Want to save money during Christmas shopping? Take advantage of Florida sales tax holidays

The Christmas shopping season is in full swing and people are pulling out their wallets and credit cards.

This year, about 38% of 3,000 survey respondents expect to spend between $501 to $1,000 on holiday gifts, according to Forbes Advisor.

Another 24% are prepared to splurge by spending more than $1,000. Slightly more — 27% — are expected to spend between $1 to $1,000.

Very few — 3% — of Americans are opting out of gift giving this year, Forbes Advisor reported.

There is a way to get the most for your money: Shop sales and take advantage of the remaining Florida sale-tax holidays.

Florida Energy Star sales-tax holiday

Ends: June 30, 2024

During the tax holiday, you don't pay sales tax on Energy Star appliances purchased for noncommercial use.

The tax exemption covers:

Washing machines with a sales price of $1,500 or less.

Clothes dryers with a sales price of $1,500 or less.

Water heaters with a sales price of $1,500 or less.

Refrigerators or combination refrigerator/freezers with a sales price of $4,500 or less.

Installation and warranty costs, as long as the total falls below the amounts shown above, also would be tax free.

Florida gas ranges and cooktops sales-tax holiday

Ends: June 30, 2024

During this sales tax holiday, gas ranges and cooktops are exempt from sales tax on retail sales.

Gas ranges and cooktops refer to any gas range or cooktop fueled by combustible gas such as natural gas, propane, butane, liquefied petroleum (LP) gas, or other flammable gas. It does not include outdoor gas grills, camping stoves or other portable stoves.

There is no price limit for gas ranges and cooktops to qualify for the sales tax exemption.

Florida impact-resistant windows and doors sales-tax holiday

Ends: June 30, 2024

During the Florida impact-resistant windows and doors sales tax exemption period, consumers who purchase impact-resistant windows, doors, and garage doors do not pay sales tax on retail sales.

“Impact-resistant windows,” “impact-resistant doors,” and “impact-resistant garage doors” are defined as windows, doors, and garage doors that are labeled as impact-resistant and have an impact-resistant rating.

There is no limit on the number of impact-resistant windows, doors, and garage doors that can be purchased and they do not have to be under a certain price to qualify for the exemption.

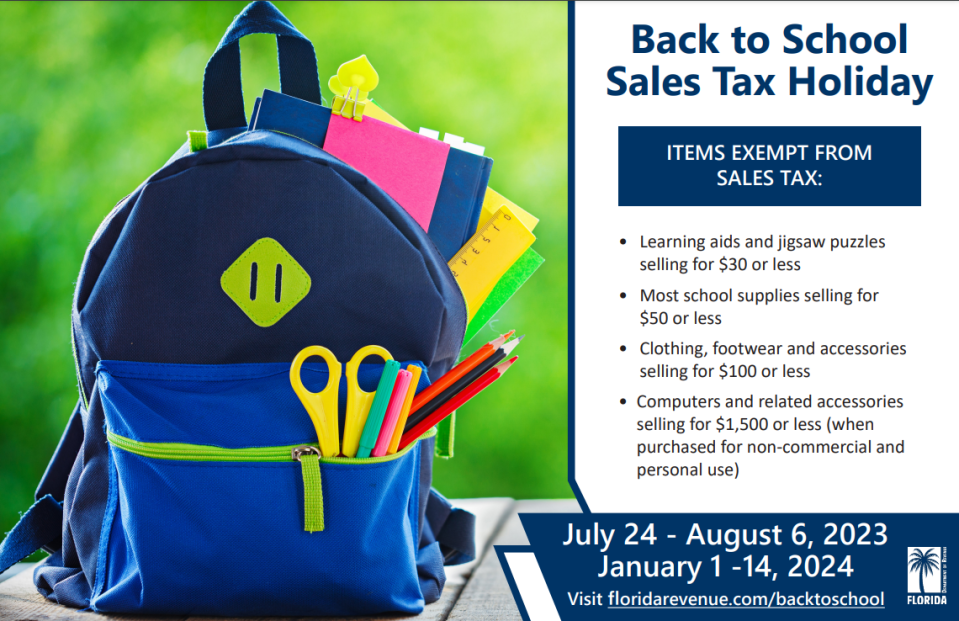

Florida back-to-school sales-tax holiday

This one won't help you for Christmas, but keep in mind a second back-to-school tax holiday for the 2023-2024 school year is coming.

When is it? Jan. 1-Jan. 14, 2024.

Just like the first back-to-school holiday in August, the following items are tax exempt:

Learning aids and jigsaw puzzles selling for $30 or less.

Most school supplies selling for $50 or less.

Clothing, footwear and accessories selling for $100 or less.

Computers and related accessories selling for $1,500 or less (when purchased for non-commercial and personal use).

Here is a complete list of tax-exempt school supplies.

This article originally appeared on Treasure Coast Newspapers: Florida sales tax holidays: Save money appliances, gas stoves, impact