Want To Have a Child? Save Up This Much Money First

Deciding when to have a baby is an intensely personal decision and one that couples should not enter into lightly. There are many factors to consider, not the least of which is how much it costs to raise a child. The U.S. Department of Agriculture estimates that the average cost of a kid who was born in 2015 through age 17 is $233,610.

Fortunately, you don’t have to have all that money saved by the time the child is born. There are some upfront costs, however. GOBankingRates looked at the average cost of a baby in their first year, including expenses related to childbirth, food, clothing and healthcare. This is how much new parents can expect to spend in their baby’s first 12 months.

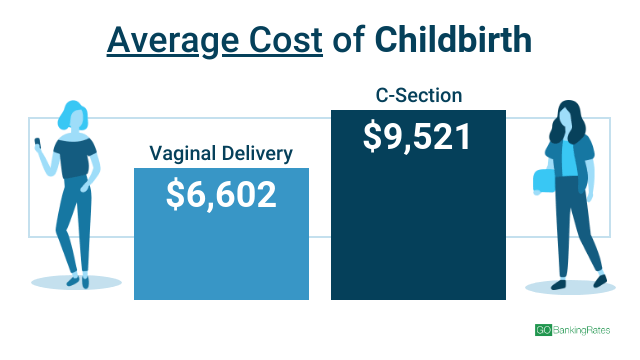

Pregnancy and Childbirth

The cost to actually give birth is significant and varies depending on what type of birth you have and where you live. A vaginal birth is less expensive than a C-section, averaging $6,602.38. If you have a C-section, you can expect to pay an average of $9,520.62.

Related: Best and Worst States for Single Parents To Raise a Family

The cost of delivery can vary quite a bit based on where you live. According to a survey from FAIR Health and Money.com, the average cost of a C-section in Alaska, for example, is $14,528. In Alabama, it’s $7,730. For a vaginal birth, you’ll pay $10,413 in Alaska, but just $5,017 in Alabama.

The Cost To Deliver a Child in the US

State | Average Price for | Average Price for |

U.S. Average | $6,602.38 | $9,520.62 |

Alabama | $5,017.00 | $7,730.00 |

Alaska | $10,413.00 | $14,528.00 |

Arizona | $6,822.00 | $9,616.00 |

Arkansas | $5,600.00 | $8,037.00 |

California | $7,626.00 | $10,675.00 |

Colorado | $6,739.00 | $9,647.00 |

Connecticut | $8,102.00 | $11,208.00 |

Delaware | $6,388.00 | $8,640.00 |

Florida | $7,800.00 | $10,926.00 |

Georgia | $6,813.00 | $9,598.00 |

Hawaii | $5,743.00 | $8,265.00 |

Idaho | $5,695.00 | $8,341.00 |

Illinois | $7,526.00 | $10,737.00 |

Indiana | $6,379.00 | $9,688.00 |

Iowa | $5,848.00 | $8,627.00 |

Kansas | $5,541.00 | $8,519.00 |

Kentucky | $5,905.00 | $8,773.00 |

Louisiana | $5,590.00 | $7,985.00 |

Maine | $5,893.00 | $8,182.00 |

Maryland | $6,782.00 | $9,354.00 |

Massachusetts | $7,767.00 | $10,534.00 |

Michigan | $5,868.00 | $8,533.00 |

Minnesota | $6,299.00 | $9,340.00 |

Mississippi | $5,605.00 | $8,534.00 |

Missouri | $5,842.00 | $8,830.00 |

Montana | $6,042.00 | $8,602.00 |

Nebraska | $5,432.00 | $8,373.00 |

Nevada | $7,157.00 | $10,199.00 |

New Hampshire | $6,887.00 | $10,034.00 |

New Jersey | $9,302.00 | $13,300.00 |

New Mexico | $6,189.00 | $9,028.00 |

New York | $8,936.00 | $11,887.00 |

North Carolina | $6,375.00 | $9,247.00 |

North Dakota | $6,820.00 | $9,221.00 |

Ohio | $5,836.00 | $8,371.00 |

Oklahoma | $6,003.00 | $8,688.00 |

Oregon | $6,565.00 | $9,624.00 |

Pennsylvania | $6,850.00 | $10,266.00 |

Rhode Island | $5,401.00 | $8,337.00 |

South Carolina | $6,521.00 | $8,898.00 |

South Dakota | $6,102.00 | $8,866.00 |

Tennessee | $6,748.00 | $9,400.00 |

Texas | $7,349.00 | $10,576.00 |

Utah | $5,357.00 | $8,226.00 |

Vermont | $6,257.00 | $10,067.00 |

Virginia | $6,953.00 | $10,288.00 |

Washington | $6,482.00 | $9,546.00 |

West Virginia | $5,815.00 | $8,639.00 |

Wisconsin | $8,314.00 | $11,640.00 |

Wyoming | $6,823.00 | $9,861.00 |

Source: FAIR Health | ||

How You Can Prepare For This Cost

Understanding your health insurance is the best way to prepare for the cost of pregnancy and childbirth. Know what is covered and what is not and have a plan to cover your out-of-pocket costs.

If you have a high-deductible health insurance policy and a health savings account (HSA), you can contribute pre-tax dollars to the HSA. When it comes time to head to the hospital, you can use the HSA funds to pay for the delivery. For 2019, a family can contribute $7,000 to an HSA as long as their health insurance plan has at least a $2,700 deductible.

Groceries, Baby Apparel and Diapers

According to the Bureau of Labor Statistics Consumer Expenditure Study, the average American family spends $629 per year on clothing, diapers and wipes for a child under two.

Groceries for a family of three average $5,493 per year. If you live in an expensive city, you can expect the cost to be higher. This doesn’t factor in costs for take-out, delivery, fast food or full-service restaurants that you’ll most likely indulge in at some point throughout the year.

How You Can Prepare For This Cost

These first-year baby expenses will typically come out of earned income, so you’ll pay as you go. But you should adjust your budget to account for the added cost of a child.

“I have found that a 50/20/30 budgeting method can be a straightforward budgeting guideline that sets young people up for a successful transition,” said Kateri Turner, a certified financial planner with Government Employee Benefits Association (GEBA) and a mother of two. “This method allows for 50% of take-home pay to be designated to needs, such as rent, food, transportation, utilities and debt repayment. Twenty percent is designated for savings, and 30% for wants, like cable, vacations, dining out, etc.”

Don’t Miss: The Most (and Least) Expensive States To Have a Child

Family Health Insurance and Healthcare

The average family will pay $5,345 per year for family healthcare and health insurance. Babies require a lot of doctor visits during the first year, but most preventative care is fully covered by health insurance.

How You Can Prepare For This Cost

Understanding your health insurance is critical to keeping costs down. Know how much you have to pay out of pocket, which includes premiums, deductibles, and co-payments or coinsurance. Be sure to use physicians who are in your insurance network. And if you have a choice of plans from your employer, review them to make sure you are enrolled in the best one for your growing family.

Child Care and Education

The average cost for baby’s first year includes $2,642 for child care expenses, but putting your baby in day care will cost you far more than that. According to a 2018 Care.com survey, the average weekly cost for infant child care is $211 for a day care center, $195 for a family care center and $580 for a nanny. The survey also found that one in three families now spend 20% or more of their annual household income on child care.

Also See: How Much It Costs To Raise an Ivy League-Kid

How You Can Prepare For This Cost

To reduce your infant day care cost, or avoid it entirely, try to have one parent stay home with the child, even if it means you have to work part-time or telecommute. If the nature of your work won’t allow this, and leaving the workforce entirely isn’t an option, perhaps you and your spouse or partner could work opposite shifts, so someone is always at home.

You could also explore a nanny share option, where two or more families join together to hire one person to care for multiple children. Research your neighborhood or surrounding area online, too, for nanny referral services or nanny agencies that might be able to assist you in hiring a nanny.

To prepare for the cost of college, consider starting a 529 plan. “These plans provide tax-free growth of your investment, and there are no income, age or contribution limits,” said Turner. “The funds are transferrable among family members, and grandparents and others can contribute as well.”

Up Next: The Best States To Raise a Family All Have These Things in Common

Consider the Big Picture Before Having a Child

Having a baby involves many different types of sacrifices. You likely won’t have as much time to dedicate to hobbies or your favorite television shows, your social life could take a serious hit and you definitely won’t get as much sleep.

There are also financial implications. Because of the high expense of childbirth and other medical expenses, the first year of a child’s life is typically more expensive than subsequent years. In fact, on average, you can expect to spend over $20,000 during the first year alone. That’s something couples need to seriously consider before having a child.

By carefully prioritizing expenses that are most important to you, you will be better able to provide for your family and will teach your child an important lesson at the same time. Turner says, “While I have found that there is no ‘perfect’ time to have a child, it is important to consider and create a new financial plan that will ensure you start your life as a parent on the right foot.”

Keep reading to see many families are flocking to this one state.

More on Saving Money and Family

Taking Care of Your Kids and Parents? 8 Ways To Thrive When You’re in the ‘Sandwich’ Generation

96% of Americans Are Missing Out On Major Savings Using This Trick

Methodology: GOBankingRates found the cost for the first year of having a child by using the following factors: (1) average annual expenditure on apparel for “children under 2” for a family of three (defined as a “married couple with oldest child under 6”), sourced from the Bureau of Labor Statistics 2017 Consumer Expenditure survey; (2) the annual cost of “Food at Home” for a family of three as sourced from the Bureau of Labor Statistics 2017 Consumer Expenditure survey; (3) the annual “Healthcare” costs for a family of three as sourced from the Bureau of Labor Statistics 2017 Consumer Expenditure survey; (4) the annual cost of child care and education as sourced from the United States Department of Agriculture’s Cost of Raising a Child Calculator, assuming it will be a two-parent household, with no other children and an income of $59,200 or below (current U.S. median household income is $57,652, according to the Census Bureau); and the average cost of childbirth for both (5) vaginal deliveries and (6) C-section deliveries as sourced from FAIR Health’s and Money.com’s survey, “Find Out How Much it Costs to Give Birth in Every State.” These factors were combined to give a total cost for the first year of having a child in a two-parent household for both vaginal and C-section deliveries.

This article originally appeared on GOBankingRates.com: Want To Have a Child? Save Up This Much Money First