Want to be mortgage-free by 50? Here’s how

Reaching the age of 50 mortgage-free is fast becoming a pipe dream for today’s new home buyers.

Successive interest rate rises and double-digit house price growth have forced prospective homeowners to settle for less and pay more.

For many, affording a mortgage in today’s market has meant extending the terms of their loans in order to shrink monthly repayments – pushing the age they will be mortgage-free beyond their initial hopes.

Over a quarter (27pc) of those born between 1965 and 1980 (otherwise known as Generation X) are not confident they will pay off their mortgage before the age of 67, according to retirement company Just Group.

With average mortgage rates still more than double what they were in 2021 – the year of sub-1pc deals – those who have already borrowed are now having to pay far more in interest, meaning the mortgage-free dream is slipping further away for them, too.

But there are decisions borrowers can make now to improve their financial position in the decades to come. Not least because the sooner a homeowner becomes mortgage-free, the sooner they can increase their pension contributions.

Here are steps experts say you could do to get nearer to your goal, ranging from the obvious to some little-used tricks and tips.

Overpay your mortgage – even by small amounts

It might not seem like the right time to try and overpay your mortgage, but when confronted with the savings potential of such a move it can make a lot of sense.

And overpaying your mortgage isn’t just an option for those earning hefty bonuses. Forgoing a couple of inessential monthly subscriptions, overpriced morning coffees and fee-riddled food deliveries could be all it takes.

A first-time buyer with a £250,000 mortgage on a 6pc interest rate could save £50,000 in interest and knock off nearly five years from their 30-year term if they paid off an extra £100 each month.

But a word of warning: If you’ve got one of the ultra-low mortgage rates (1pc and 2pc), it will be worth waiting and getting a better return on your money in a savings account, which can pay as much as 5pc interest, until you renew your deal. Use our calculator (below) to see if it makes financial sense to overpay or not.

Ben Merritt, director of mortgages at Yorkshire Building Society, said: “A little amount now can make a huge difference in the future.

“Most lenders will allow overpayments on the majority of their products, and this is largely limited to 10pc of the loan each year – I rarely see people trying to pay off more than that.”

Even a £50-a-month overpayment can go a long way. On a £200,000 loan and a 4.5pc rate, a borrower could save £11,520 in interest and end their 25-year mortgage term two years early.

This is because the more of your loan you pay off each month, the smaller the remaining amount becomes which the bank applies interest too.

Nick Mendes, of broker John Charcol, said this also puts you into a lower loan-to-value bracket (the proportion you have paid off versus what you still have to pay). So, when you refinance, you will be eligible for lower rates.

The smaller the loan, the less risky a customer you are – hence the more willing the bank is to lend to you at a cheaper interest rate.

If you want to overpay more than 10pc each year, there are products which allow 20pc, 50pc, and even 100pc overpayments penalty-free. These sorts of terms are typically only available if you opt for a tracker loan rather than a fixed rate.

Earn £7,500 tax-free by getting a lodger

If you have a spare room, make the most of it. All homeowners can let a room for up to £7,500 each year tax-free. Again, this extra income can be channelled into overpayments.

If you were to overpay by £7,500 each year on a 30-year loan of £300,000 with a rate of 5pc, then you could save £85,330 in interest and shave seven years and seven months off your mortgage term.

Recommended

What to know before you rent out your spare room for extra cash

Set up an Isa alongside your mortgage

Saving into an Isa allows you to earn interest, dividends and capital gains on up to £20,000 of savings each year tax-free.

The average one-year fixed cash Isa rate is around 4.72pc, according to Moneyfacts. On £10,000 this will give you £472 in interest at the end of the year which you can then use to overpay your mortgage.

A stocks and shares Isa is another option, but it depends how much risk you’re willing to take on.

In the past 10 years, the average return on stocks and shares of Isas has been 9.64pc annually – compared with 1.21pc for lower-risk cash ISAs, according to financial adviser directory Unbiased.

But over the past two years, markets have suffered while savings rates have jumped, which means there is less of a gap today than when savings rates were at historic lows.

Ask family for help – and save on inheritance tax

If you don’t have the money to hand right now to overpay on your mortgage, it might be worth speaking to your parents or grandparents to see if it’s something they could help you with.

Simon Gammon, managing partner at Knight Frank Finance, said if a borrower can get closer to repaying their mortgage with the help of family then it could help minimise their inheritance tax liabilities.

He added: “If you are an 80-year-old with a child who is 45 looking to retire at 50 – you could help them now. This money doesn’t need to be saved for a rainy day. It can act as a double gift, saving them interest too.”

Any estate worth more than £325,000 – which includes property, money and possessions – is taxed by HMRC on your parents’ death. There is an extra allowance where a family home is passed on to a direct descendant. Most couples can pass on £1m tax free.

This means anything your parents want to pass on to you over this amount will be taxed at 40pc.

If your parents live for seven years after gifting you their money, then none of it is taxed. So, the earlier they pass on their wealth, the more of it you will get.

Put your savings in an offset mortgage

Out of favour since the 1990s and 2000s, an “offset” mortgage lets a borrower use their savings to make their mortgage cheaper.

The product works by linking a borrower’s savings account with their mortgage. The savings are then used by the lender to offset the amount it charges you in interest.

So if the loan is £200,000 and you have £10,000 in savings, you will only pay interest on £190,000.

Since rates began to rise from the rock-bottom lows of 2021, offset mortgages have become more attractive – and make a lot more financial sense.

The average easy access savings rate was around 3.15pc at the beginning of 2024, according to Moneyfacts. This equates to £315 of interest paid on £10,000 after one year.

But because the average two-year mortgage rate is still around 5.93pc, someone with £10,000 to offset can save £768 in mortgage repayments each year.

Mr Merritt said this is precisely what offset mortgages should be used for. He added: “You can deposit into an offset account each month, reducing the interest you pay and to top it off you get any money you put in back at the end.”

Get a new EPC certificate to unlock ‘green’ deals

Some mortgage lenders give customers access to cheaper deals if they can improve the energy efficiency of their homes.

Banks are under pressure from the Government to get their loan books more eco-friendly, so one way they are trying to do this is by giving customers incentives to invest in their homes’ energy efficiency.

Energy performance certificates – referred to as “EPCs” – are valid for 10 years. But often owners have done work during that time that mean their rating has likely increased. Ratings range from A to G, with A being the best. The ratings, which have many critics, are based on the running cost of heating a home. It only costs between £50 and £100 to get another survey done and a new certificate,” said Mr Mendes.

At today’s rates, a NatWest customer remortgaging a property with an EPC rating of A or B, can get access to deals that carry significantly cheaper product fees (£995 versus £1,495 on a £240,000 loan, for example).

Halifax also offers £250 cashback to borrowers switching to them if their home is an A or B rating. Anything you save could then go towards overpaying your mortgage.

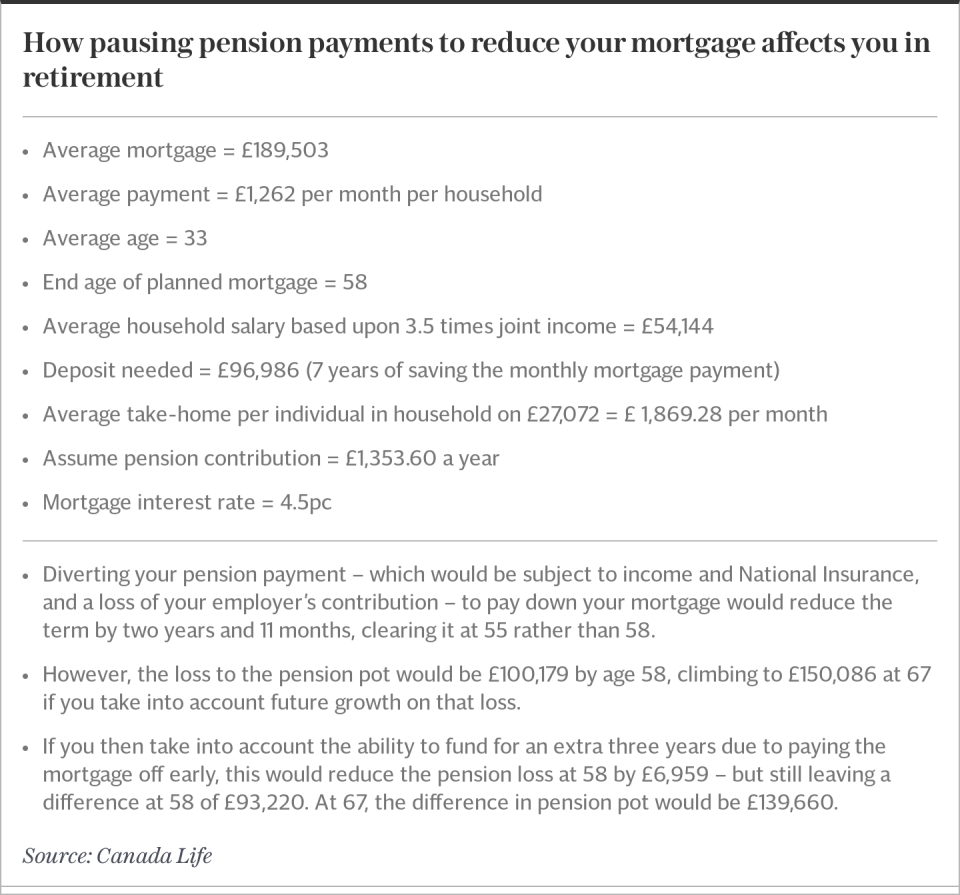

Should you touch your pension?

Some homeowners may be considering pausing pension contributions and instead use the money to pay down their mortgage. Experts unanimously agree this would be a bad idea for most people.

John Chew, a pension specialist at Canada Life, said: “It will mean you have less savings and a smaller pension to live off in the later stages in life. You’d then need to raise funds ahead of retirement, perhaps through equity release.

“This product comes with higher lending rates and effectively takes you back out of mortgage-free territory.”

The Pensions and Lifetime Savings Association says a single person in retirement needs an income of £23,300 for a “moderate” living standard.

To accumulate this pot – assuming 20pc tax relief on the pension contribution and a 5pc investment return – wealth manager Quilter says this would require contributions of:

£650 (including tax relief) per month. This would give you £541,000 to spend after 30 years; or

£1,500 (including relief) per month would return £400,000 after 15 years

Chris Flower, a chartered financial planner at Quilter, said while achieving a mortgage-free life by the age of 50 is a dream many aspire to – it is crucial to balance this ambition with a robust pension plan.

He added: “While focusing on paying off your mortgage early, don’t lose sight of the need to steadily build your pension pot.

“A life free from mortgage payments is psychologically liberating, but a well-funded retirement is essential for long-term financial security and peace of mind.”

Downsize by location

It might seem dramatic (and obvious) but downsizing is probably one of the most effective ways to become mortgage-free faster.

It will leave you paying off a smaller mortgage, and the house doesn’t necessarily have to be smaller. It could just be a case of changing location.

A three-bed in Walthamstow, London is around £650,000 on average – according to Foxtons. Semi-detached properties in Southend-On-Sea sold for an average of £430,000, according to RightMove.

Recommended

How big a mortgage can I get – and what types are available to me?

Round-up your mortgage payments

Simply rounding up your mortgage repayments each time you lock in a new fixed deal could be a good way of gradually overpaying without thinking too much about it.

If you pay £450 each month on your mortgage, round it up to £500 a month.

Mr Gammon said: “Psychologically, that might not seem like much. But it makes a huge difference.”

Reduce the term

An alternative to overpaying on your mortgage could be to reduce the term. This means your mortgage repayments would go up, but it also ensures that you do put that extra money into your mortgage and don’t spend it on something else.

Natalie Kempster, of Argentis Financial Planning, said reducing the mortgage term “saves so much in interest”.

A £400,000 mortgage on a 4.5pc rate with a 25-year term will rack up £266,739 in interest. Reduce that term by five years, and you shave off £59,593 in interest repayments.

Recommended

What 2024 has in store for the property market and mortgages