Wages up, housing costs dip. Is it enough to help ease Tri-Cities housing crisis?

A slower housing market, a dip in rents and a slight increase in wages paint a promising picture for Tri-Citians seeking homes to buy or rent.

The state Office of Financial Management sounded a hopeful note when it released its 2023 population estimates in late June, showing that population growth slowed to 1.1% statewide while housing inventory picked up.

“With strong housing growth this year in the face of slowing population growth, housing is slowly catching up with population,” the agency said.

That doesn’t mean the market to buy or rent a home is approaching a state of balance in the Tri-Cities.

Rising interest rates are offsetting any gains offered by wage increases, said Ajsa Suljic, regional labor economist for the Washington Employment Security Department.

The average Tri-City wage was $61,000 in 2022, a 2.8% gain from 2021. Suljic attributes the higher wages to cost of living and retention raises. The average wage for Washington was more than $84,000.

At the same time, the Tri-Cities added 5,000 jobs, pushing total employment to more than 130,000. The population now stands at 316,000, according to the state.

That kind of growth puts pressure on all types of housing — for sale and for rent.

It’s not enough to keep up with home prices that grew by 15% or more during the heavy pandemic years. Interest rates have pushed the cost of a 30-year mortgage to about 7%.

“The toughest part for housing right now is, where are interest rates going to stop?” Suljic said. “Wages have never gone up as much as the cost of housing.”

First-time buyers

Buying a home remains tough, particularly for first-time buyers.

David Retter, owner of Retter & Co. Sotheby’s International Realty, the Tri-Cities’ largest residential real estate firm, described a client hunting for their first home.

The client began with a budget of $270,000. With few homes available in that range, they increased to $450,000, in part by paying down debt to accommodate a bigger mortgage payment. His buyer has made several offers but lost out to rival buyers who have more cash to put down.

“We’re still getting beat out,” Retter lamented.

Retter is a perennial optimist when it come to residential real estate, noting that interest rates rise and fall as do housing supplies.

And he’s an optimist now, noting there were 619 homes listed for sale in June, a jump from the 400-500 range that has dominated the market in recent years. For context, the Tri-Cities is considered balanced when there are about 1,200 homes for sale and it takes four to six months to sell a home.

“People would go nuts right now if it took four to six months to sell a house,” he said.

In another positive sign for home buyers, prices receded in June.

The Tri-Cities Association of Realtors reports the average Tri-City home sold for $459,500, down 9% from a year ago but still $41,000 higher than the pandemic-fueled peaks of 2021. June’s median price fell by 1.7%.

Rental costs dip

The cost of renting is dropping along with home prices.

Rent.com reports the average rent in Washington dropped nearly 7% in June compared to a year ago, the largest drop of any state in the nation. Idaho, with a 6% average decline, was second.

Blame or credit the Puget Sound area for the statewide drop. The median rent there fell nearly 14%, to $2,893.

The results are more nuanced in the Tri-Cities, thanks in part to a significant bump in the inventory of units for lease. In March, Fortify Holdings Inc., a Portland area developer, began leasing former hotels in Kennewick, Pasco and Richland as microapartments.

The move added some 800 units at six properties to the market, with rents starting at more than $1,000 a month.

Rent.com tracked a dip in asking rents for Kennewick, mixed results in Richland and an increase in West Richland. Trend data was not available for Pasco.

In Kennewick, the average rent for a one-bedroom was nearly $1,400, down 6%, while the average for a two-bedroom was about $1,700, down 4%, according to rent.com. Only 4% of Kennewick units had asking rents of $1,000 a month or less.

In Pasco, the average one-bedroom rent was $1,200 and the average two-bedroom was about $1,600. comparison data was not available.

In Richland, the average for a one-bedroom was $1,600, up 3%, while the average for a two-bedroom was almost $1,800, down 1%. Only 2% of Richland units had asking rents below $1,000 a month.

In West Richland, the average for a one-bedroom was $1,400, up 5%, while the average for a two-bedroom was nearly $1,700, also up 5%.No properties had asking rents below $1,000 a month.

Help coming?

The housing market is tight across the state, said Rachael Myers, executive director of the Washington Low Income Housing Alliance, a Seattle-based nonprofit that advocates for tenants rights.

“You’re hearing the same things we are,” she said. “We need to come up with a lot more housing that’s affordable.”

The rental housing market is growing and not just because of the 800 units on offer from Fortify. Medium to large apartment projects dot the region.

Pasco authorized the 240-unit Hydro at Broadmoor and 170-unit Affinity at Broadmoor, this spring.

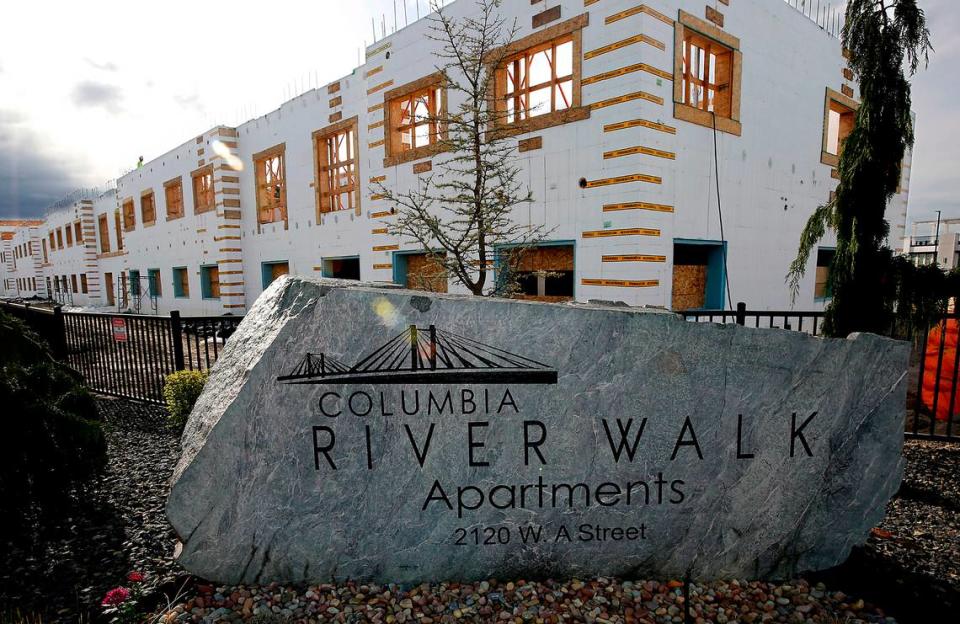

It also authorized the latest phase for River Walk, the upscale complex near the blue bridge.

Kennewick is processing several projects that will add hundreds of new units, including a 195-unit complex at Zintel Canyon called Canyon View.

Another will be built at Southridge that will be constructed around a food truck court and there is a potential 300-unit project on Bob Olson Parkway. The Falls, a mixed use project with 105 apartments, is under construction now at 4112 W. 24th Ave.

West Richland is tracking to add more than 100 units in 2023, after permitting the same number a year ago while Richland is gaining a new complex from Cedar and Sage at Columbia Point.

New home construction is a different story.

Rising interest rates and supply chain challenges have slowed construction in most of the Tri-Cities.

Local building agencies authorized 546 permits for single family homes in the first half of 2023. That’s 27% lower than the five year average of 747, according to the Home Builders Association of Tri-Cities June report.

The biggest drops were in Pasco and West Richland, which both saw home building fall by half compared to their respective five year averages. Richland saw single family activity fall nearly 31% compared to its five-year average.

In Kennewick, home building was up by a third compared to average.

Sign Up: Boom Town Tri-Cities

Stay up to date on Tri-Cities growth and development with our weekly business newsletter. Get the latest on restaurant and business openings and closings, plus the region’s top housing and employment news. Click here to sign up. In your inbox every Wednesday.