The Walt Disney Company (NYSE:DIS) is Relying on Digital Products on the Path to Profitability

This article first appeared on Simply Wall St News.

The Walt Disney Company ( NYSE:DIS ) is continuing on the path back to profitability. This last weekend it released Jungle Cruise at 4,310 North American venues, setting a pandemic record.

While it is tracking at US$25-30m domestically, it is still a drop in the ocean for 2020 yearly loss of US$2.8b and a trailing twelve-month loss of US$4.5b.

We've put together a brief outline of industry analyst expectations for the company, its timeline to breakeven, and its implied growth rate.

See our latest analysis for Walt Disney .

The Walt Disney Company, together with its subsidiaries, operates as an entertainment company worldwide. With a capitalization of US$319.8b, it is a true titan of the industry.

Latest Developments

The company just joined a list of vaccination-imposing corporations stating that all salaried and non-union hourly Disney employees in the U.S will need to be vaccinated , giving them 60-days to do so.

In addition to the screening mentioned above record, the company is supplementing with an online strategy as well, releasing Jungle Cruise for Plus Premier users at a US$29.99 surcharge. The same method for Black Widow reportedly brought an additional US$60m but also brought on a lawsuit by Scarlett Johansson . The actress argues that the practice negatively impacted her compensation because it depends on screening revenues.

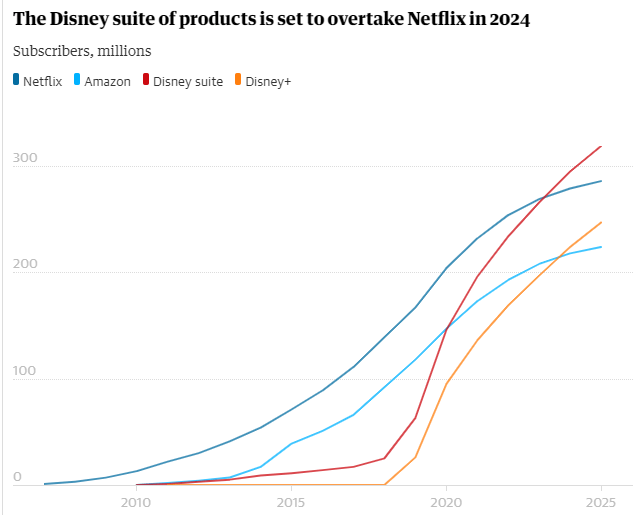

The streaming industry is projected to grow to US$150b by 2026 , and it is not surprising that Disney is using every leverage they can to get ahead of the competitors like Netflix or Amazon Prime. According to The Guardian, Disney will overtake Netflix to become the largest streaming platform by 2024 .

Profitability is Near

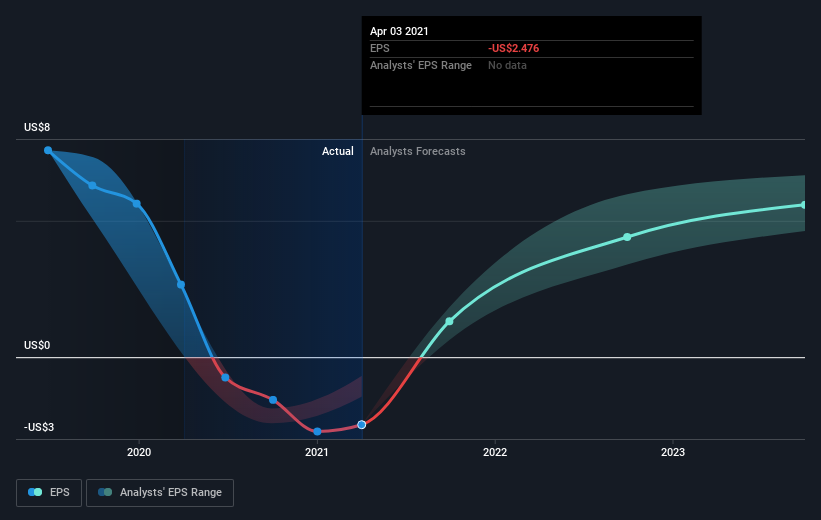

According to the 26 industry analysts covering Walt Disney, the consensus is that breakeven is near.They expect the company to post a final loss in 2020 before turning a profit of US$2.4b in 2021.Therefore, the company is expected to break even roughly a year from now.

At what rate will the company grow to realize the consensus estimates forecasting breakeven in under 12 months? Using a line of best fit, we calculated an average annual growth rate of 38%,which is highly buoyant.

Should the business grow at a slower rate, it will become profitable at a later date than expected.

Underlying developments driving Walt Disney's growth aren't the focus of this broad overview. Keep in mind that a typical high growth rate is not out of the ordinary, mainly when a company is investing.

One thing to point out is its relatively high level of debt. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, which in Walt Disney's case is 53%. A higher level of debt requires more stringent capital management, which increases the risk around investing in the loss-making company.

However, given the numerous projects that the company is currently pushing, including a five-year construction plan , a slightly elevated amount of debt is unsurprising.

Next Steps:

This article is not intended to be a comprehensive analysis on Walt Disney, so if you are interested in understanding the company at a deeper level, take a look at Walt Disney's company page on Simply Wall St . We've also put together a list of important aspects you should look at:

Valuation : What is Walt Disney worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether the market currently misprices Walt Disney.

Management Team : An experienced management team at the helm increases our confidence in the business - take a look at who sits on Walt Disney's board and the CEO's background .

Other High-Performing Stocks : Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here .

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com