Voters may be asked to renew a 1% sales tax to pay for capital projects in Collier County

A local one-cent tax that has funded millions of dollars of capital projects in Collier County is set to expire this month, but there's talk of renewing it.

County commissioners will discuss whether to pursue a renewal of the surtax on Tuesday, which would require another referendum.

If they move forward with a referendum, the question could go before voters again in 2026.

Voters first approved the surtax in November 2018, by a slim margin (51% to 49%). The surtax differs from the state sales tax, applying only to the first $5,000 of the purchase price for qualifying items, which don't include such necessities as groceries and gas.

More: Collier voters approve sales tax increase by slim margin

While more than 91% of the money from the infrastructure tax goes to Collier County government, the rest is shared by its three cities, Naples, Marco Island and Everglades, to fund their own projects.

Marco Island has lobbied for the renewal of the tax, citing the "remarkable impact" it's had on the city, providing revenue for a fire station, park upgrades and road improvements.

The city of Everglades has also urged the county to consider another referendum, and so have a number of community leaders and organizations, after seeing the benefits from the tax money.

Despite all the money the tax has raised, the county is still facing budget shortfalls. This year, the county is using taxpayer money collected for land buys through Conservation Collier for other purposes after commissioners decided to cut property taxes, as they search for ways to "cut the fat" from the overall budget.

Commissioners have promised to refund the voter-approved conservation program, as soon as possible, once other solutions are found.

Last month, commissioners started asking for feedback from voters, through their newsletters, email blasts, and personal conversations, to gauge support for a second round of the infrastructure surtax.

Tax collections began on Jan. 1, 2019. They were to continue for seven years, or until they reached $490 million countywide. After hitting that mark earlier this year, the tax is now set to expire two years early, having generated more than $525 million.

The tax is projected to raise more than $541.9 million by the end of the year, with about $50.6 million going to the cities (combined).

The faster-than-expected pace of collections is attributed to several factors, including the influx of new residents during and after COVID, and record inflation.

Where has the money gone?

Here's a look at some of the larger investments the county is making with the extra money, with a stamp of approval from a seven-member citizen-led oversight committee:

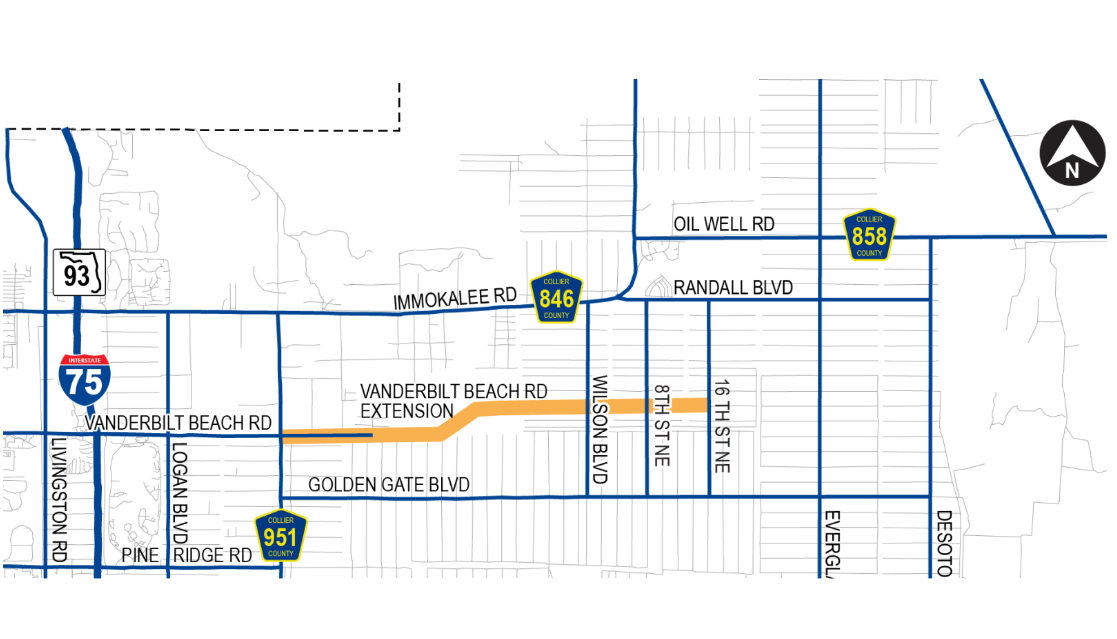

Vanderbilt Beach Road extension: $74 million. This involves a seven-mile stretch from Collier Boulevard to 16th Street NE, which is under construction.

Bridges in Golden Gate Estates: $60 million. There are 11 bridges planned in all, designed to improve mobility, and evacuation and emergency response times.

Big Corkscrew Island Regional Park: $40 million. The money has gone toward the build out of the new regional park, which opened in 2021.

Building upgrades and equipment replacements: $39 million. This is for new air conditioning and heating systems, roofing and capital equipment at county buildings, and sheriff's offices, including the jail.

Forensic/evidence building: $33 million. It's for the construction and outfitting of a new building for the Collier County Sheriff's Office.

Veterans' nursing home: $30 million. The 120-bed nursing home is planned at the former Golden Gate Golf Course, which is now county owned.

Mental health complex: $25 million. Located in Golden Gate, it would serve as a central receiving center, adding more beds and services for mental health and addiction treatment.

Workforce housing: $20 million. A trust fund has been set up to fund eligible projects, with several proposals floated by private and nonprofit developers, but not yet approved by the county.

Other funded projects include three new stations for the county's Emergency Medical Services and a new Career and Technical Training Center, which the county plans to build in partnership with the Collier County School District.

About $400 million has been approved and allocated to county projects.

The Greater Naples Chamber of Commerce was one of the biggest and most vocal proponents of the tax, viewing it as critical to not only fund overdue infrastructure projects and community priorities, but to maintain "paradise." At the time, county leaders were struggling to find the money to tackle their long to-do list.

The county needed to catch up on projects deferred during the Great Recession and take on new ones to keep up with a growing population.

Julie Schmelzle, the Naples chamber's voluntary chairwoman, said the organization is proud of the results and success of the one-cent tax, which is providing funding in areas of particular interest to the business community, including workforce housing and training and mental health.

"The benefit gained for the entire community to further advance our infrastructure, such as roads, water/sewer infrastructure and a new park are additional highlights," she said.

Asked whether the chamber would get behind the renewal of the tax, she said: "We welcome further discussion with Collier County staff and the board of county commissioners, who have the ultimate decision on whether to pursue a second voter referendum as the sales surtax sunsets early."

Is it the right time to renew the tax?

Some aren't in favor of renewing the tax, seeing it as a one-time fix, not a long-term solution. That includes Scott Lepore, who serves as chairman of the Infrastructure Surtax Citizens Oversight Committee.

He didn't vote for the tax, but when it passed, he fought to get on the committee as a taxpayer advocate to ensure that the county spent the money "properly." After joining the committee, he said he realized the trouble the county would have been in without the tax.

"You can only put so much property taxes on people," he said. "So, it was a necessary evil."

He's happy with the way the money has been spent, and how the county has handled the money and the projects, having "no complaints" about the process.

"It has been a lot better than I thought. They are very well organized," he said of county staff involved in the spending.

Still, he doesn't think the county should be considering, or pushing for another referendum. In part, that's because so many of the projects funded by the soon-to-expire tax haven't been completed, or even started yet in some cases.

"Let's see how everything plays out," Lepore said.

As it is, the tax will raise more money than expected, resulting in a surplus, which the county still must decide how to spend, he pointed out.

On top of that, he emphasized much has changed in the local and national economy since the passage of the surtax before the pandemic hit. The cost of living has soared, from the price of food to the cost of health care and housing.

"I don't think it's the appropriate thing to do at this time," Lepore said. "I think the citizens really need to see some of the projects coming out of the ground before we go down that road. This was a tax that was to fill an immediate need."

This article originally appeared on Naples Daily News: Surtax for infrastructure in Collier is set to expire: What's next?