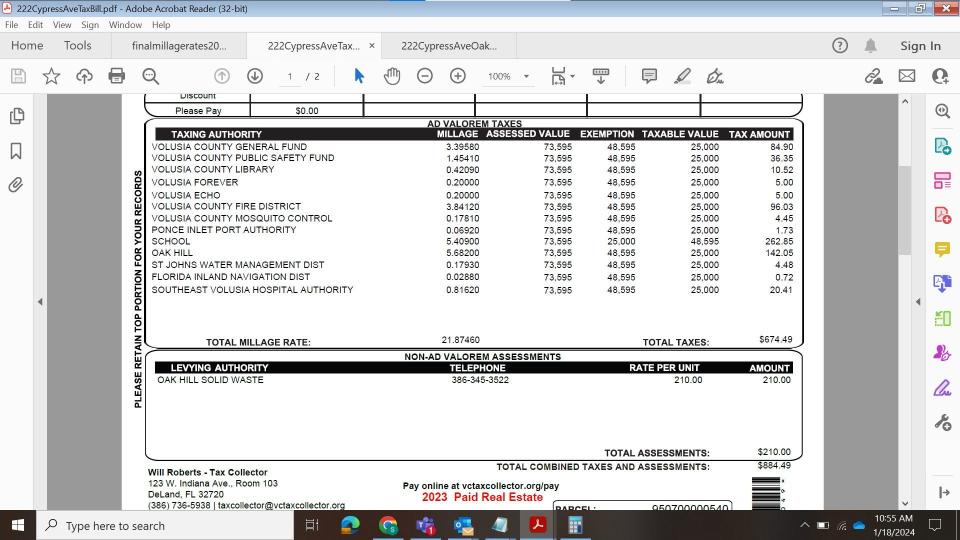

Here's how the total millage rate for properties in the Oak Hill area breaks down by taxing authority:

Volusia County total operating: 5.2708 mills.

Volusia County voter-approved debt service: 0.4 mills.

Volusia County Schools taxes: 5.409 mills.

St. Johns River Water Management District: 0.1793 mills.

Florida Inland Navigation District: 0.0288 mills.

Hospital Operating: 0.8162

Fire control district: 3.8412 mills.

Mosquito Control District: 0.1781 mills.

Ponce Inlet & Port Authority: 0.0692 mills.

Oak Hill local government: 5.682 mills.

People can also receive on their tax bill special charges in addition to property taxes, such as for garbage collection.

What does the millage rate mean for a property tax bill?

One mill is equal to $1 for every $1,000 of assessed value. The millage rate, a property's value and any tax exemptions determine what people pay.

Here's an example from a 2023 tax bill for a single-family home in Oak Hill.

The Volusia County property appraiser's office sets property values. The taxing authorities, such as a city commission and the County Council, set their tax rates. The tax collector gets the money and gives it to government entities.

The Florida Department of Revenue has a guide about millage rates and how property taxes are calculated.

The tax collector's office can be reached at 386-736-5938. More details on taxes are at vctaxcollector.org.

This article originally appeared on The Daytona Beach News-Journal: Volusia County property taxes are due in March. What to know.